Fantastic Balance Sheet Assertions Audit

This is the main principle behind the balance sheet audit approach.

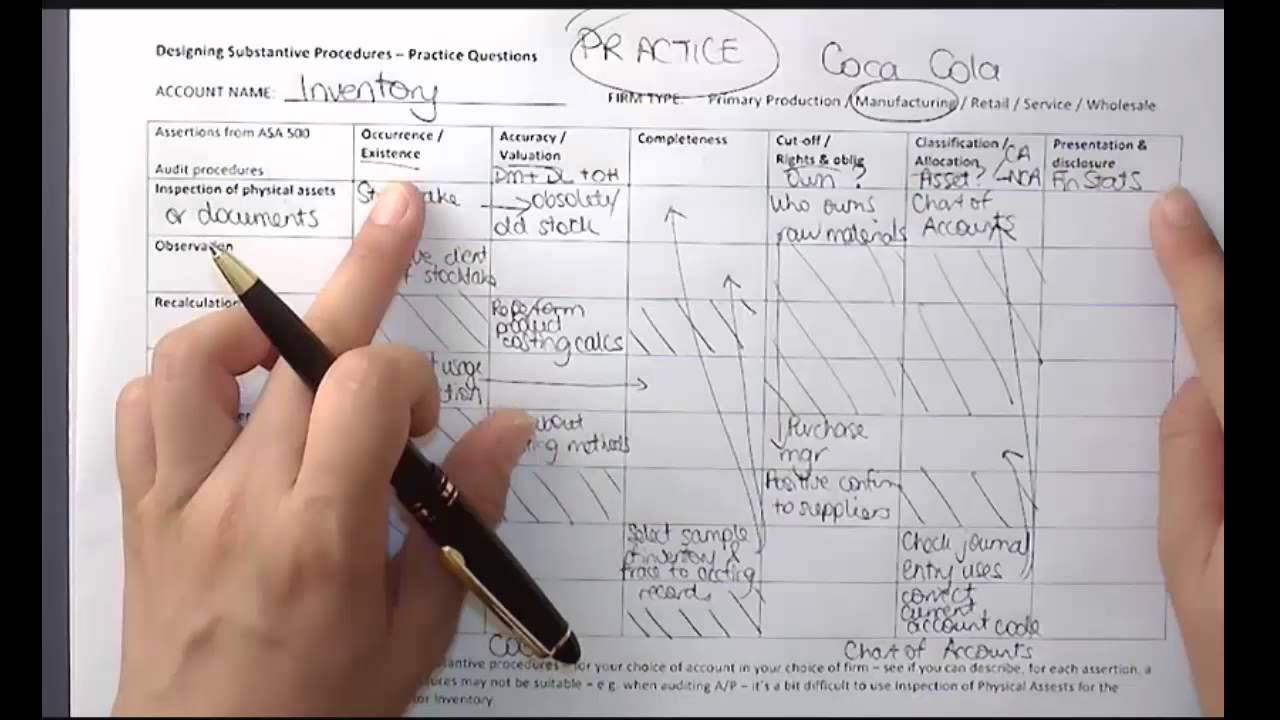

Balance sheet assertions audit. These assertions are classified in the. There are four types of account balance assertions. Account Balance Assertions.

They are called Other Current Assets because they usually represent a very small or insignificant percentage of the total. 8 rows Items recorded actually exist at the balance sheet date. These representations may be explicit or not.

For example if a balance sheet of an entity shows buildings with carrying amount of 10 million. Account balance assertions apply to the balance sheet items such as assets liabilities and shareholders equity. Audit assertions for inventory.

10 rows Account Balance Assertions. Other Current Assets are a type of assets owned by an entity that can be used to generate income and be converted into cash within one accounting period ie usually in less than 12 months. Key assertions for the audit of property plant and equipment are described below.

Audit Procedures for Accounts Receivable Existence. Inventory reported on the balance sheet includes all inventory transactions that have occurred during the accounting period. The assets equity balances and liabilities exist at the period ending time.

Assertions regarding the recognition measurement and presentation of assets liabilities equity income expenses and disclosures in accordance with the applicable financial reporting framework eg. Inventory balances reported on financial statements actually exist at the reporting date. That means if the assertions in the account balance are correctly account in the balance sheet the income statement assertion is also assumed to correctly account for.