Unbelievable Deferred Revenue Normal Balance

Each of the accounts in a trial balance extracted from the bookkeeping ledgers will either show a debit or a credit balance.

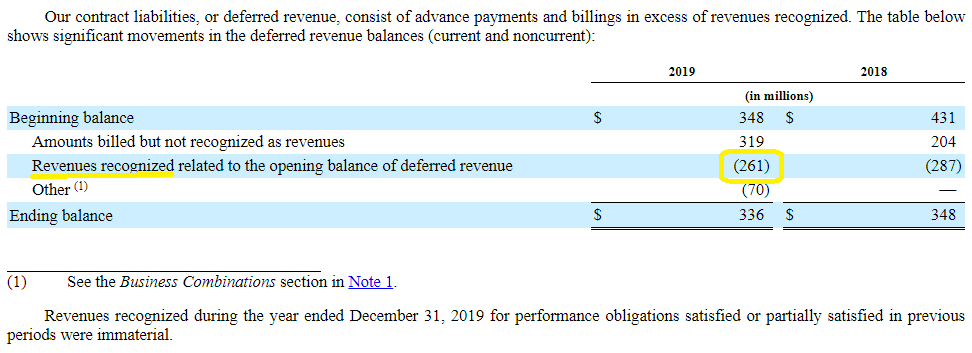

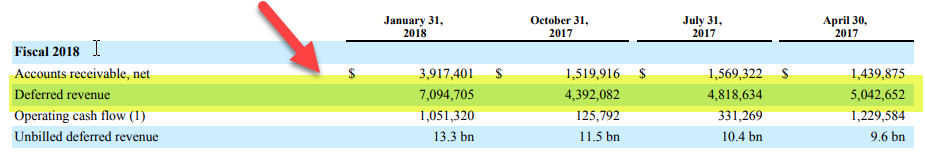

Deferred revenue normal balance. The payment is not yet revenue because you havent earned it. AccountsBalances Deferred Revenue20000 CommonStock25000 Cash20000 Retained Earnings17000 Salaries Expense40000 NotesPayable20000 Dividends5000 Accounts Receivable80000 Service Revenue63000. Deferred revenue is recognized as.

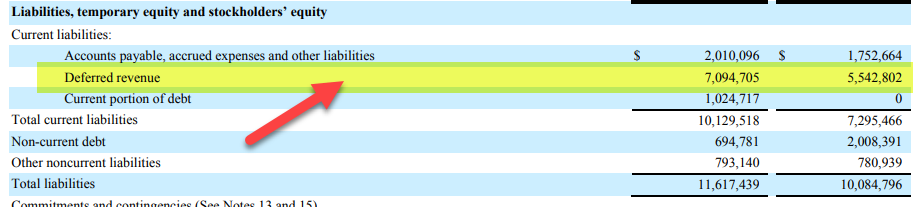

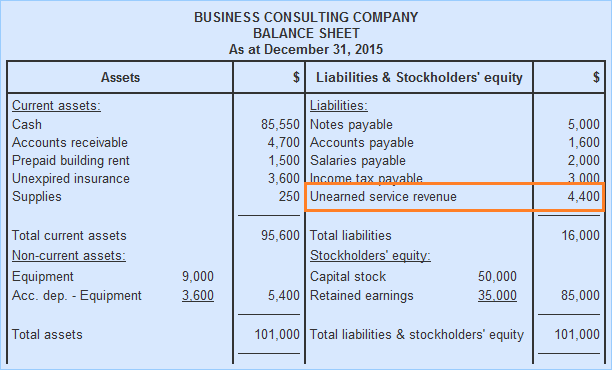

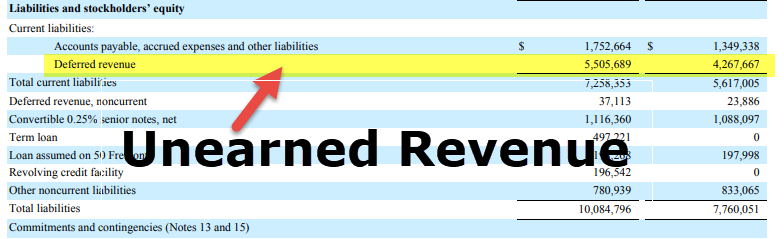

Lets illustrate revenue accounts by assuming your company performed a service and was immediately paid the full amount of 50 for the service. Companies of all sizes and industries commonly enter into transactions involving deferred revenue. Deferred revenue which is also referred to as unearned revenue is listed as a liability on the balance sheet because under accrual accounting the revenue recognition process has not been.

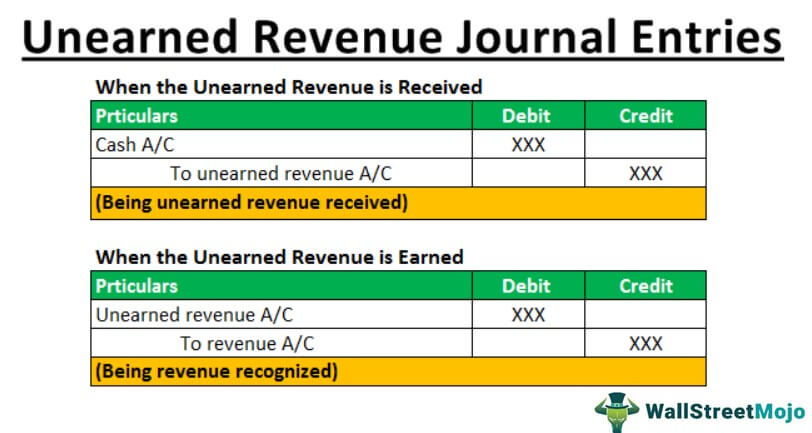

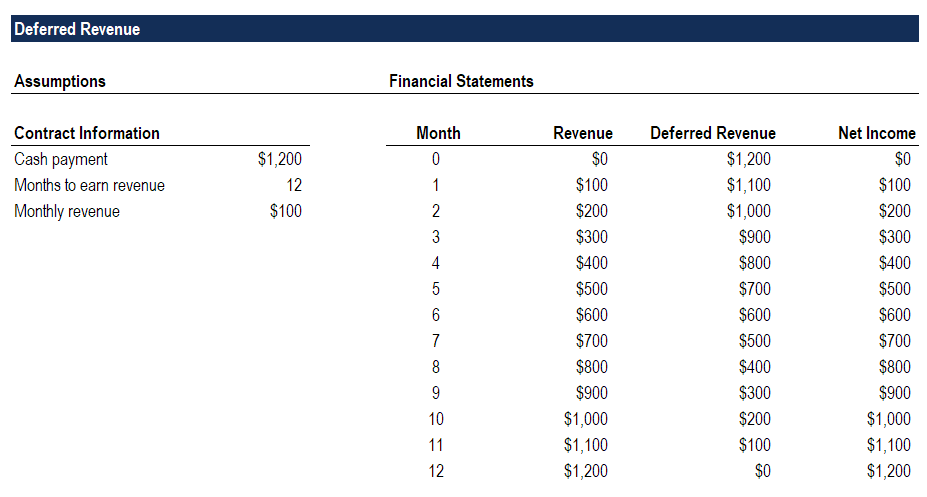

Accounting Equation for Deferred Revenue Journal Entry The accounting equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus the total equity of the business This is true at any time and applies to each transaction. What is Deferred Revenue Deferred Income. Normal Balance and the Accounting Equation.

Accounting for Deferred Revenue. That debit is reconciled with a 225 credit to revenues. Deferred revenue is a liability on a companys balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered.

The debits and credits are presented in the. The deferred revenue account is normally classified as a current liability on the balance sheet. This classification depends on how long it will take the company to earn the revenue.

Deferred revenue also called unearned revenue refers to money received by a company before it provides the related goods or services to the customer. This continues until the service 12 months of a magazine issue is completed. Deferred revenue is common in businesses where customers pay a retainer to.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)