Impressive Audited P&l How To Prepare Balance Sheet In Excel

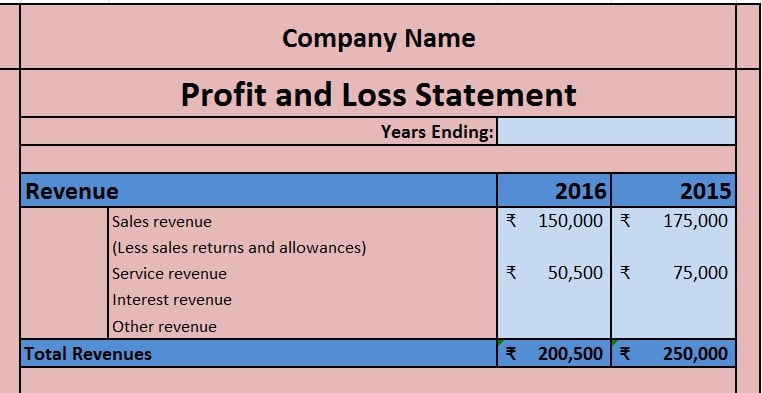

A profit and loss statement can go by many names such as a PL income statement earnings statement revenue statement operating statement.

Audited p&l how to prepare balance sheet in excel. Balance Sheet Template is a ready-to-use template in Excel Google Sheets and OpenOffice that helps you to gain insights into the financial strengths of the company. R2RHOW TO PREPARE MIS PL Balance sheet FROM TRIAL BALANCE in EXCEL. Existing Loan Repaid In 5 Yrs In 5 Equal Principal InstalmentsInterestinstallment paid in the beginning of the next year.

Public companies are obligated by law to ensure that their financial statements Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. Gen BAL can be used to prepare audit forms annual returns and calculate depreciation. No loan taken or given should be normally shown however if there is genuine loantake exact figure as on 31 march as per loan statement Stock figures depends upon business.

It is loaded with all basic excel formulas and formats to make calculation automatic as well as to draft balance sheet eliminating errors and mistakes. 5 Balance Sheet Formats In Excel. What is a Profit and Loss PL Statement.

The information provided by a balance sheet helps the potential investors lenders or any other key stakeholders to better understand how the business of the company functions. These three core statements are are audited by a registered CPA. Preparing a Periodic Profit and Loss Statement.

Download a sample Balance Sheet for Microsoft Excel - by Jon Wittwer. Balance sheet with financial ratios. One of the best features of our Balance Sheet Software is the capability to import data directly from Tally Busy MS Excel and other popular accounting and tax software.

Format of provisional projected balance sheet in excel. According to Investopedia a profit and loss statement is a financial statement that summarizes the revenues costs and expenses incurred during a specific period of time usually a fiscal quarter or year. Usually the businesses prepare a Balance Sheet quarterly half-yearly.