Looking Good Decrease In Trade Payables Cash Flow

Increase in Inventory Increase in Trade Receivables Decrease in Trade Payables Increase in Other Financial liabilities.

Decrease in trade payables cash flow. Proceeds from issue of common stock. For example On June 1 2017 your Accounts Payable balance is 500000. The reason for this is because accountants want to define individual transactions on this financial statement.

View Cash flow-Excel. Add the amount to Net income. A decrease in trade receivables means less credit customers therefore cash inflow.

On the cash flow statement you start out with the 95000. Cash flow is the amount of cash inflow and outflow form the cash account of an organization. An increase in trade payables means the business is taking longer to pay the suppliers therefore holding the cash in the business longer meaning it ˇs a cash inflow.

A decrease in accounts payable will also represent a decrease in a companys statement of cash flows. Maximizing your trade credit means that you are delaying your cash outflows and taking full advantage of each dollar in your own cash flow. This is also common for seasonal products.

Calculate trade payables from the below balance sheet. It eliminated the non-cash transactions and only accounted for the cash transactions. Typical dating terms are 306090 days meaning that you pay one-third of the amount due at 30 days another third at 60 and the last third at 90 days.

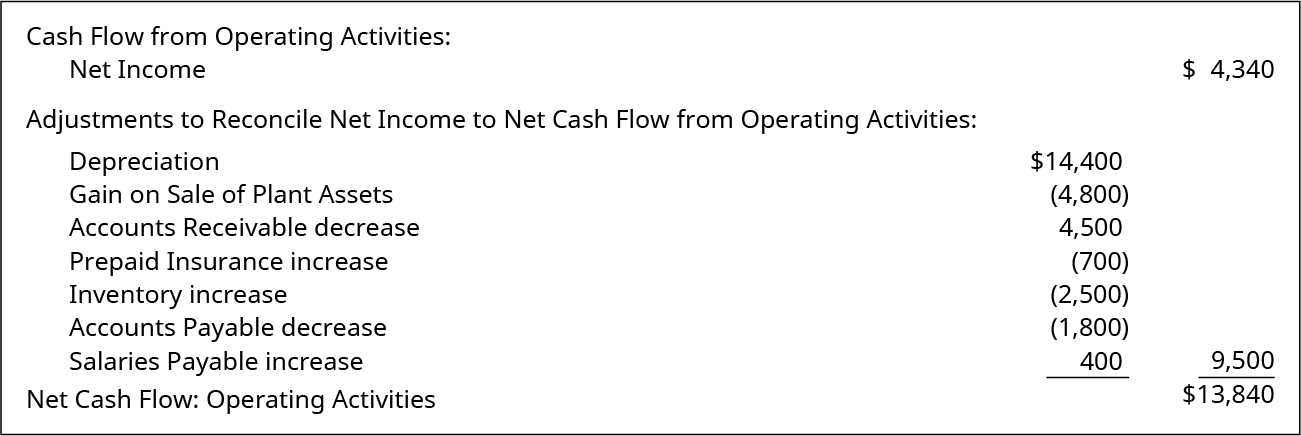

When the statement of cash flows SCF cash flow statement is prepared using the indirect method it begins with the companys net income for the accounting period. 5000 as a positive item. Increasing accounts payable is a source of cash so cash flow increased by that exact amount.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/cash-1462856_1920-5a3353653b0b4ba882838c80df7e89f3.png)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)