Beautiful Cash Flow From Financing Activities Definition

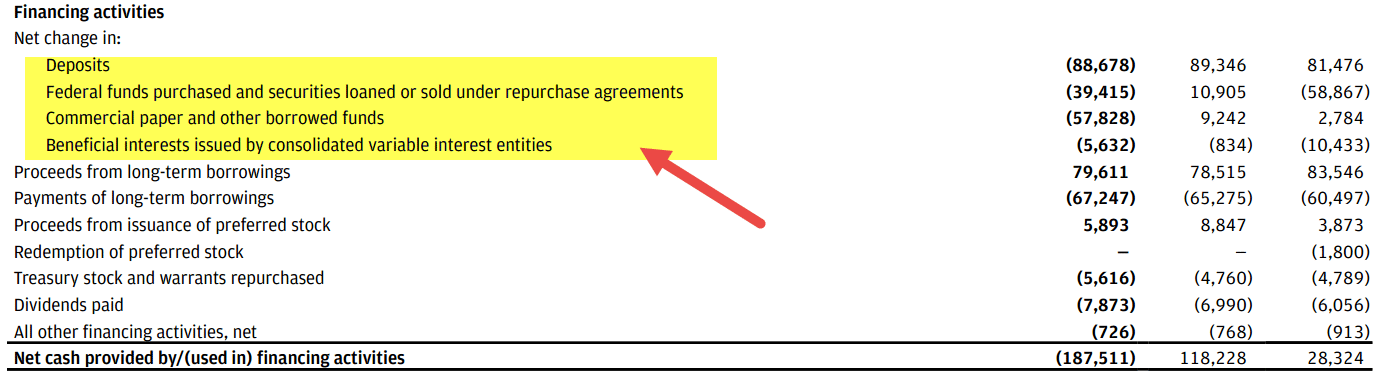

Cash inflows from creditors usually consist of new loans issued to the company while cash outflows from creditors include loan and interest payments.

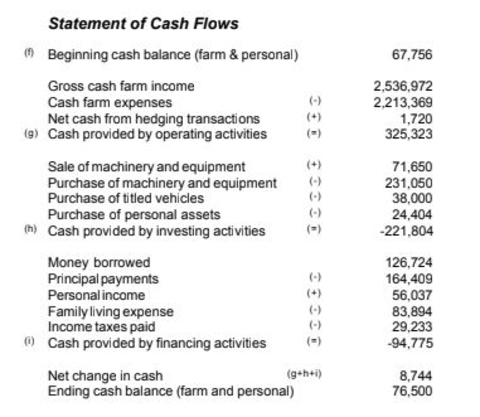

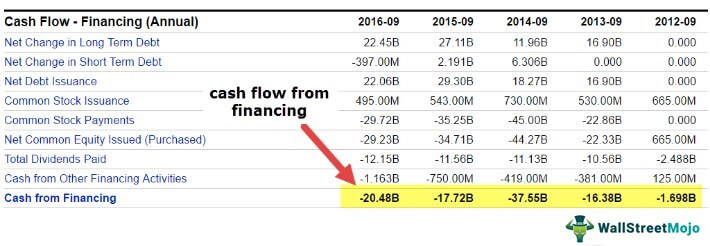

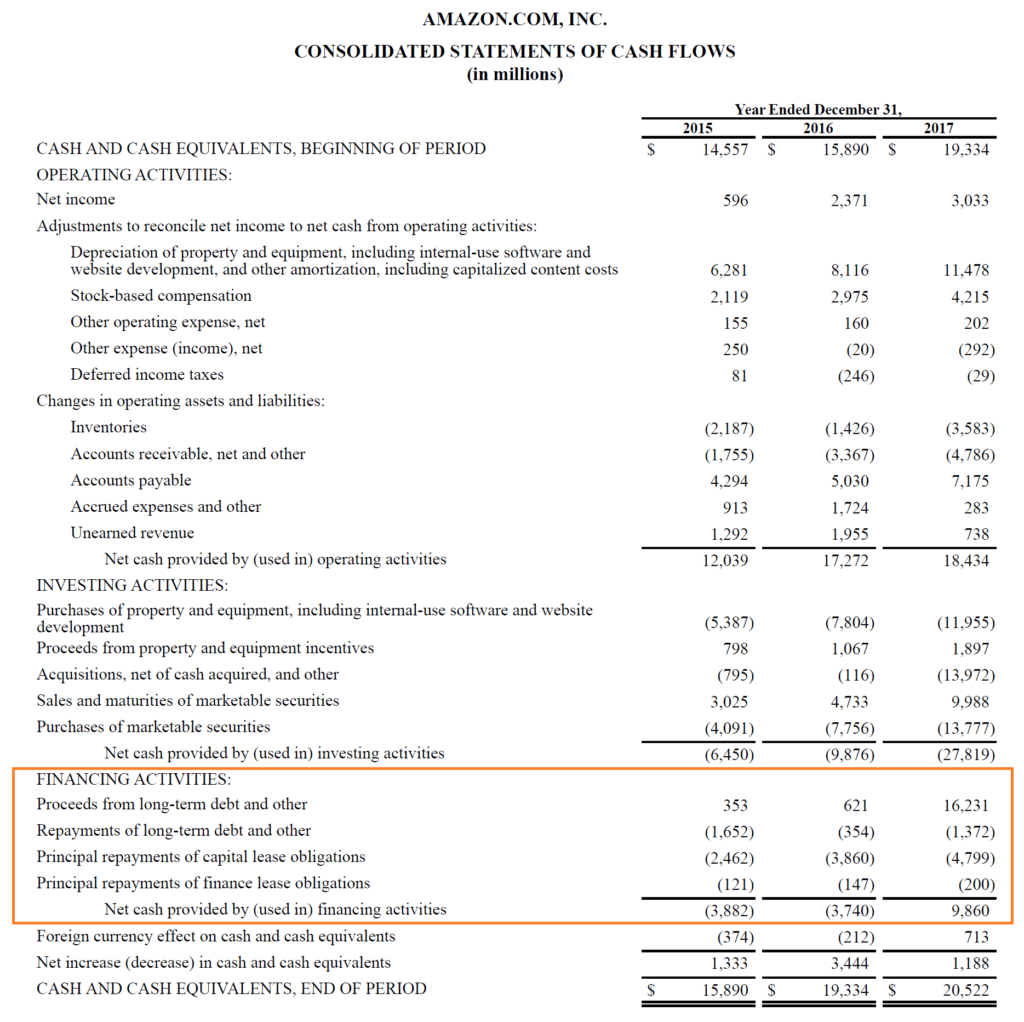

Cash flow from financing activities definition. The cash flow from financing activities are the funds that the business took in or paid to finance its activities. Cash flow from financing activities CFF is a section of a companys cash flow statement which shows the net flows of cash that are used to fund the company. Financing activities refer to the transactions involved in raising and retiring funds.

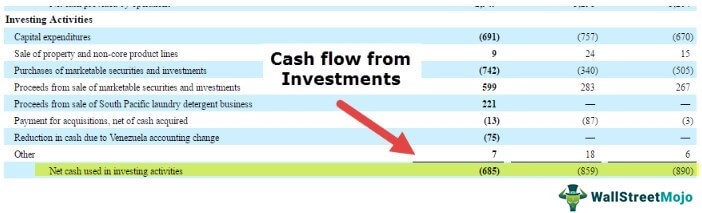

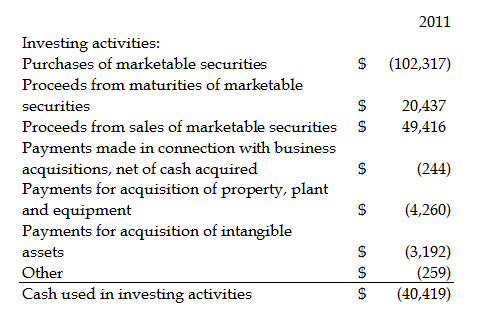

What are some examples of financing activities. Issuance of ordinary shares. Its one of the three sections on a companys statement of cash flows the other two being operating and investing activities.

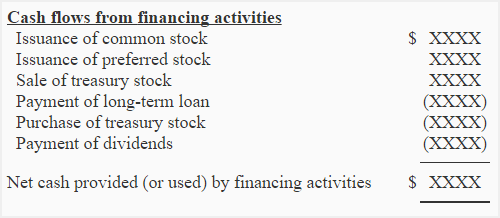

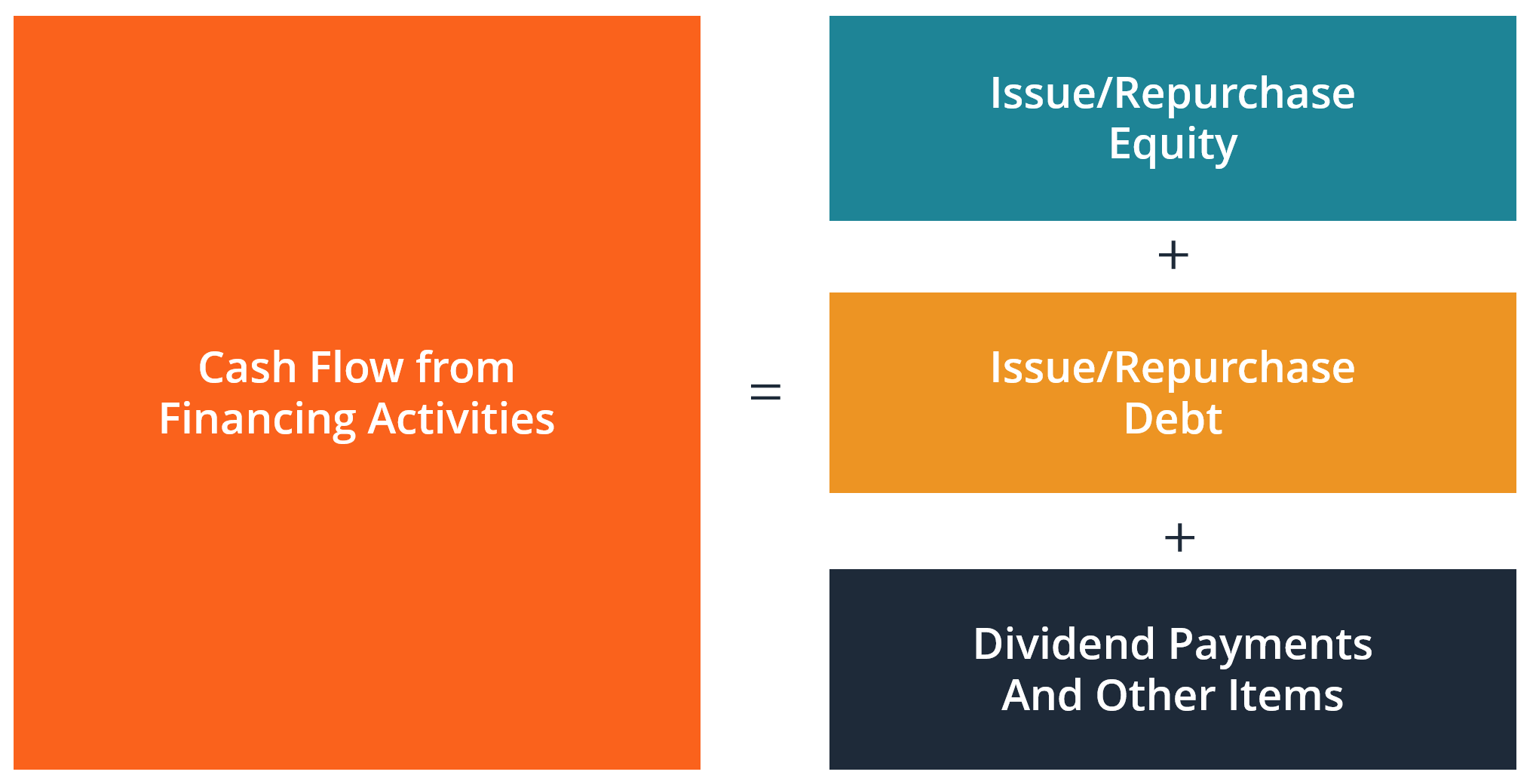

Financing activities include transactions involving debt equity and dividends. That is cash flow from financing activities is the net amount that a company receives from issuing stock and bonds. Cash flow from financing activities refers to inflow and the outflow of cash from the financing activities of the company like change in capital from the issuance of securities like equity share preference shares issuing debt debentures and from the redemption of securities or repayment of a long term or short term debt payment of dividend or interest on securities.

Cash flow statement definition. The former is associated with cash inflow and the latter denotes cash outflows. What this article covers.

Along with the balance sheet and income statement the cash flow statement is an important document outlining a businesss financial position. It is the last section in the statement of cash flows and shows cash or cash equivalent transactions done with owners and creditors of the company. Here we will pour light on Cash Flows from Financing Activities.

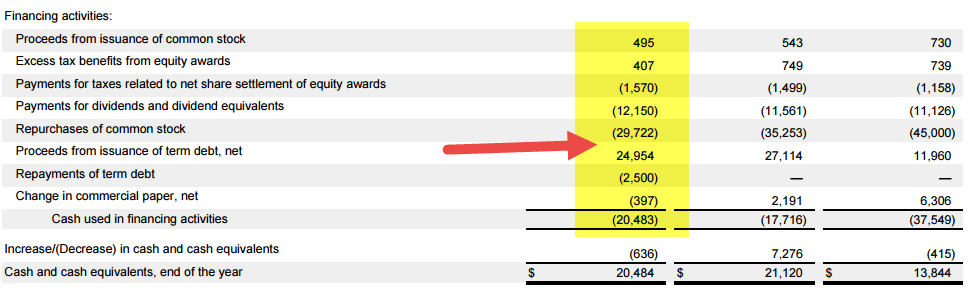

The section of the cash flow statement titled Cash Flow from Financing Activities accounts for inflows and outflows of cash resulting from debt issuance and financing the issuance of any new stock dividend payments and any repurchase of. Financing activities include both cash inflows and outflows from creditors and investors. Borrowing and repaying short-term loans.

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)