Matchless Adjusting Entry For Interest Payable

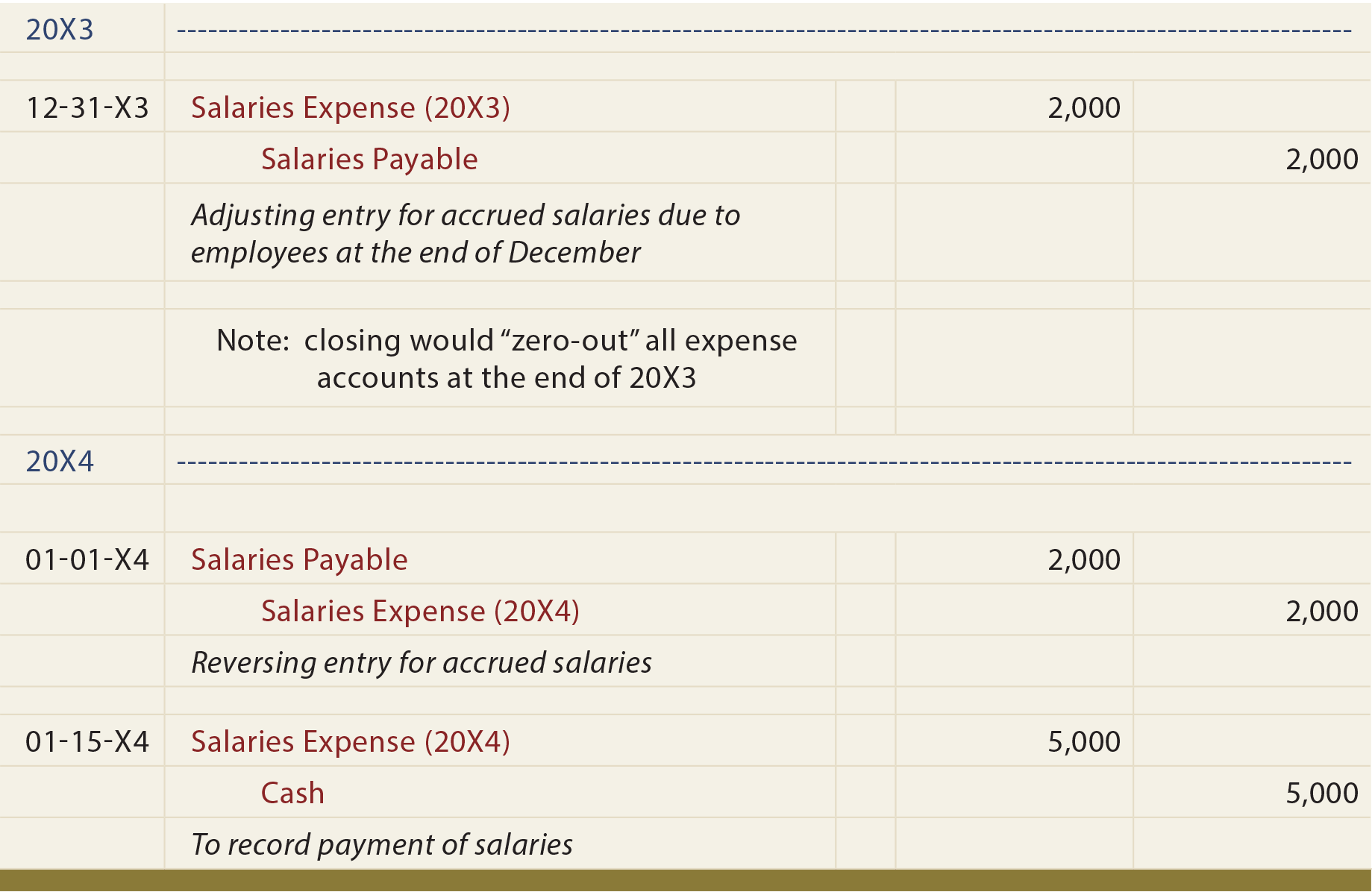

You would repeat this procedure every quarter until you pay back the loan.

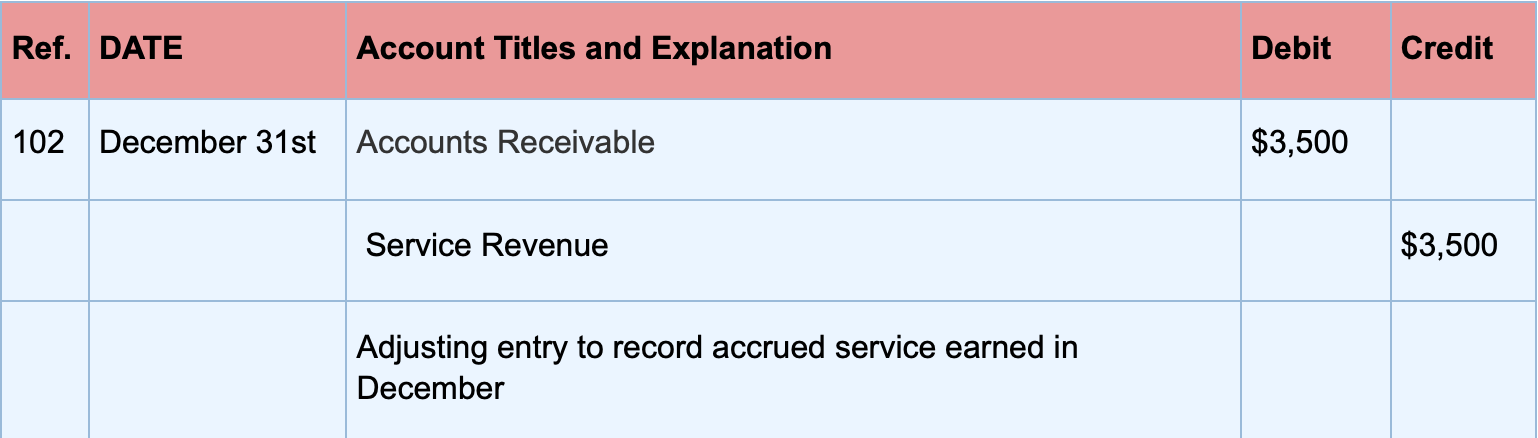

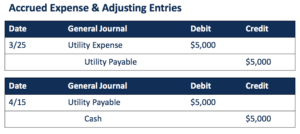

Adjusting entry for interest payable. As the deferred or unearned revenues become earned the credit balance in the liability account such as Deferred Revenues needs to be reduced. Typical adjusting entries include a balance sheet account for interest payable and an income statement account for interest expense. This video shows how to record interest expense on a loan which the expense has been.

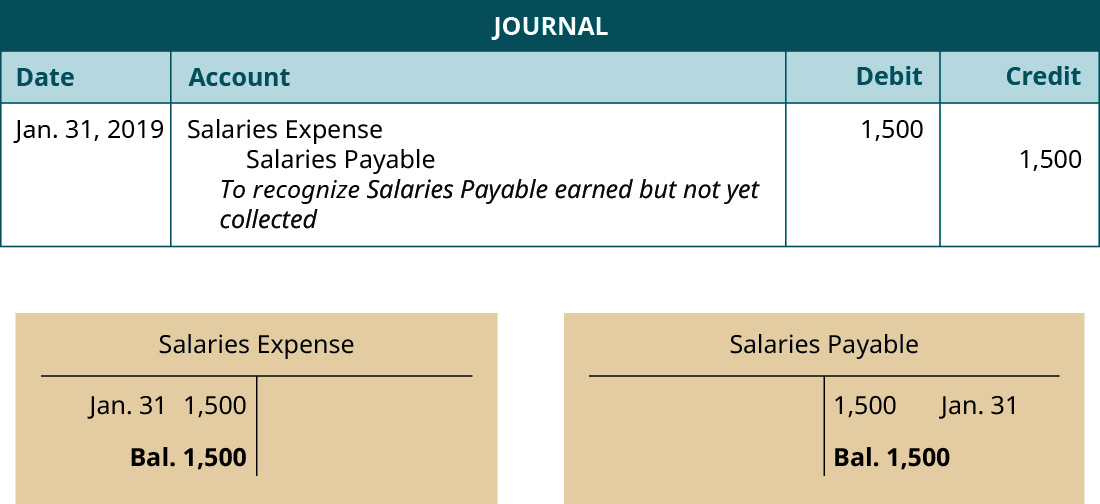

Understand the details of the note. On the other hand if the interest payment is made at the date of period-end adjusting entry there is no need to record the interest payable as the company will just record the expense with the cash outflow for the interest payment. Each month that a company has a notes payable an adjusting entry is required to record accrued interest expenses.

Interest payable journal entry. The adjusting entry will debit interest expense and credit interest payable for the amount of interest from December 1 to December 31. Adjusting Entry for Interest on Drawings Written by True Tamplin BSc CEPF Updated on August 2 2021 In accounting drawings mean the withdrawal of cash merchandise or another item from business by the owner for his personal use.

Accrued Interest Expense - YouTube. Adjusting entries also known as adjusting journal entries AJE are the entries made in the accounting journals of a business firm to adapt or to update the revenues and expenses accounts according to the accrual principle and the matching concept of accounting. A Debit To Fees Earned.

You should have an amortization schedule or a statement from your lender showing you the amount of interest paid for the year and the year-end loan balance. 31 is to debit the interest expense account for 1250 and credit the interest payable account for 1250. The company can make the interest payable journal entry by debiting the interest.

Ad Choose Your Accounts Payable Tools from the Premier Resource for Businesses. Ad Choose Your Accounts Payable Tools from the Premier Resource for Businesses. Adjusting entry so that your period end books show the proper amount of interest expense and mortgage payable.