Recommendation Understanding Balance Sheets For Beginners

Balance Sheet A Beginners Guide A Balance Sheet is an accounting report required by all companies registered at Companies House and is useful for self-employed to see how their business performs.

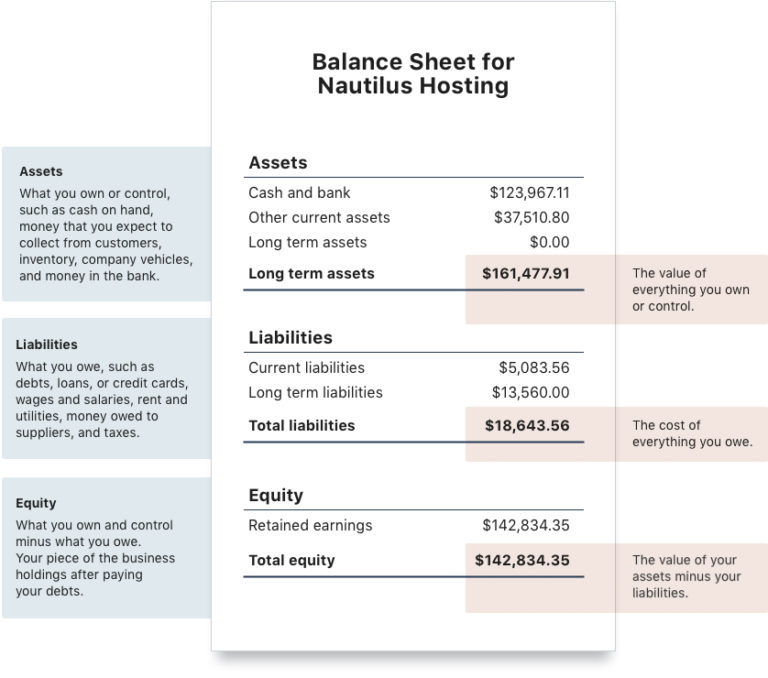

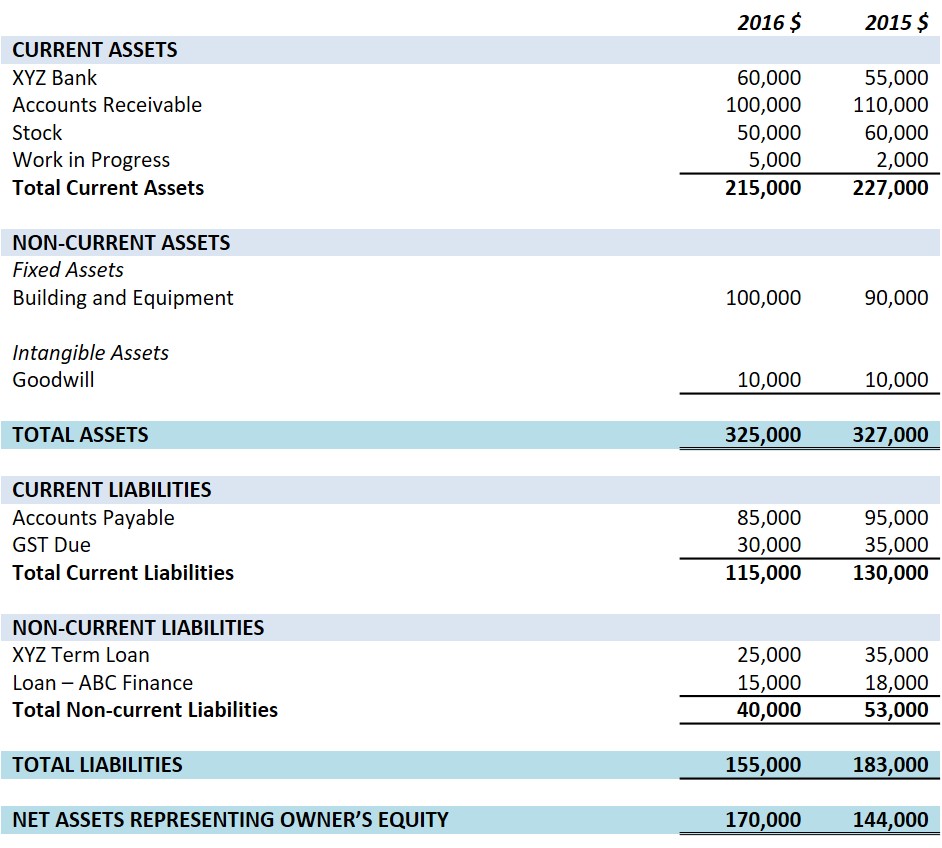

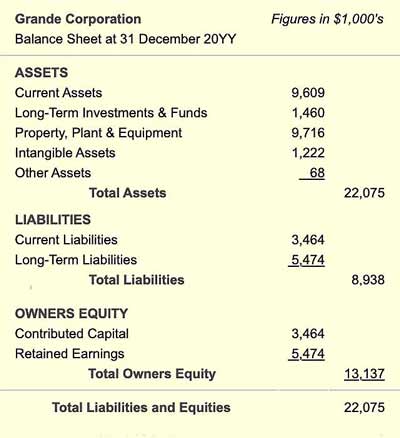

Understanding balance sheets for beginners. Balanced sheet can be divided into three parts Asset what a company owns liabilities and equity what a company owes. January 1 to December 31. It is also a condensed version of the account balances within a company.

Balance sheet is one of the three financial statements that gives you insight into the financial health of a company. The two sides of a balance sheet are. The Balance Sheet forecast is the last of the big three financial reports were covering in this series.

One of the main financial reports of a business is called a balance sheet or statement of financial position. A companys balance sheet also known as a statement of financial position reveals the firms assets liabilities and owners equity net worth. A balance sheet is a record of what a company owns and what it owes just like CIBIL score of an individual.

A balance sheet works by ensuring those two sides are equal to each other. Reading a Balance Sheet. A balance sheet presents a financial snapshot of what the company owns and owes at a single point in time typically at the end of each quarter.

A Beginners Guide to the Balance Sheet Forecast Report. Lets deal with the obvious question first why it is called a balance sheet and why does it need to be. Two balance sheets flank an income statement.

The balance sheet together with the income. Reading and understanding the balance sheet of the company includes consideration of the accounting equation which states that the sum of the total liabilities and the owners capital is equal to the companys total assets knowing different types of assets shareholders equity and liabilities of the company and analyzing the balance sheet using ratios. It is a summary of assets liabilities and equity.