Nice Types Of Profit And Loss Account

Reported income and expenses are directly related to an organizations are considered to measure the performance in terms of profit loss.

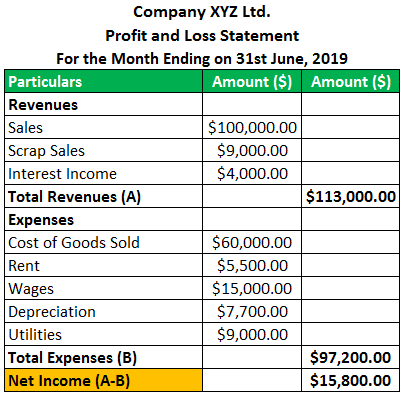

Types of profit and loss account. Trading Account is prepared first and then profit and loss account is prepared. Indirect Expense All business expenses other than direct expenses. It is prepared to determine the net profit or net loss of a trader.

Gross profit Gross loss. Following is the list. We prepare Trading account to ascertain the Gross profit Gross loss.

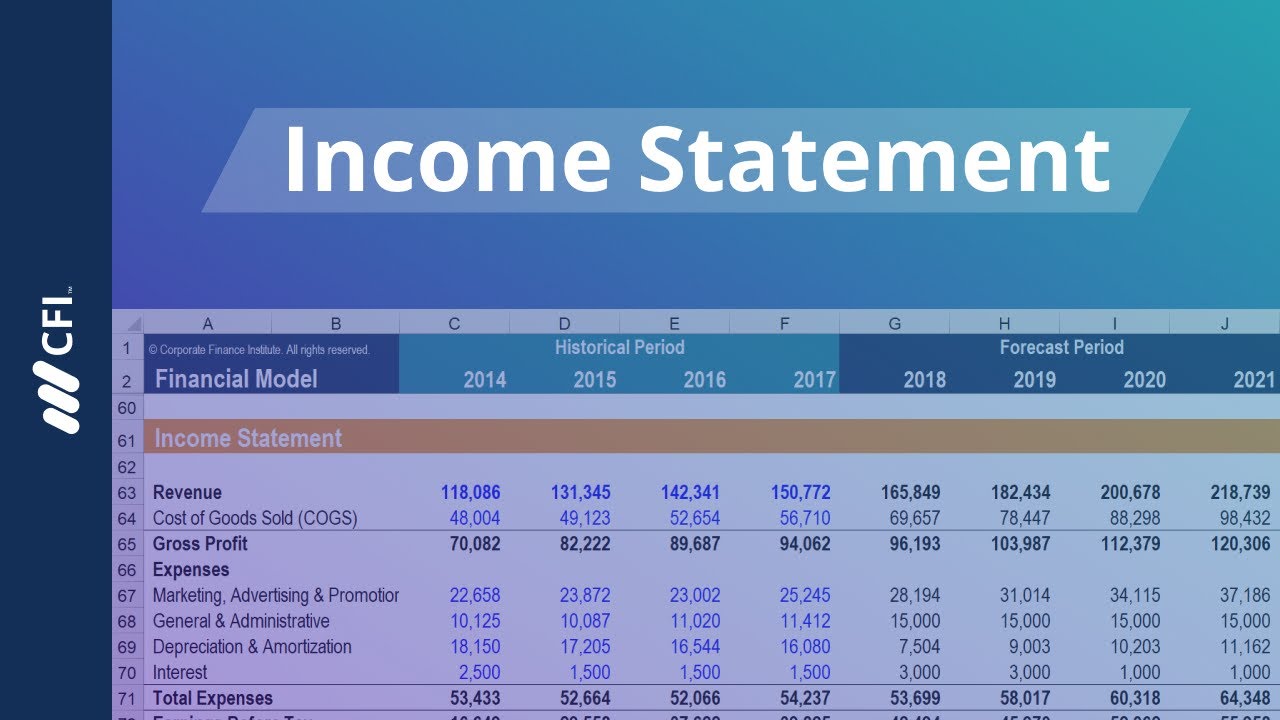

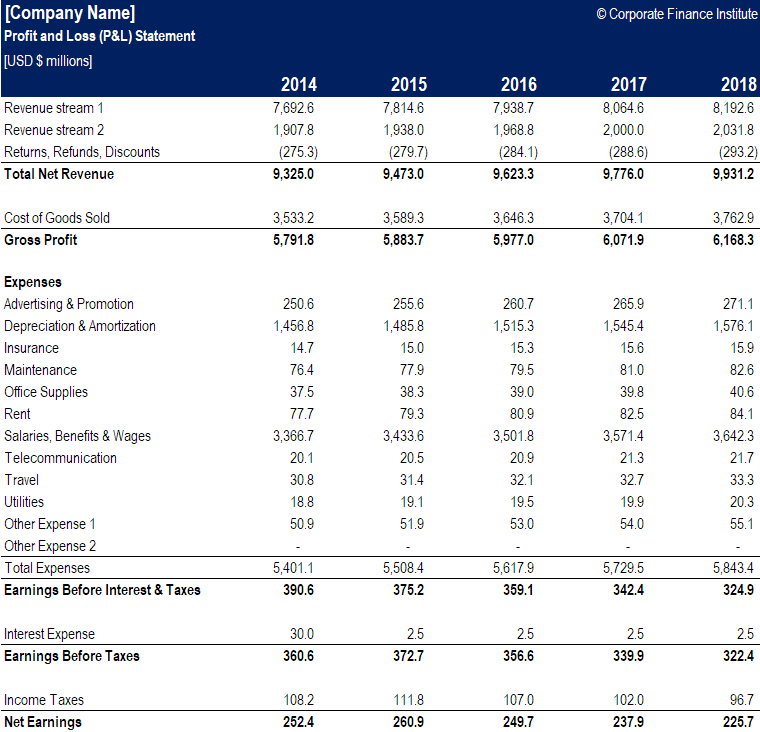

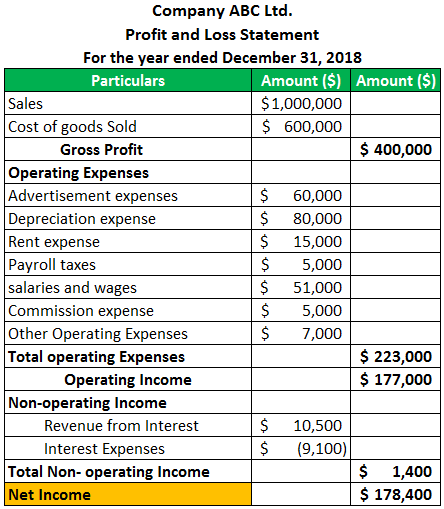

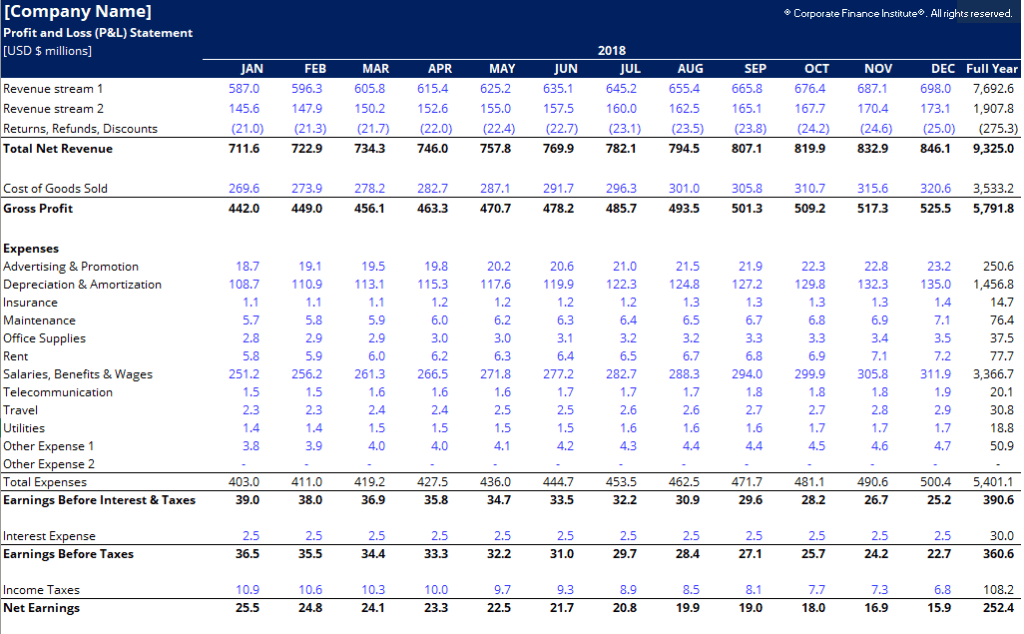

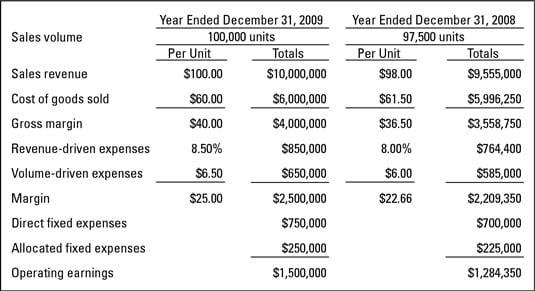

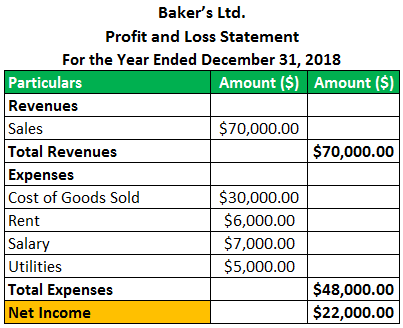

There are two main categories of accounts for accountants to use when preparing a profit and loss statement. It is customary to add up all the expenses first then deducting the entire column from the gross profit after adding other revenue The result is net profit or net loss. The profit and loss PL statement is a financial statement that summarizes the revenues costs and expenses incurred during a specified period usually a fiscal quarter or year.

Profit and loss account is made to ascertain. Profit and loss account Definition The account that shows annual net profit or net loss of a business is called Profit and Loss Account. While we prepare Profit and loss account to ascertain the Net profit Net loss.

Gross Profit Ratio 2. Postage Telephone. Gross profit or loss of a business is ascertained through trading account and net profit is determined by deducting all indirect expenses business operating expenses from the gross profit through profit and loss account.

The balance sheet and the profit and loss PL statement are two of the three financial statements companies issue regularly. The account through which annual net profit or loss of a business is ascertained is called profit and loss account. Trading account used to find the gross profitloss of the business for an accounting period.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)