Heartwarming Closing Entry For Net Loss

Then post the closing entries to the T accounts.

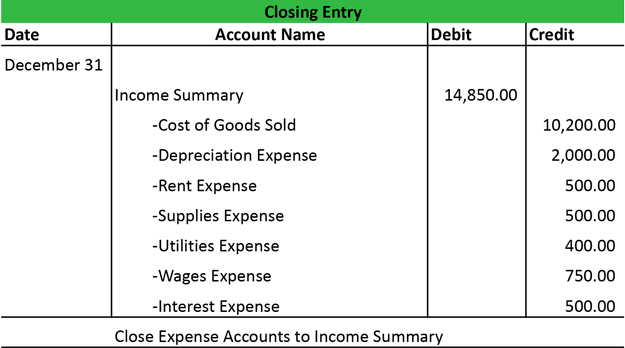

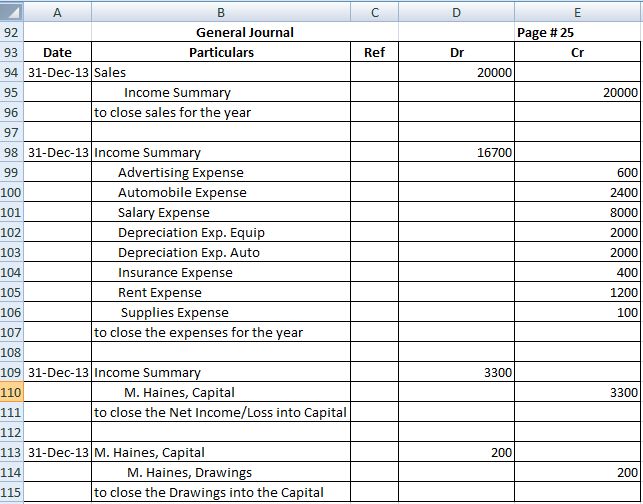

Closing entry for net loss. Net income or net loss. Closing Entry 3 for Bob To close the income summary account to the retained earnings account Bob needs to debit the retained earnings and credit the income summary. The closing entries for completing the Profit and Loss Account are the following.

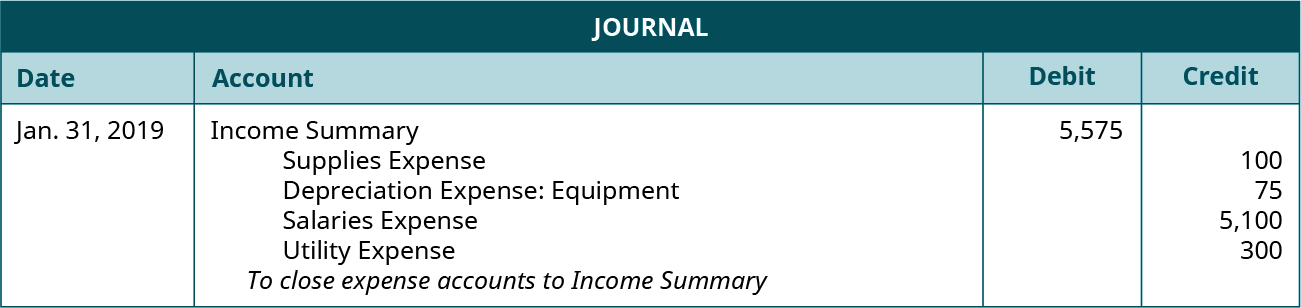

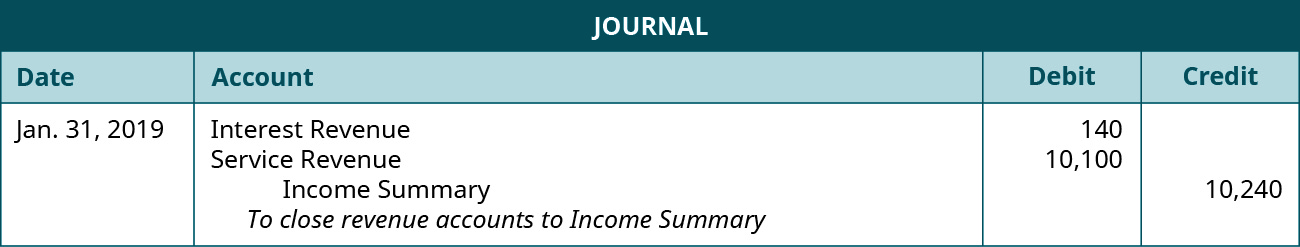

In partnerships a compound entry transfers each partners share of net income or loss to their own capital account. Then you shift the balance in the income summary account to the retained earnings account. CLOSING ENTRIES NET LOSS Using the following partial listing of T accounts prepare closing entries in general journal form dated January 31 20--.

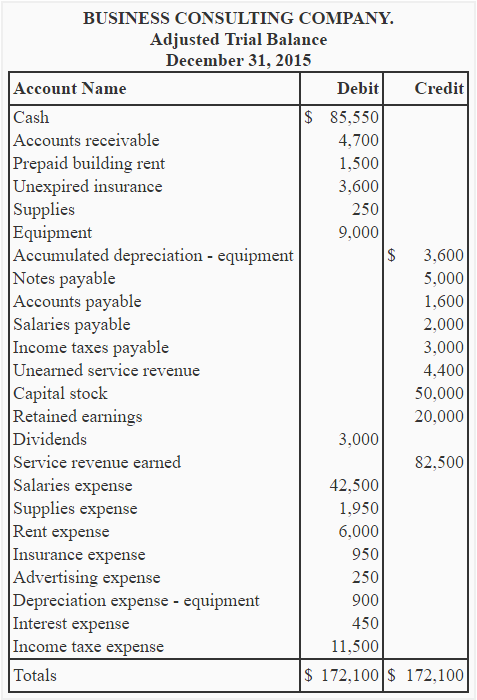

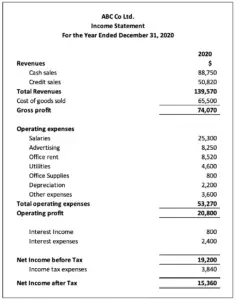

Closing Entries with Net Loss. The income summary accounts 61 credit balance equals the companys net income for the month of April. Credit the various Expenses Accounts appearing in the Trial Balance except those already debited to the Trading Account.

Balance in Profit and Loss ac The Profit and Loss ac is also a nominal account. Income Summary is a temporary account showing net profit or loss for an accounting period. Offers its services to individuals desiring to improve their personal images.

The amount in the income summary account after the first two closing entries has been posted is equal to this. It is prepared under the single entry system in order to find out the amount of opening or closing capital of the business. To close income summary debit the account for 61 and credit the owners capital account for the same amount.

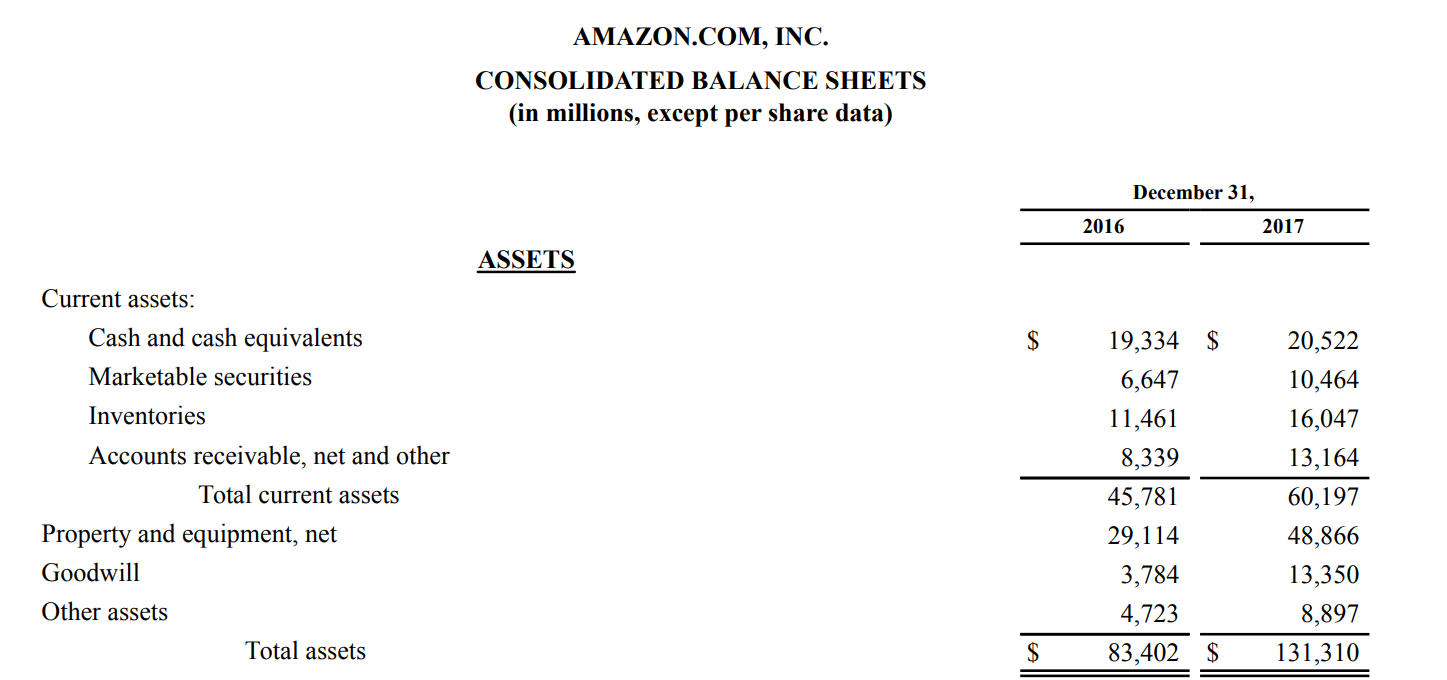

It is closed at the end of the accounting period by transferring its balance to either the Capital ac or the Profit. Assets Liabilities or Capital. Fourth closing entry closes out this account.