Beautiful Work Calculate The Following Financial Ratios For Phone Corporation

Round your final answers to 2 declmal places a.

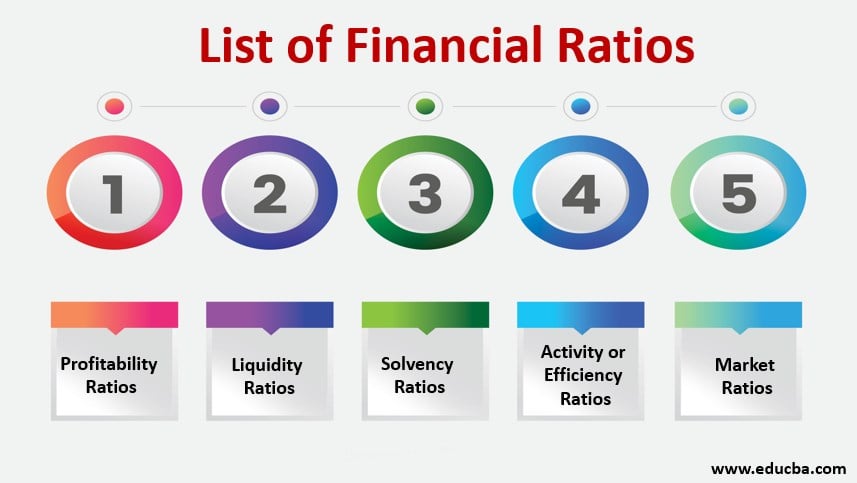

Calculate the following financial ratios for phone corporation. Return on equity use average balance sheet figures b. Liquidity ratios Operational Risk ratios Profitability ratios and Efficiency Ratios. Do not round intermediate calculations.

Return on equity use average balance sheet figures 1319 576 b. Use the following information for items 12 and 13. Return on assets use average balance sheet figures c.

The companys income statement included Income Tax Expense of 140000 and Interest Expense of 60000. Quick Ratio CashandCashEquivalentsShortTermInvestmentsAccountReceivables Current Liabilities. Do not round Intermedlate calculations.

Calculate the following financial ratios for Phone Corporation. Calculate the following financial ratios. The firm paid out 102000 in cash dividends and has 25000 shares of common stock outstanding.

Financial Ratios Calculators help determine the overall financial condition of businesses and organizations. Financial risk leverage analysis ratios. Times interest earned -- This ratio is also known as interest coverage and is calculated by dividing your earnings before interest and taxes EBIT by the interest youll pay annually.

Average collection period k. Cash coverage ratio e. The corporations quick ratio as of December 31 is calculated as follows.