Beautiful Work Working Capital On Trial Balance

Neel started business with a capital of 80000.

Working capital on trial balance. Calculate the Capital Balance and prepare a Trial Balance in chart of accounts order from the figures given. Working capital should be used in conjunction with other financial analysis formulas not by itself. A working trial balance is a trial balance that is in the process of being adjusted.

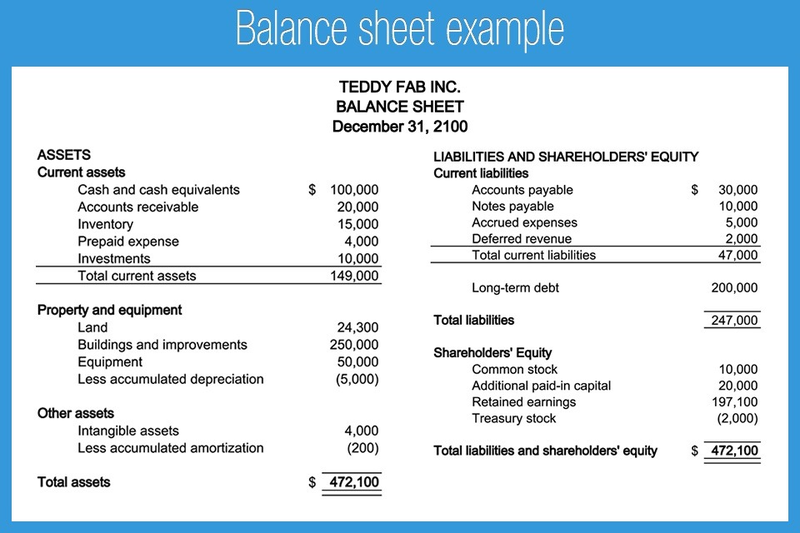

The current ratio which is sometimes referred to as the working capital ratio is calculated by dividing a companys current assets by its current liabilities. Due to the dual aspect of accounting the sum of total credits should be equal to the sum of total debits. Working capital is the amount of a companys current assets minus the amount of its current liabilities.

Both current assets and liabilities can be found directly on your companys balance sheet. Ivanhoe Company Worksheet For the Month Ended June 30 2020 Trial Balance Account Titles Dr. Usually the accounting software automatically blocks all accounts having a zero balance from appearing in the report.

Cash 2100 Accounts Receivable 2800 Supplies 2000 Accounts Payable 1100 Unearned Service Revenue 400 Owners Capital 3160 Service Revenue 3000 Salaries and Wages Expense Miscellaneous Expense 160 Total 7660 7660 Other data. It measures a companys liquidity operational efficiency and short-term financial. Adjusted Trial Balance Example.

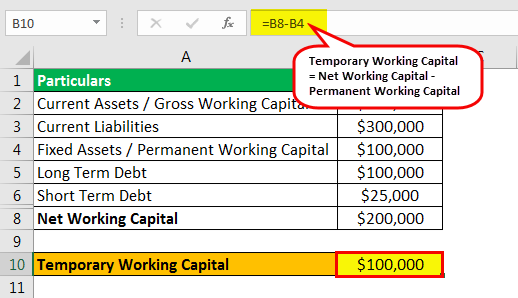

Working Capital Current Assets Current Liabilities. The adjusted version of a trial balance may combine the debit and credit columns into a single combined column and add columns to show adjusting entries and a revised ending balance as is the case in. Calculating Working Capital.

Trading account Profit and Loss account and Balance Sheet are prepared according to the ledger balances as posted in the trial balance. The term trial balance refers to as the total of all the general ledger balances. Record the following transactions in the Journal and post them into ledger and prepare a Trail Balance.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)