Ace Summary Statement Of Earnings

Paul is expecting 26400.

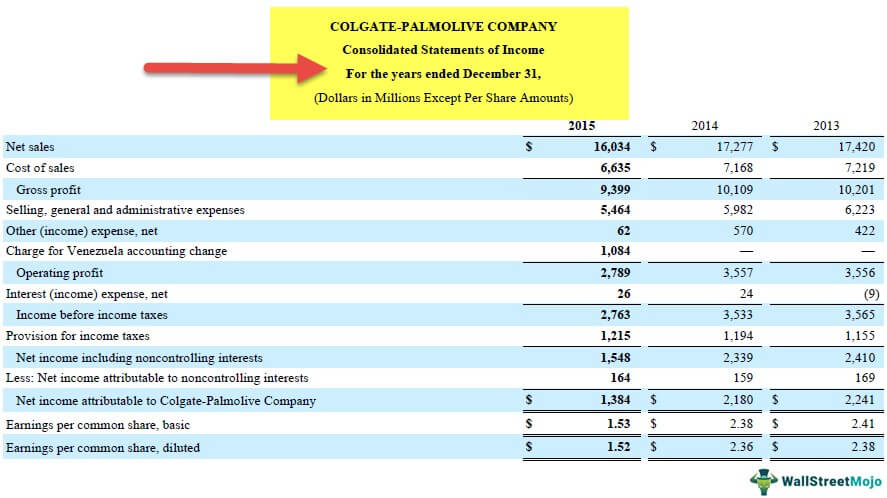

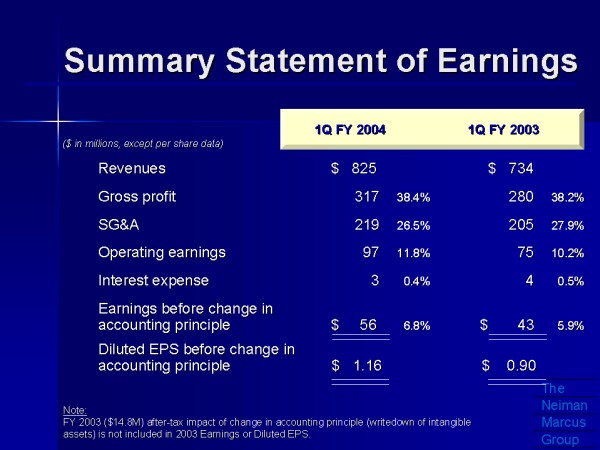

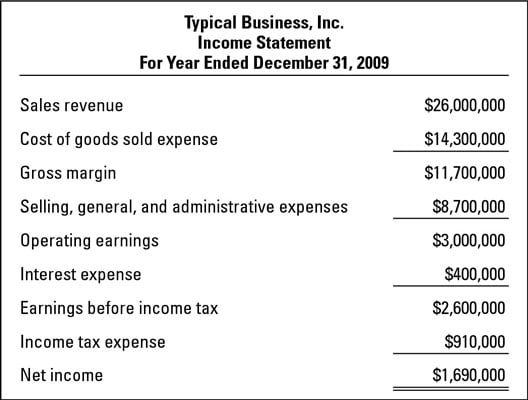

Summary statement of earnings. The partial income statement. Profit and loss statement. This means that the value of each account in the income statement is debited from the temporary accounts and then credited as one value to the income summary account.

This statement includes the total earnings for each year requested but. The former is a breakdown of your wages or earnings for the pay period and the latter is your annual wage and tax statement. Reporting expenses by function.

It may indicate that funds are being allocated to the acquisition of more assets or perhaps sent to investors in the form of dividend payments. If they report your income tax and super information through Single Touch Payroll your income statement will be in ATO online services. If you need more detailed or itemized earnings information for purposes not directly related to administering Social Security programs there is a fee needed in advance.

A wage and earnings statement should not be confused with a W-2 form. Ad Create Your Earning Statement Now Just Fill-in the Blanks Print. To set up or use your account to get your online Social Security Statement go.

All earnings set out must be gross ie before tax. It is highly similar to a payslip or paystub. You should allow until the end of the third week of July to get your Payment Summary in the mail before requesting any replacements.

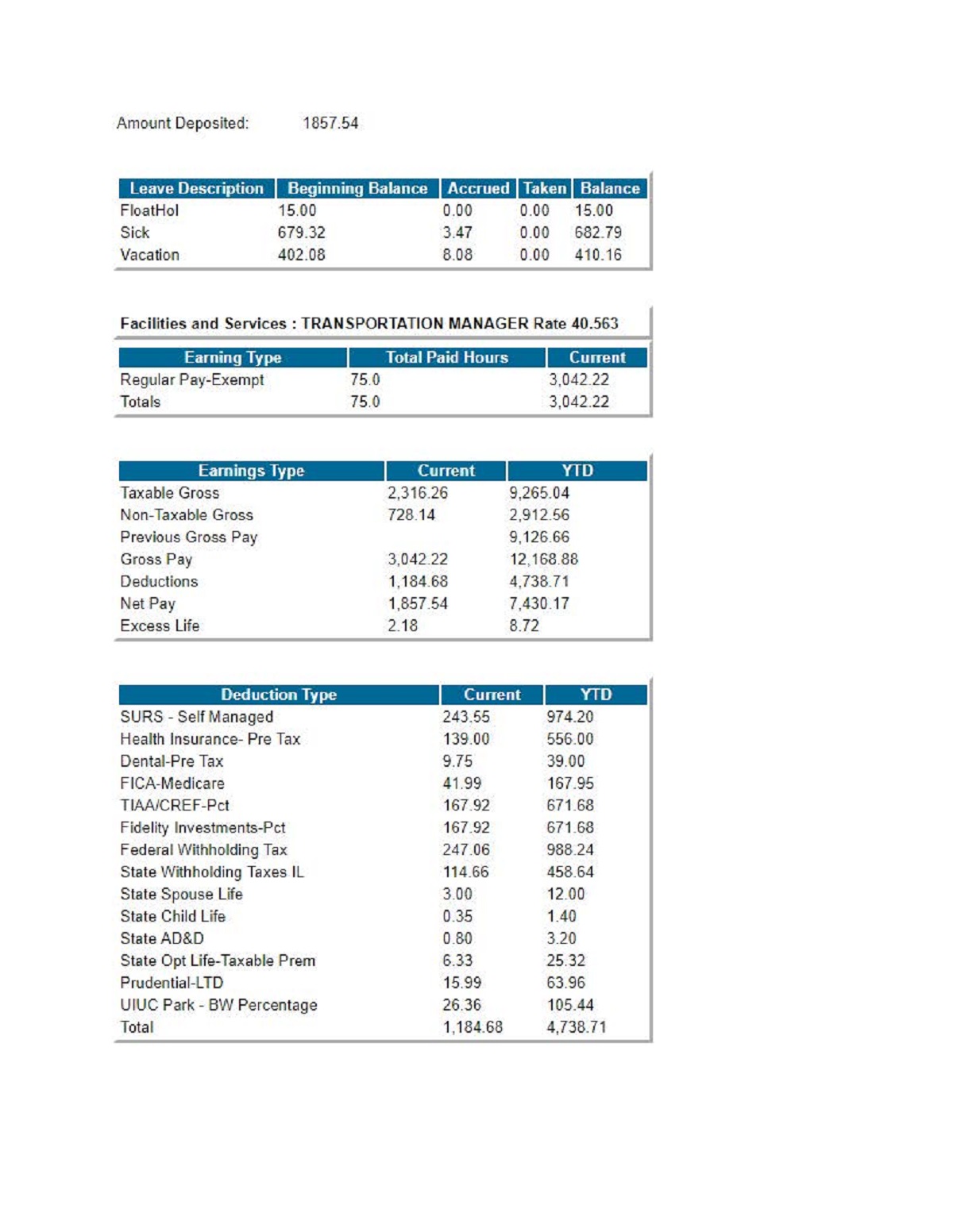

Advantages of the Statement of Retained Earnings A key advantage of the statement of retained earnings is that it shows how management chooses to redirect the retained earnings of a business. Take a look at his statement of earnings to see why he only got 22002. Provided by Centrelink If you get a taxable payment for example Age Pension Centrelink will send you a Payment Summary at the end of the financial year.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)