Simple Types Of Reserves In Balance Sheet

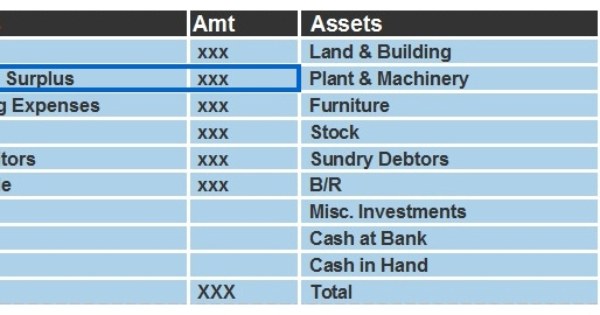

Every balance sheet has to classify assets in categories of current and non-current.

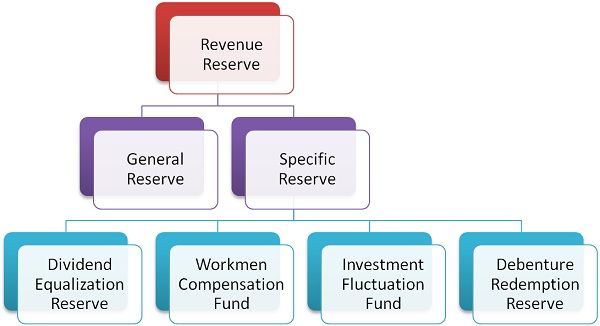

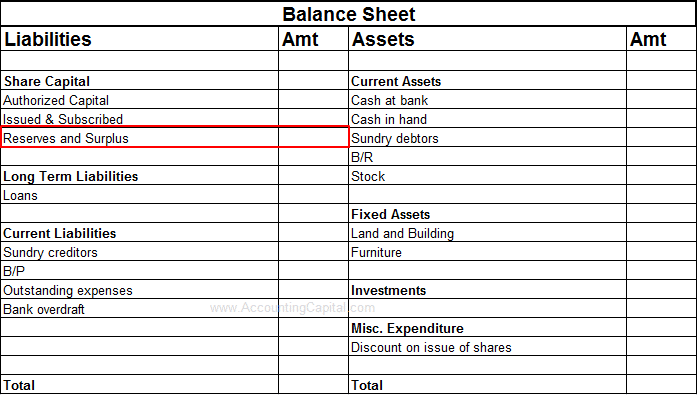

Types of reserves in balance sheet. Current non-current assets. Revenue reserve is a portion of profit owned by the company and is kept aside for the use of other multiple purposes. Greater than 90 probability of recovery.

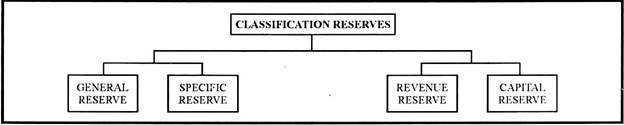

There are several types of reserves which raise up the balance in company balance sheet. Revenue reserves and capital reserves. They are taken from different sources of income and are usually set aside for different purposes.

This type can also divide in sub parts. Some reserve may increase and decrease balance from time to time. However profits may be distributed also to other types of reserves for example.

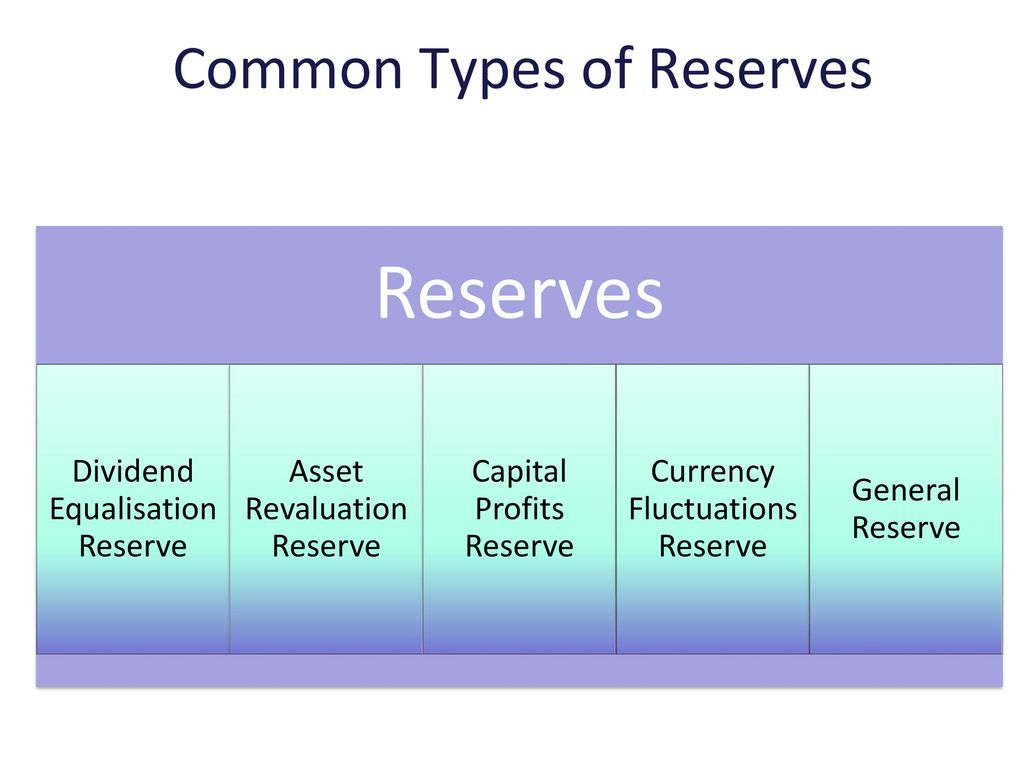

Those reserves provide full information to shareholders about which amount has gone to reserves or why they are not getting all amount of dividend. These arise from changes in the relative value of the currency in which the balance sheet is reported and the currency in which the balance sheet assets are held. Modern day terminology have started to refer to current assets and non-current assets.

Current assets fixed assets and intangible assets. For example the currency translation will change depending on the risk of the foreign exchange rate. These arise when a company has to adjust the value of an asset that is carried in the asset section of its balance sheet.

Current non-current and contingent liabilities. Current assets have a life span of one year or less meaning they can easily be converted into cash. Reserves always have a credit balance.

:max_bytes(150000):strip_icc()/dotdash_final_Cash_Reserves_Dec_2020-01-be14cdc169de4288af1aa6ea495ec0ef.jpg)

/GettyImages-172989638-93bc56a92e0e4844b31d175ea1b37b91.jpg)