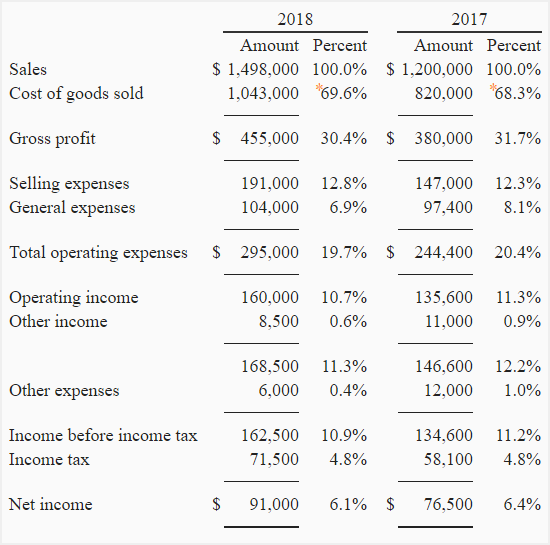

Fabulous Common Size Comparative Income Statement

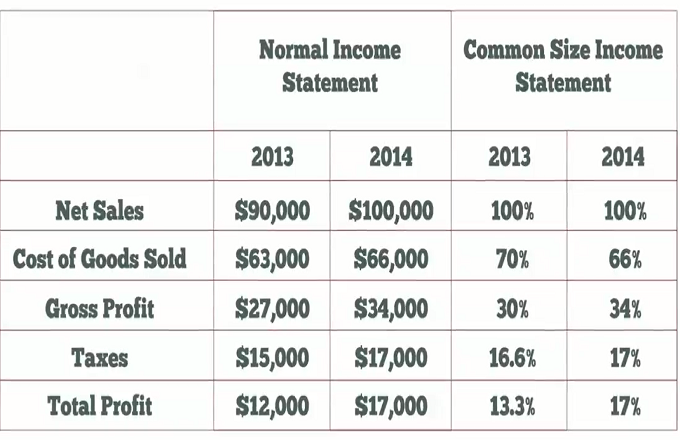

Creating common size financial statements makes it.

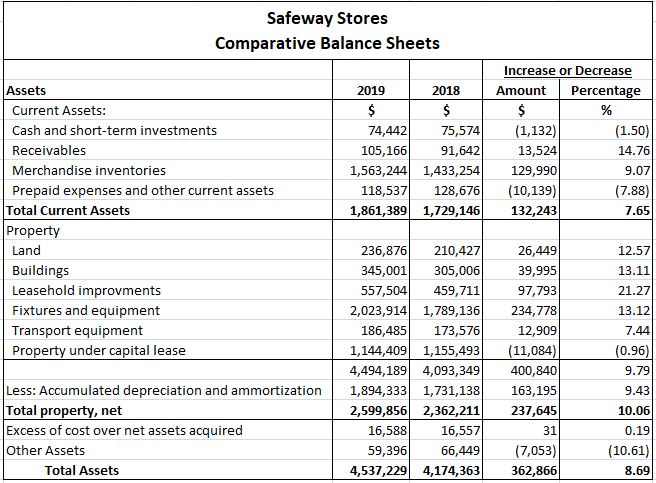

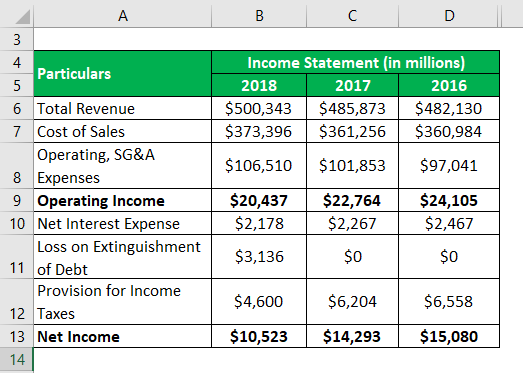

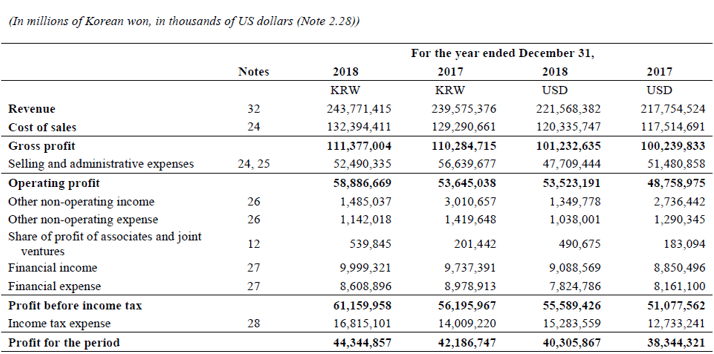

Common size comparative income statement. NASDAQCSCO Common-Size Income Statement. The ratios tell investors and finance managers how the company is doing in terms of revenues and they can make predictions of future revenues. Walt Disney Co common-size consolidated income statement.

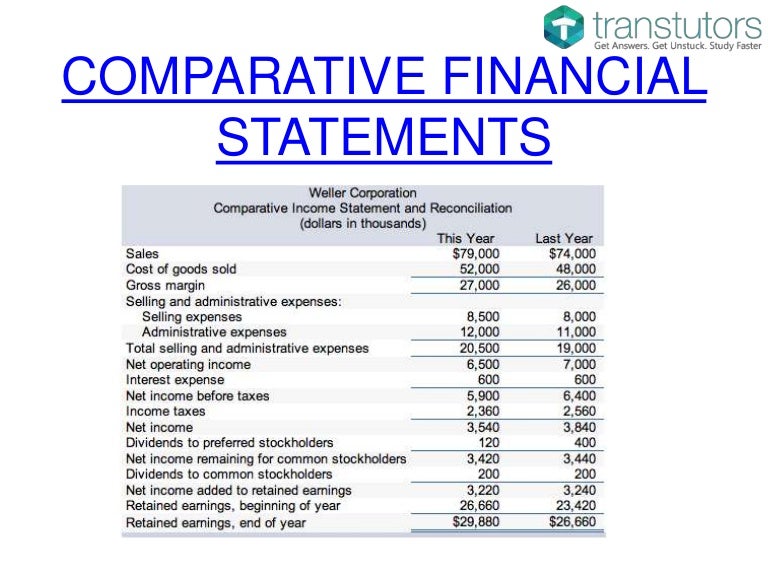

Apple Inc common-size consolidated income statement. The difference between comparative and common size statement depends on the way financial information in statements are presented. Take a look at each example of a comparative income statement.

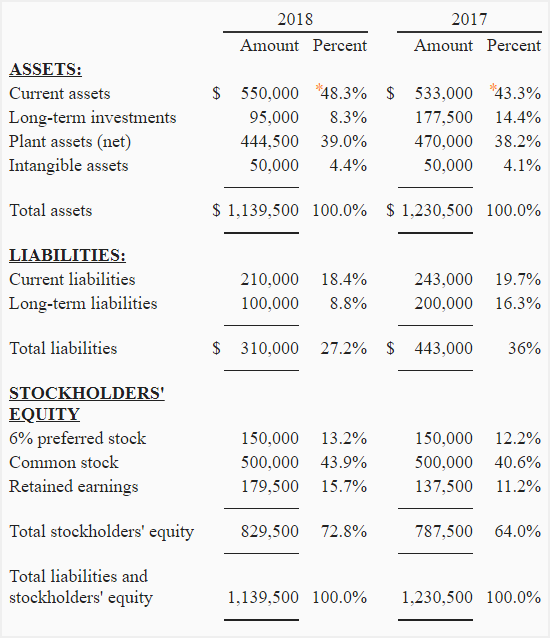

There are two reasons to use common-size analysis. The common-size percent is simply net income divided by net sales or 336 percent 11809 35119. Required information Problem 13-2A Static Ratios common-size statements and trend percents LO P1 P2 P3 The following information applies to the questions displayed below Selected comparative financial statements of.

The base item in the income statement is usually the total sales or total revenues. Sep 26 2020 Sep 28 2019 Sep 29 2018 Sep 30 2017 Sep 24 2016. Income loss from 12 Oct 3 2015 Oct 1 2016 Sep 30 2017 Sep 29 2018 Sep 28 2019 Oct 3 2020 -10 -05 00 05 10.

The Common-Size statement is that statement that shows the percentage to a common base of all accounts of the financial statement of the business for the period of more than two years. Net income loss attributable to The Walt Disney Com. Common-Size Income Statement Quarterly Data.

Each item is then expressed as a percentage of sales. Common size analysis is used to calculate net profit margin as well as gross and operating margins. A common size financial statement displays line items as a percentage of one selected or common figure.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)