Neat Statutory Reserve In Balance Sheet

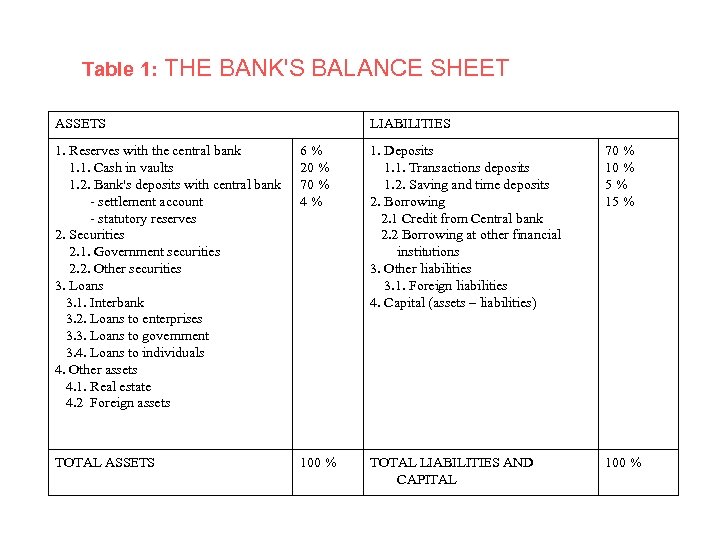

Statutory Reserve is the amount of money securities or assets that need to be set aside as a legal requirement by insurance companies and financial institutions to cover its claims or obligations which are due in the near future.

Statutory reserve in balance sheet. Type of Equity Reserve. So the equation now stand as Assets liability owners capital includes cash reserves thanks. March 31 2001 0000 By A.

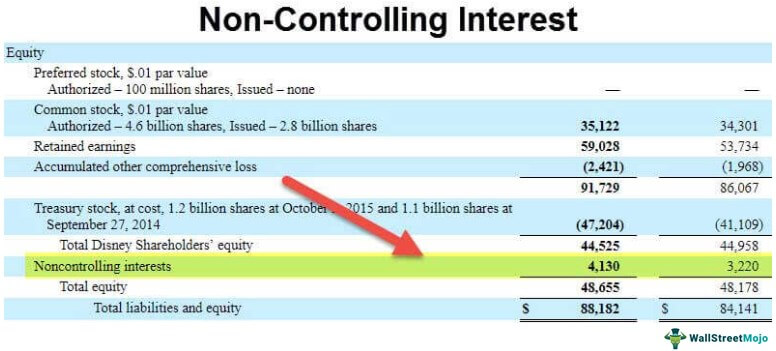

Reserve accounting In financial accounting reserve always has a credit balance and can refer to a part of shareholders equity a liability for estimated claims or contra-asset for uncollectible accounts. Retained Earnings are a part of companys net income which is left after paying out dividends to shareholders. Statement of changes in the equity.

Profit and loss account. Statutory reserves are excluded. Alternatively the company could use the reserve to perform a distribution of own funds among its shareholders.

It is maintained by the company for meeting future losses. As per the companys law no 2 of 2015 UAE Companys law The limited liabilities companies is required to reserve 10 of the annual net income as a statutory reserve which is not subject to distribution or withdraw. Statutory reserves are the minimum amounts of cash and readily marketable securities that insurance companies must hold.

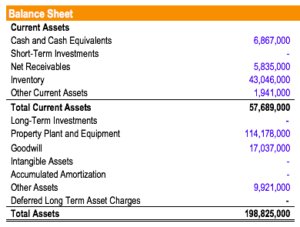

For instance the balance of the statutory reserve could be transferred to the account Profit Carried Forward or be used to cover Loss Carried Forward. Balance sheet value as at 1 January 3527. Balance sheet reserves appear as liabilities on a companys.

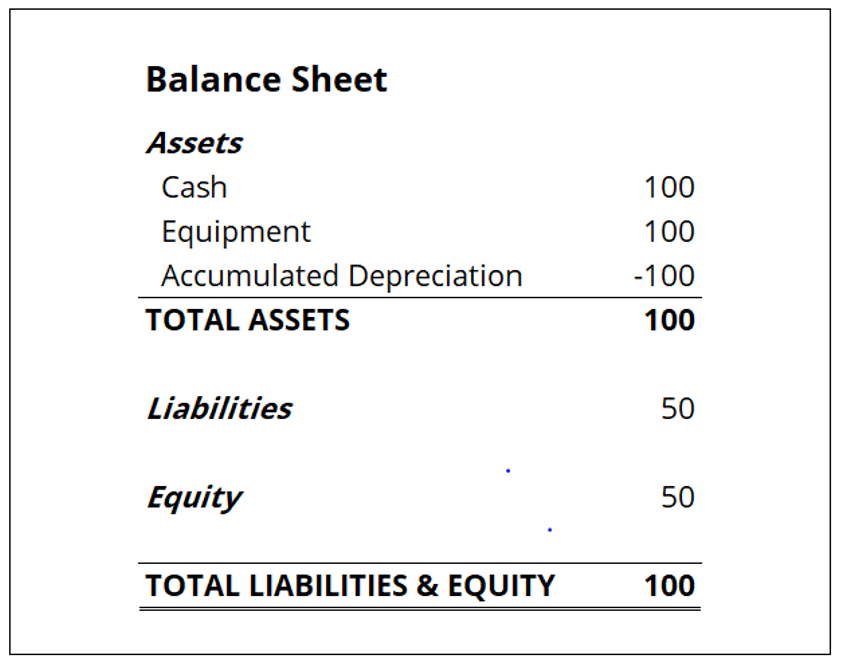

In thousands of EUR. From Wikipedia the free encyclopedia In the business of insurance statutory reserves are those assets an insurance company is legally required to maintain on its balance sheet with respect to the unmatured obligations ie expected future claims of the company. The balance sheet is divided into two parts that based on the following equation must equal each other.

:max_bytes(150000):strip_icc()/dotdash_final_Cash_Reserves_Dec_2020-01-be14cdc169de4288af1aa6ea495ec0ef.jpg)

:max_bytes(150000):strip_icc()/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Tier_1_Leverage_Ratio_Definition_Nov_2020-01-4741405e9a8f49b79939f1a51fc3de54.jpg)