Unbelievable Ratio Analysis Of Maruti Suzuki Pdf

Pavithira journalInternational journal of applied research year2018 volume4 pages06-10 B.

Ratio analysis of maruti suzuki pdf. Agricultural producer companies collective marketing farmers group Introduction. Until recently 1828 of the company was owned by the Indian government and 542 by Suzuki of Japan. Management efficiency ratio.

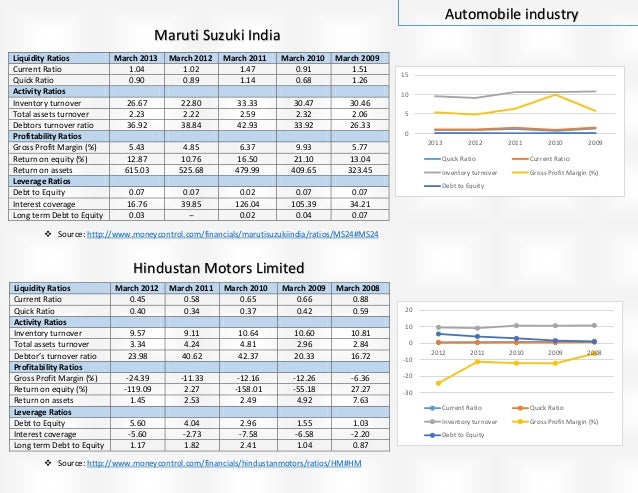

A ratio analysis of Maruti Suzuki India Ltd. Presentation OnRatio Analysis on Maruti Suzuki. This study has been undertaken to understand the overall financial performance of Maruti Suzuki India Limited.

From the study position of Maruti Suzuki Tata Motors is ascertained. To make the short term financial analysis of Maruti Suzuki 2. This means that Maruti is best equipped to pay off its short term debt obligations.

The goal of such an analysis is to determine the efficiency and performance of the firms management as reflected in. Analysis of Assets Turnover Ratios of Maruti Suzuki India Limited DR. After his death Indira Gandhi decided that the project should not be allowed to die.

The EVEBITDA NTM ratio of Maruti Suzuki India Limited is significantly higher than the average of its sector Automobiles. INTRODUCTION Maruti Suzuki and Hyundai are the two leading automobile giants in the Indian economy but for Hyundai it looks bit. Key Financial Ratios of Maruti Suzuki India in Rs.

The financial data and information required for the study are drawn from the various annual reports of companies. Marutis quick ratio is stable and constant when compared to current ratio and far better than tata motors which states that the company follows conservative policy and liquidity of the company is better off when compared to Tata motors. Agarwal Nidhi 2015 the study focus on the comparative financial performance of Maruti Suzuki and Tata motors ltd.