Ideal Tangible Net Fixed Assets On Balance Sheet

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

Such assets have a scrap or residual value.

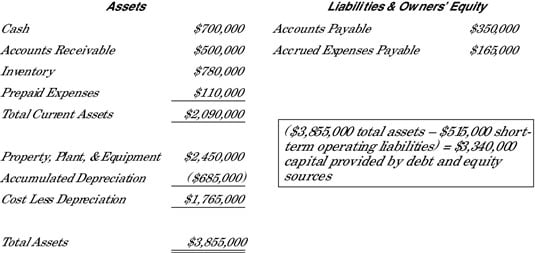

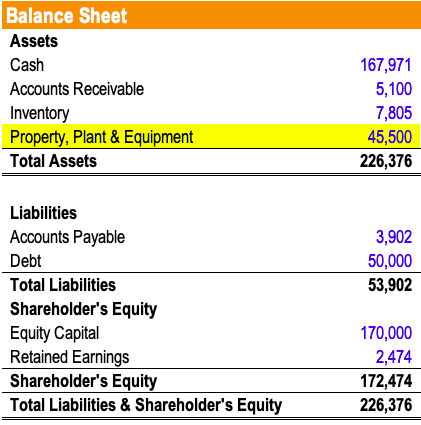

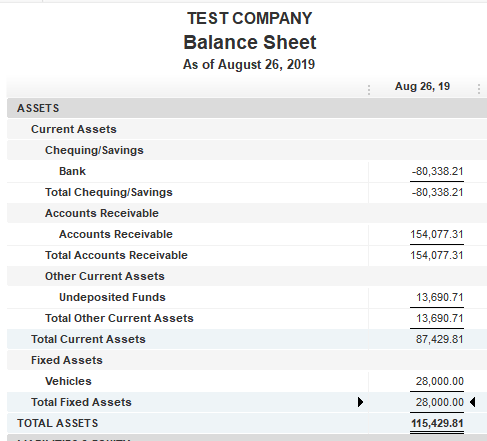

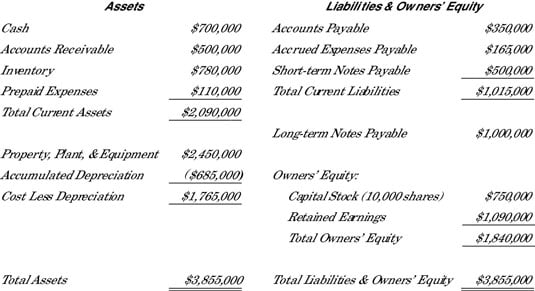

Tangible net fixed assets on balance sheet. Fixed assets or hard assets are those held by a business for a long time and cannot be easily converted into cash. Tangible assets are the most basic type of asset listed on the balance sheet and typically account for the majority of an organisations total assets. Also called the book value of the asset.

Some common tangible assets examples include. Net tangible assets are listed on a companys balance sheet and indicate its book value based on the amount of its total assets less all liabilities and intangible assets. Such as fixed assets and current assets.

Characteristics of Tangible Assets. Beneficial ownership Ensure all the fixed assets are shown in the financial statements so that any relevant user would have a clear perception of the financial position. A company can use these assets as collateral to get a loan.

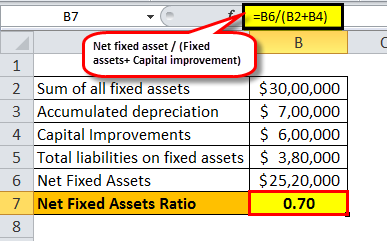

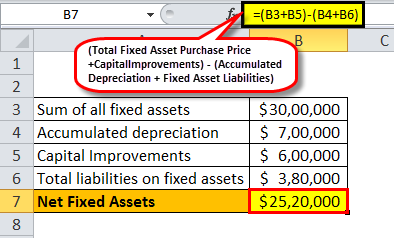

Theyre considered long-term assets because you need them for everyday business over time rather than quickly liquidated. Depreciation - The Net block of Fixed assets is shown in the balance sheet. The Tangible Net Worth TNW is a relevant indicator to assess the real value of a company based on the balance sheet.

At its most basic definition an asset is something of value that usually produces an income stream. List the companys fixed assets. Ensure the client owns the assets detailed in the fixed asset schedule and included on the balance sheet or if leased they have the rights of ownership ie.

Net tangible assets which is also referred to as net tangible book value is calculated by subtracting intangible assets and liabilities from total assets. To calculate the NTA. Difference between tangible and intangible assets.

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Tangible_and_Intangible_Assets_Differ_Sep_2020-01-9b5bbac8d4e34db598936af62d5d55cb.jpg)