Unbelievable Bookkeeping To Trial Balance Tests

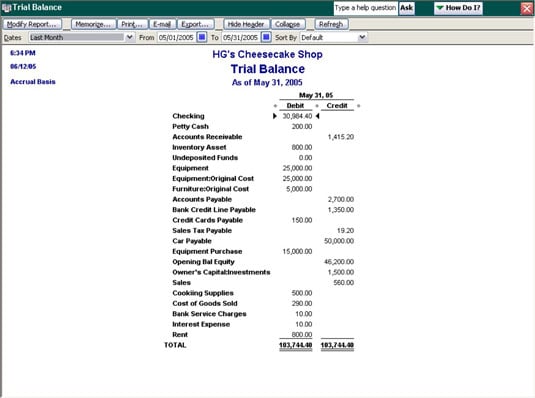

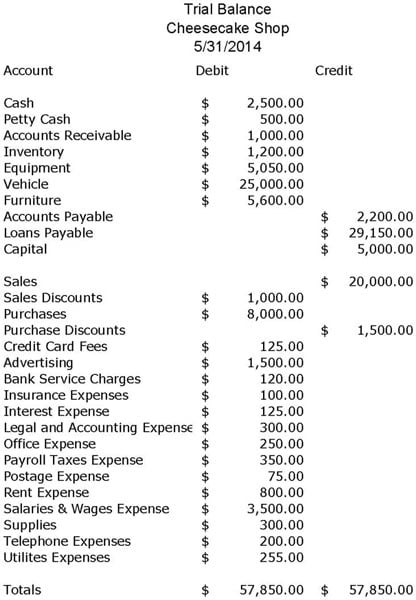

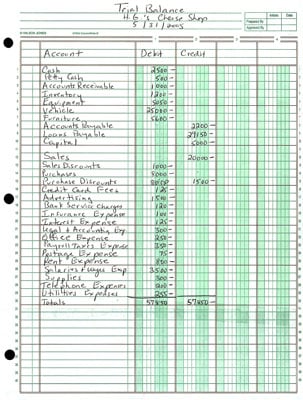

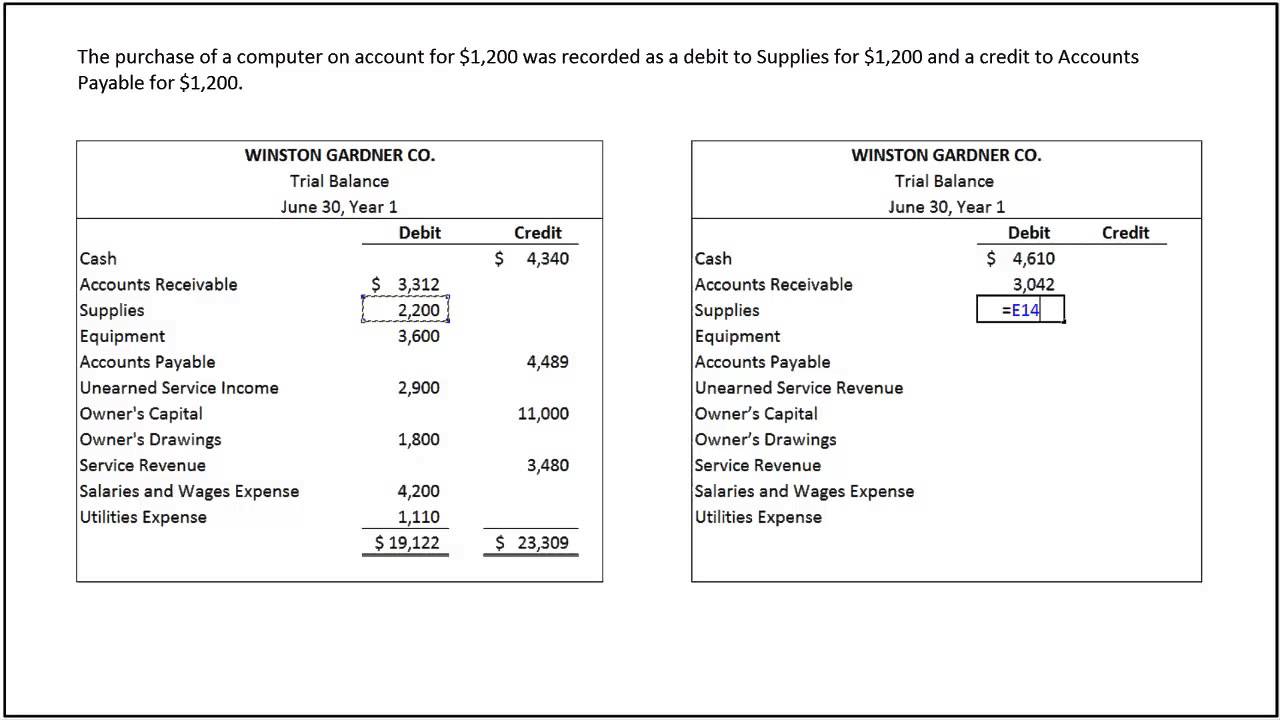

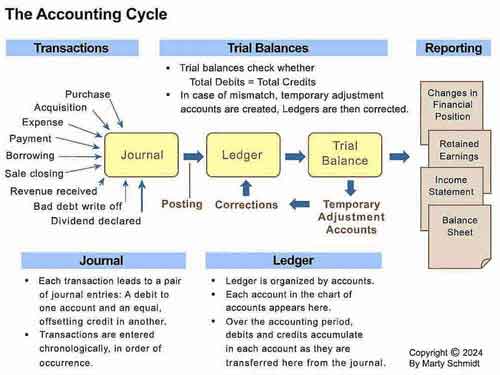

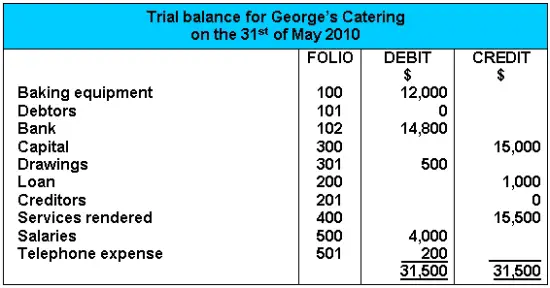

A trial balance is used by accountants to confirm the accuracy of the accounts at the end of the financial year before and after special adjustments.

Bookkeeping to trial balance tests. ICB Assignments form part of the formative mark and are to be completed in an open book environment. C a 2000 debit balance. It assumes no knowledge of bookkeeping and teaches the student to prepare the books of account from source documents to the subsidiary journals to the general and subsidiary ledgers trial balance and the bank and creditors reconciliations.

C Shows that the arithmetic is correct but errors may still be present in the bookkeeping. We now offer 10 Certificates of Achievement for Introductory Accounting and Bookkeeping. 1 QUESTION ASSIGNMENT 3.

In the example above the TB extraction date is 31 December. A bank reconciliation however shows that a standing order payment for 365 had been entered in the cash book twice and that a dishonoured customers cheque for 275 had been debited in the cash book rather than credited. Institute of Certified Bookkeepers as a Quality Assurance Partner of the QCTO.

A business needs it when they change to new bookkeeping software. An introduction to business bookkeeping and accounting In addition to the various integration tasks practice exercises and self-assessment activities must work through the Revision Questions for Class Test 1 during this phase. If you need a refresher course.

The below mark allocations are merely illustrative and may differ from your final assessment. Quiz and Worksheet Goals. If you find difficulty in answering these questions read Trial balance chapter thoroughly from explanation section of.

Bktb-icbtest-1a qp-2018v1 page 1 of 4 bookkeeping to trial balance bktb icb test 1a question paper apr 2018 to mar 2019 this test paper consists of 3 questions 50 marks 1 ½ hours question 1. A Shows that there must be more than one error within the bookkeeping system. Briefly closing entries transfer close the balances in the General Ledgers individual revenue expense and drawing accounts to the owners capital account at the end of a period usually year end which results in the same General Ledger Capital Account ending balance as contained in the Capital.