Exemplary Cash Inflow And Outflow Formula

Beginning Cash is the money you have in hand in your current day.

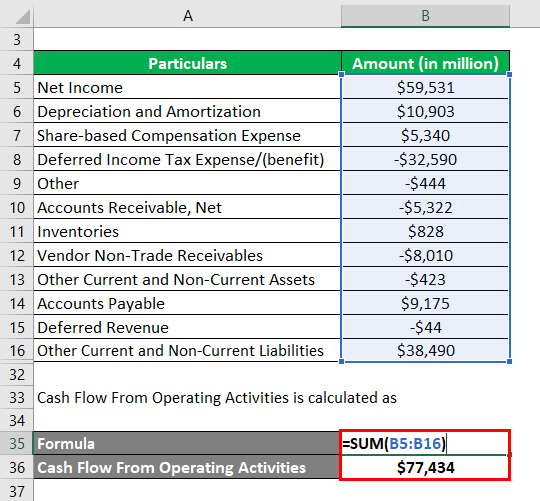

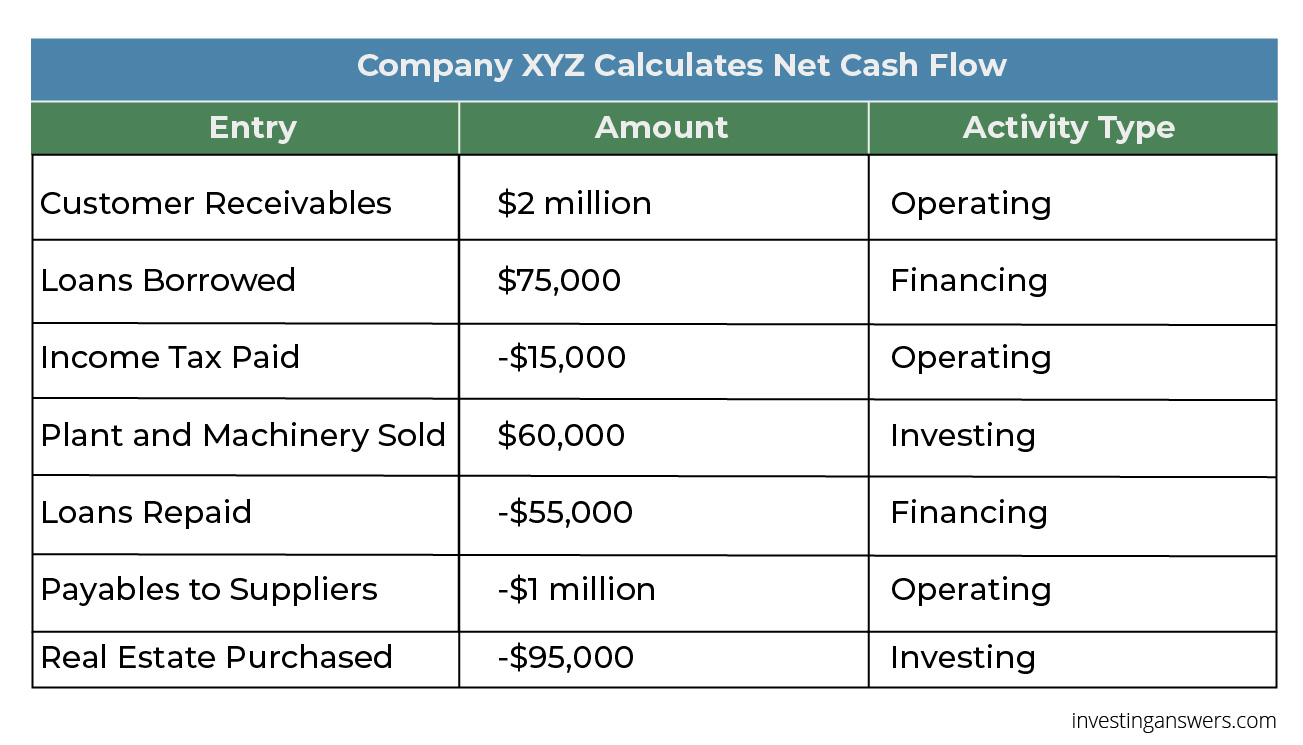

Cash inflow and outflow formula. Cash flow from Investments formula Cash inflow from Sale of Land Cash outflow from PPE 30000 50000 -20000 CFI is an outflow of 20000 Cash Flow from Investing Activities Example Apple Now let us have a look at few more sophisticated cash flow statement for companies which are listed entities in NYSE. The reasons for these cash payments fall into one of the following classifications. Project outflow is the expenditures you are about to make in a specific time phase.

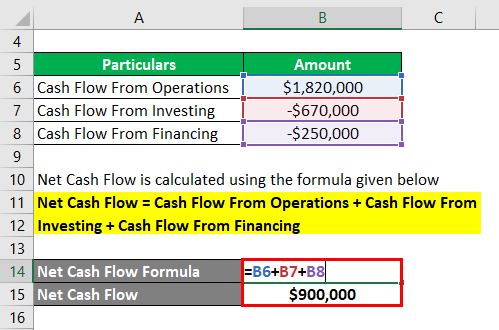

The formula for net cash flow calculates cash inflows minus cash outflows. Changes in accounts receivable inventory or accounts payable can also result in cash outflows. To calculate net cash flow you need to find the difference between the cash inflow and the cash outflow.

Cash outflow is the amount of cash that a business disburses. It is not restricted only to your capital and investment. For instance goods purchased on credit and goods sold on credit will not be included in this statement as these transactions have no effect on inflow and outflow of cash.

But you can also separate cash flow. Companies should monitor the movement of cash in their business closely and ensure that there is a higher cash inflow than outflow. Again cash inflows are positive and cash outflows are negative.

Project inflow is the money you are supposed to get during a specific time phase. Cash inflows only represent one part of cash management. It could be due to expenditure related to raw.

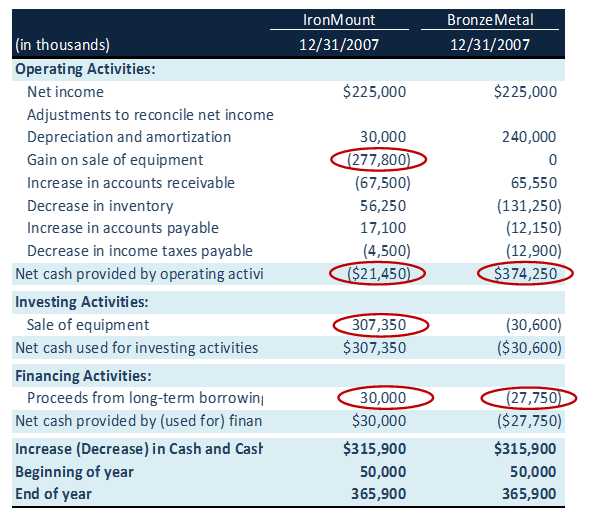

Read more this would be most of the cases be in negative as the firm invests their major cash flow either in plant and machinery or in another product as an investment and the cash inflow here would be dividend received etc. Net cash flow cash inflows - cash outflows It can also be expressed as the sum of cash from operating activities CFO investing activities CFI and financing activities CFF. Cash outflow is the money that leaves the business.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)