Heartwarming Adjusting Entry For Salaries Payable

Make the adjusting journal entries.

Adjusting entry for salaries payable. This video is about the AJE required when payday is not the same as the end of the period. Salary expense for the period was 1100 and 1400 was paid to employees in cash. Examples include utility bills salaries and taxes which are usually charged in a later period after they have been incurred.

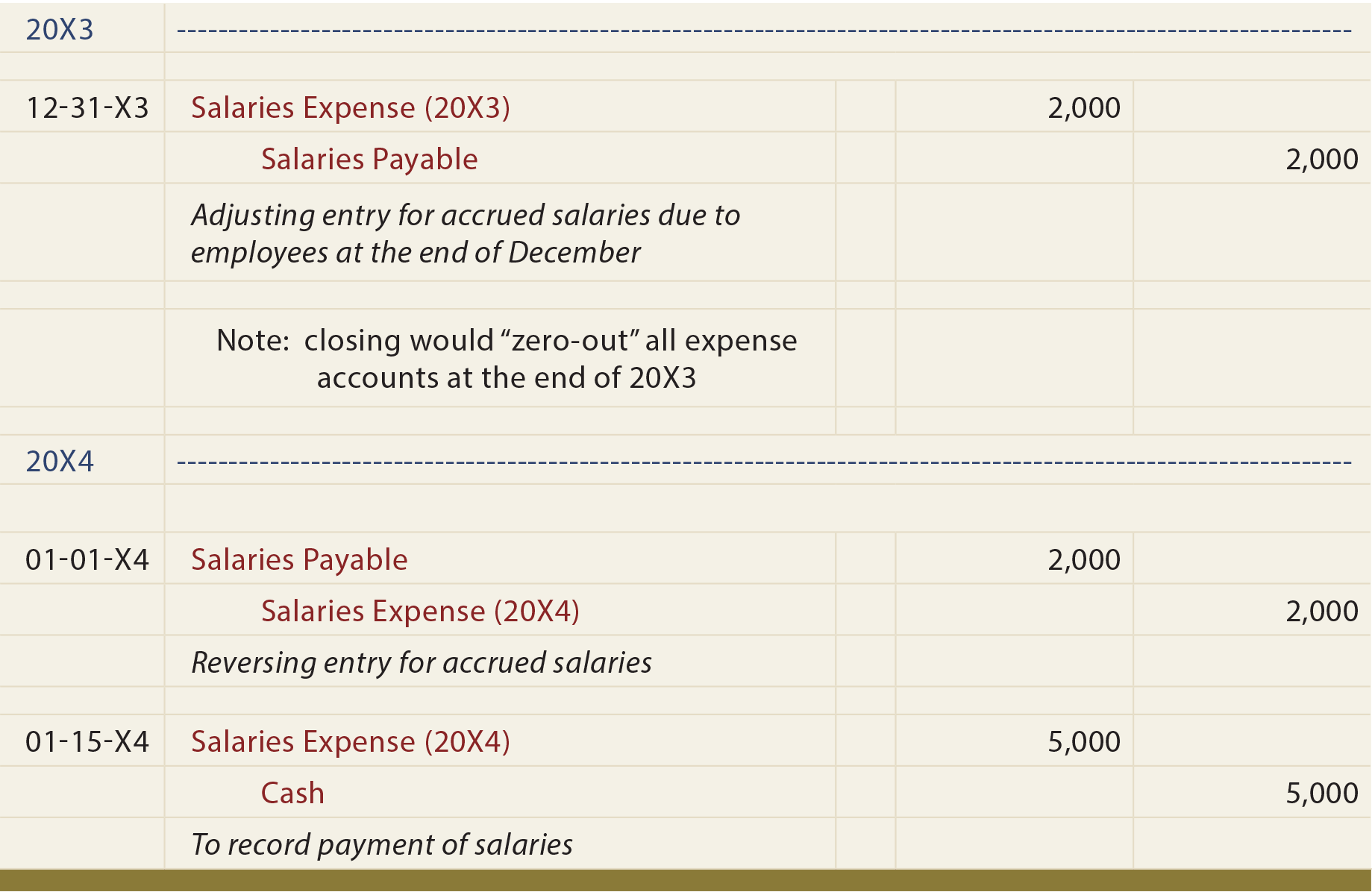

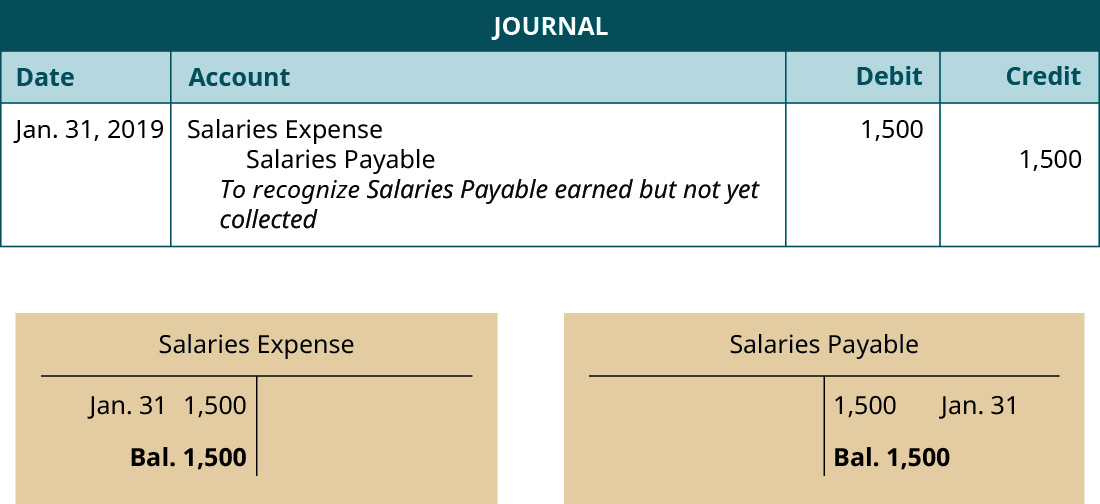

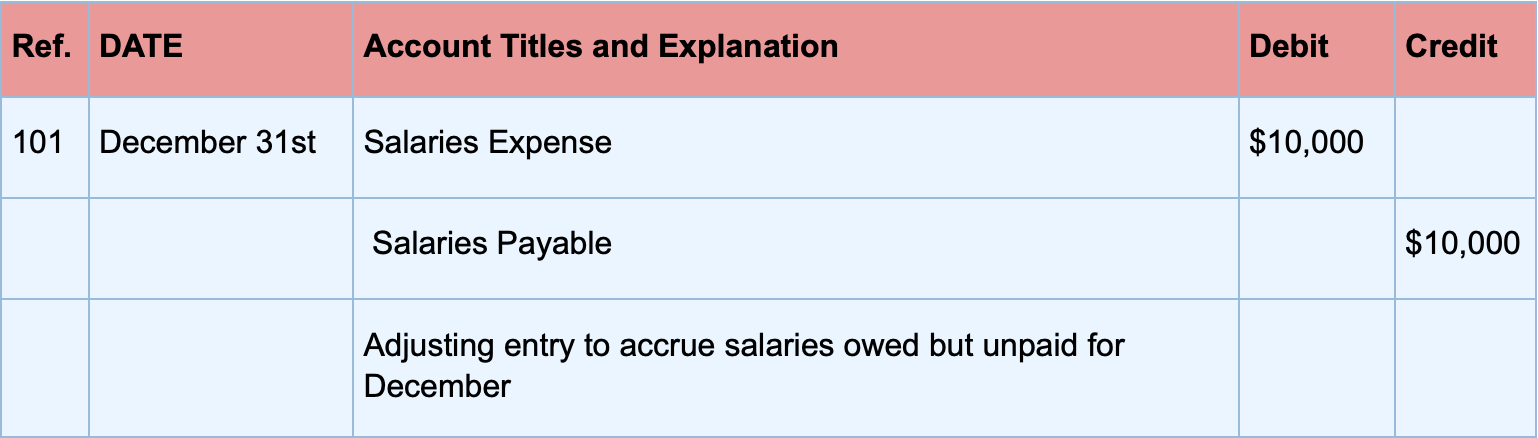

The adjusting entry at year end on the end-of-period spreadsheet would The adjusted trial balance verifies that total debits equals total credits before the adjusting entries are prepared. Debit salaries expense and credit salaries payable to record the accrued salaries. If you keep the books yourself you can be more informative and label it Adjusting Entry for Accrued Wages or something similar to help you remember more clearly what youve done.

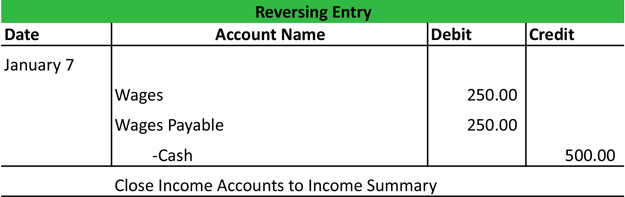

However the salary for last month is not yet paid so they prepare adjusting entry for this transaction. Adjusting Entry - Wage Expense. The Wages Payable amount will be carried forward to the next accounting year.

Salary expense for the period was 1100 and 1400 was paid to employees in cash. Journal Entries for Salaries Payable There are two steps to think about when we think about Salaries Payable. Salaries payable at the end of the period was 500.

Now youll place a new entry there with the description Adjusting Entry and add the wages youve calculated for those last few days of the period. Salary expense for the period was 1100 and 1400 was paid to employees in cash. Unless a company pays salaries on the last day of the accounting period for a pay period ending on that date it must make an adjusting entry to record any salaries incurred but not yet paid.

The 13420 of Wages Expense is the total of the wages used by the company through December 31. Adjusting Entry - Salaries Payable in Chapter 3 Problem 12 of 20 Moderate. Adjusting entries for accruing uncollected revenue.