Beautiful Work Tax Paid In Cash Flow Statement Job Order Cost Sheet Example

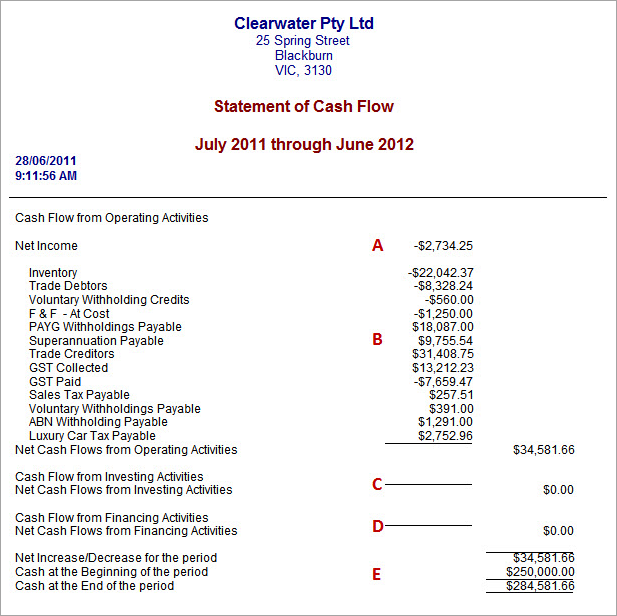

The first component is the cash flows relating to your operations the core activities of your business.

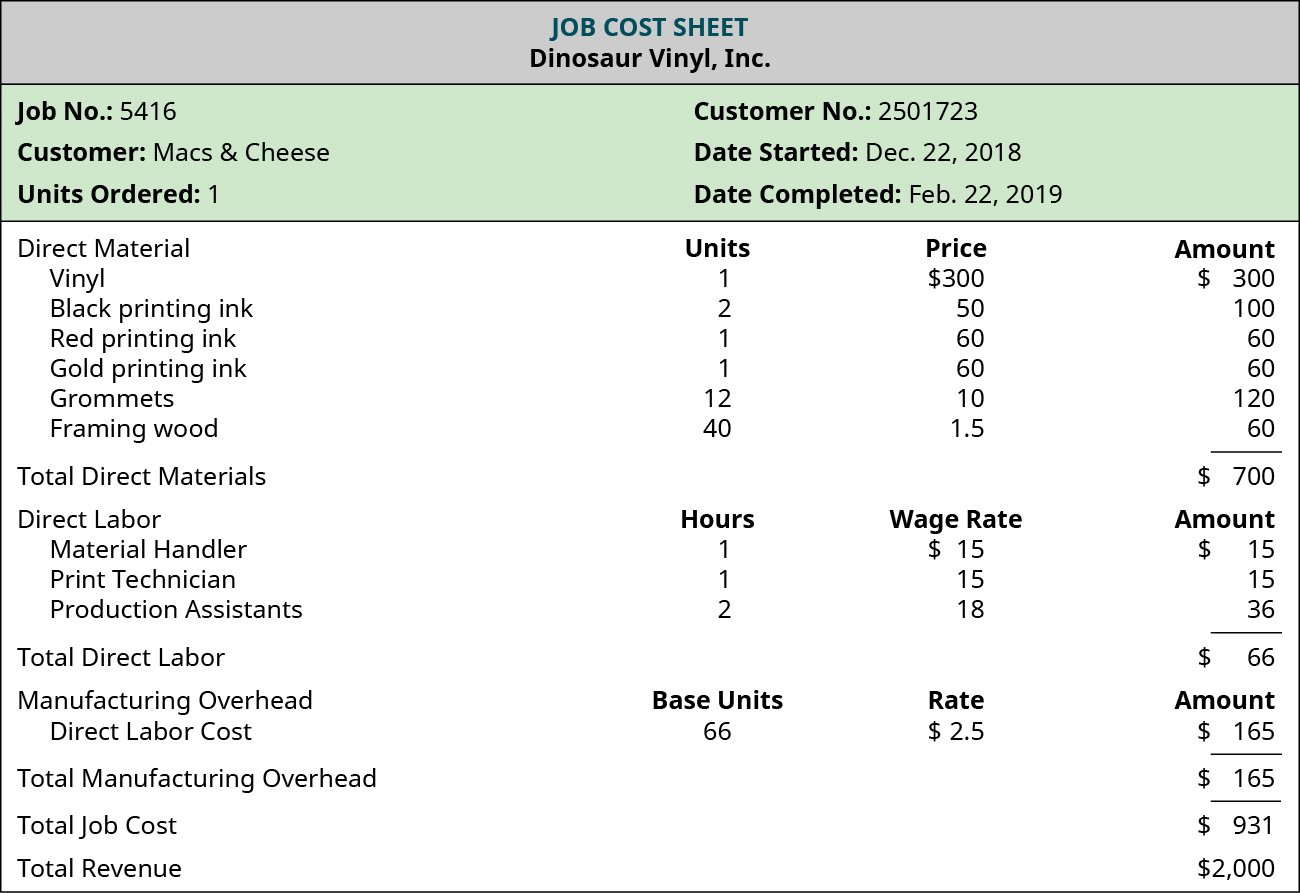

Tax paid in cash flow statement job order cost sheet example. EBIT - tax paid depreciation. A cash flow statement is a valuable measure of strength profitability and the long-term future outlook for a company. Materials direct labor and factory overhead.

The topic this time is your personal cash flow statement. Preparation of Cash Flow Statement With Example In this article we will discuss about the preparation of cash flow statement explained with the help of suitable illustrations. Reduces profit but does not impact cash flow it is a non-cash expense.

This will be the third part of our ongoing series on personal financial statements. At the bottom of our cash flow statement we see our total cash flow for the month. 114 Use Discounted Cash Flow Models to Make Capital Investment Decisions.

Thats 42500 we can spend right now if need be. This sub-total represents the amount of the tax liability that there would have been at the reporting date in the event that no tax had been paid. The total cost of 931 is transferred to the.

A cash flow direct method formula is used to calculate cash inflows and cash outflows when preparing a cash flow statement using the direct method. An example format for a direct method cash flow statement is shown below. Cash flow for the month.

JOB ORDER COST FLOWS AND DOCUMENTS A job order cost accounting system allocates costs to each job. This includes cash receipts cash received from your customers cash paid to suppliers and employees and for general operating expenses interest received or paid and tax paid. Cash paid for wages -53000 Cash flow from operations 21500.