Sensational Prepare Cash Flow Statement Online

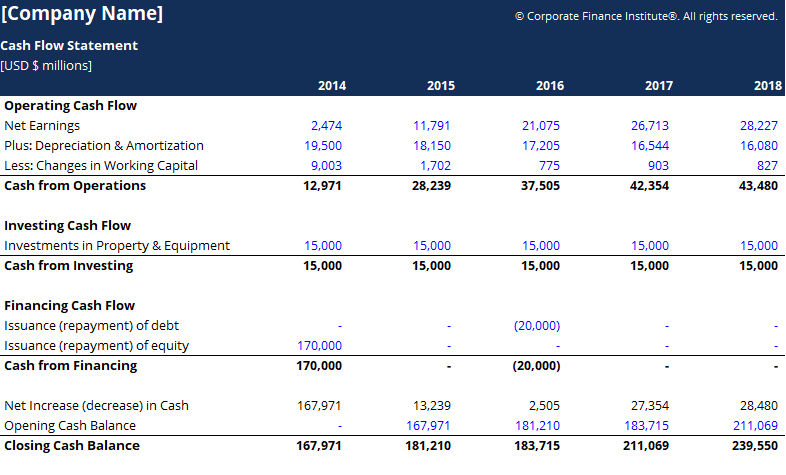

Cash flow statements are most commonly prepared using the indirect method which is not especially useful in projecting future cash flows.

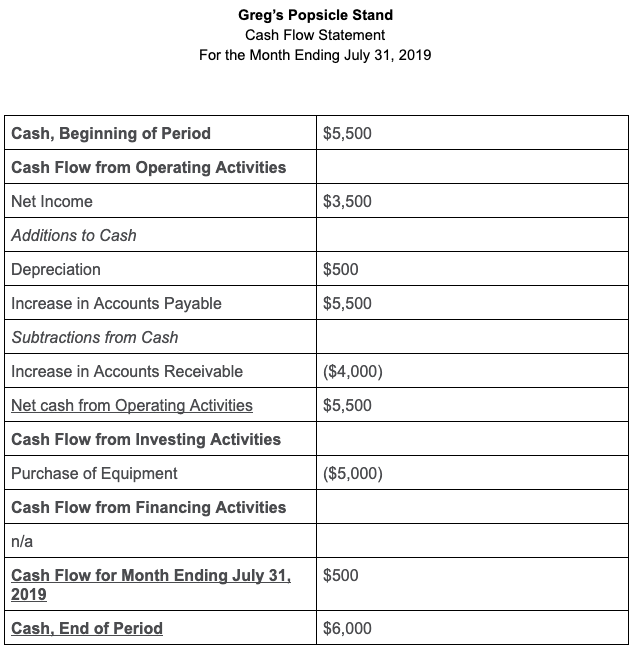

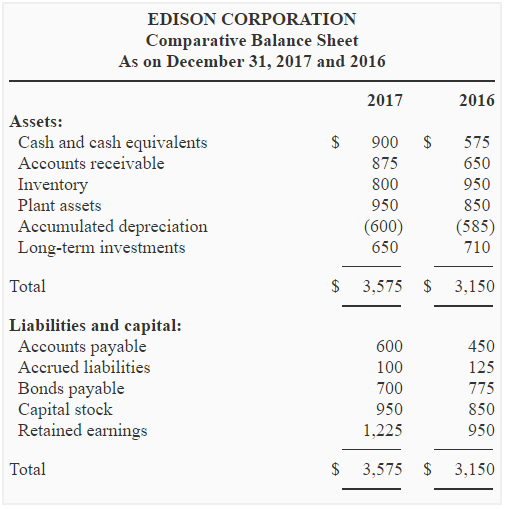

Prepare cash flow statement online. The indirect method of preparing a statement of cash flows is a technique that begins with the net profit from the income statement which is then adjusted for non-cash items such as depreciation. The fields in the tan colored cells of the spreadsheet are left blank for you to enter your own figures and you can also change labels for these rows to reflect your own categories of cash flows. It is important to note that there is a difference between a cash flow statement and an income statement.

It will show the cash coming into a company from sales investments borrowings etc and cash going out of the company such as bill payments salaries tax payments loan repayments dividends etc. Both result in the same financial statement showing how financial transacations affected would have affected the bank account of the company. Net income is the companys gross profit.

The indirect method is based on accrual accounting and is generally the best technique since most businesses use accrual accounting in their bookkeeping. Operating investing and financing will be the same. The amount generated as net income and that a business has at the moment are determined and entered in the cash flow statement.

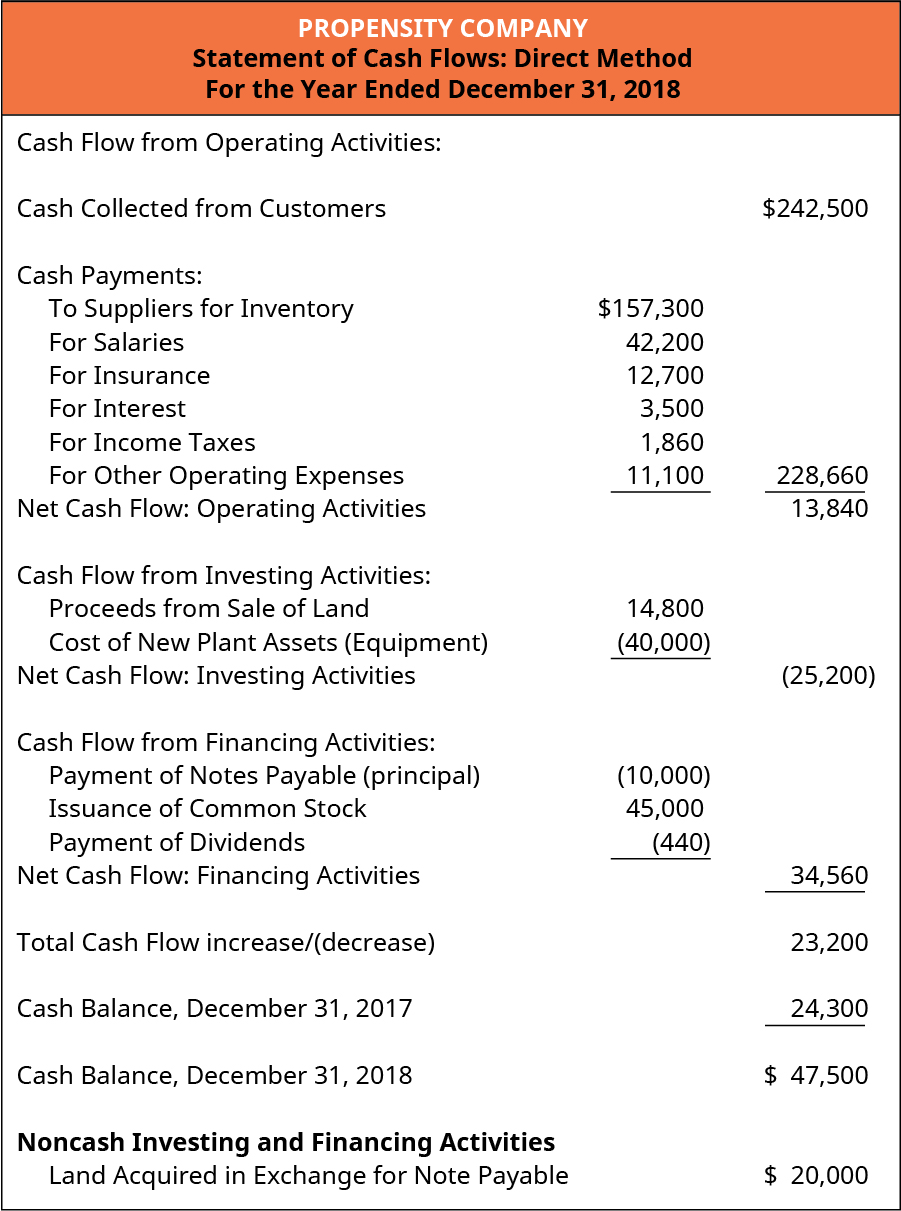

The direct method and the indirect method. As prescribed by the Accounting standard -3 there are two methods which can be used to prepare cash flow statements. A cash flow statement is a statement produced by a company to help in identifying cash inflow and cash outflow.

How to Prepare a Statement of Cash Flows. The various sources of inflow and outflow of cash are usually categorized into operation financing or investments. This method depends on the accrual accounting method in which the accountant records revenues and expenses at times other than when cash was paid or receivedmeaning that these accrual entries and adjustments cause the cash flow from operating activities to differ from net.

Simply enter the financial data for your business and the template completes the calculations. 11 min read. Reporting on Cash Flows from Operating Income and Expenses.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)