Nice Cash Flow Statement Exchange Difference

There are many differences between Income statement and Cash Flow Statement which are not known by lots of people.

Cash flow statement exchange difference. The exchange differences are recognized in the financial statements. Income Statement vs Cash Flow Statement The key difference between income statement and cash flow statement is the basis that is used to prepare these statements. The document shows the different areas in which a company used or received cash and reconciles the beginning and ending cash balances.

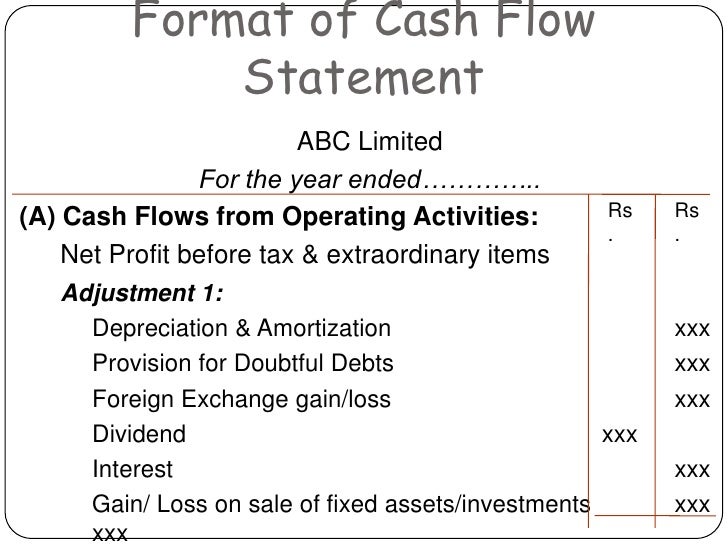

The items in the cash flow statement are not all actual cash flows but reasons why cash flow is different from profit Depreciation expense Depreciation Expense When a long-term asset is purchased it should be capitalized instead of being expensed in the accounting period it is purchased in. Further IAS 7 requires all entities to present a Statement of Cash Flows with no exceptions IAS 73. 2 This Standard supersedes SSAP 15 Cash Flow Statements.

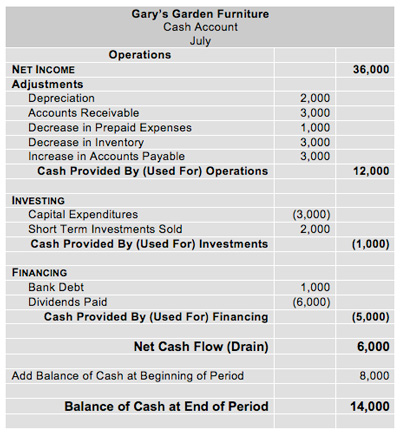

A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. Statement of cash flow is one of the main financial statements along with the income statement and balance sheet. A Statement of Cash Flows is part of an entitys complete set of financial statements in accordance with paragraph 10 of IAS 1 Presentation of Financial Statements IAS 110.

For the income statement it is the accrual basis whereas for cash flow concept it is mere cash basis. Cash flow starts from the point of profit after tax PAT which is taken from the income statement and then the non-cash items appeared in income statement would be adjusted under the heading of Cash flow from operating activities As unrealized gains are non-cash items so it would be adjusted under the heading of non-cash item adjustment. The income statement is based on an accrual basis due or received while the cash flow statement is based on the actual receipt and payment of cash.

Therefore extending credit to a customer accounts receivable is an investing activity but it only appears on the cash flow statement when the customer pays off their debt. Flows IAS 7 the Standard. The three financial tables the income statement the balance sheet and the cash flow statement are the worlds standard formats for expressing corporate activities in terms of the movement of goods money and cash and they are knowledge that should be systematically understood in order to generate new ideas based on the essence of business operations even if the systemization of business.

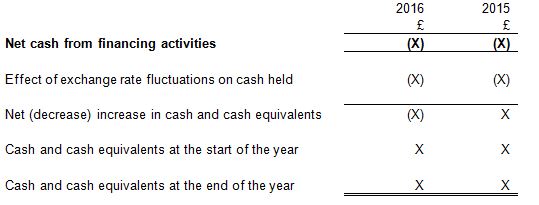

Reduces profit but does not impact cash flow it is a non-cash expense. One such difference is that an income statement and cash flow statement is cash ie. Once the statement has been converted the differences between the exchange rates used for conversion and at the period end on the cash providedused in will be the amount needed to get the statement to balance.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)