Best Us Gaap Extraordinary Items

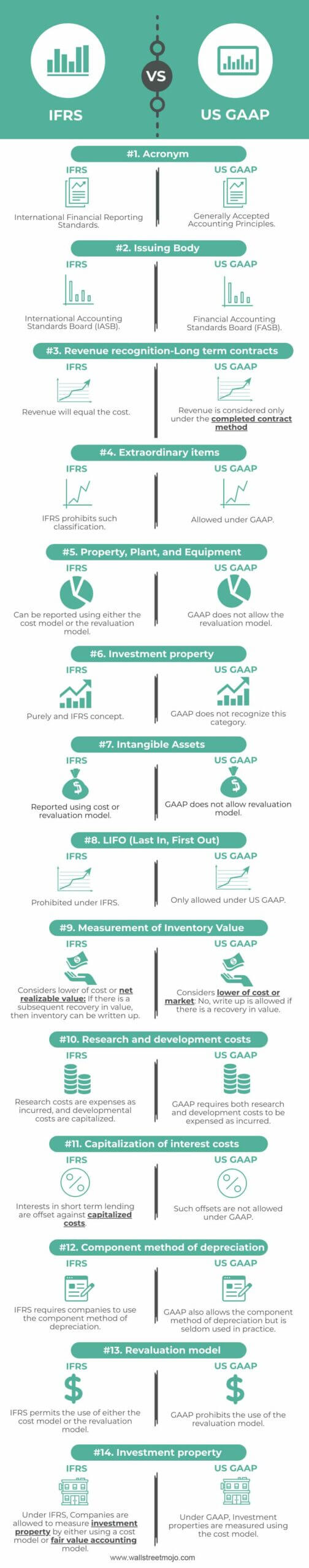

However the presentation disclosure or characterization of an item as extraordinary is prohibited.

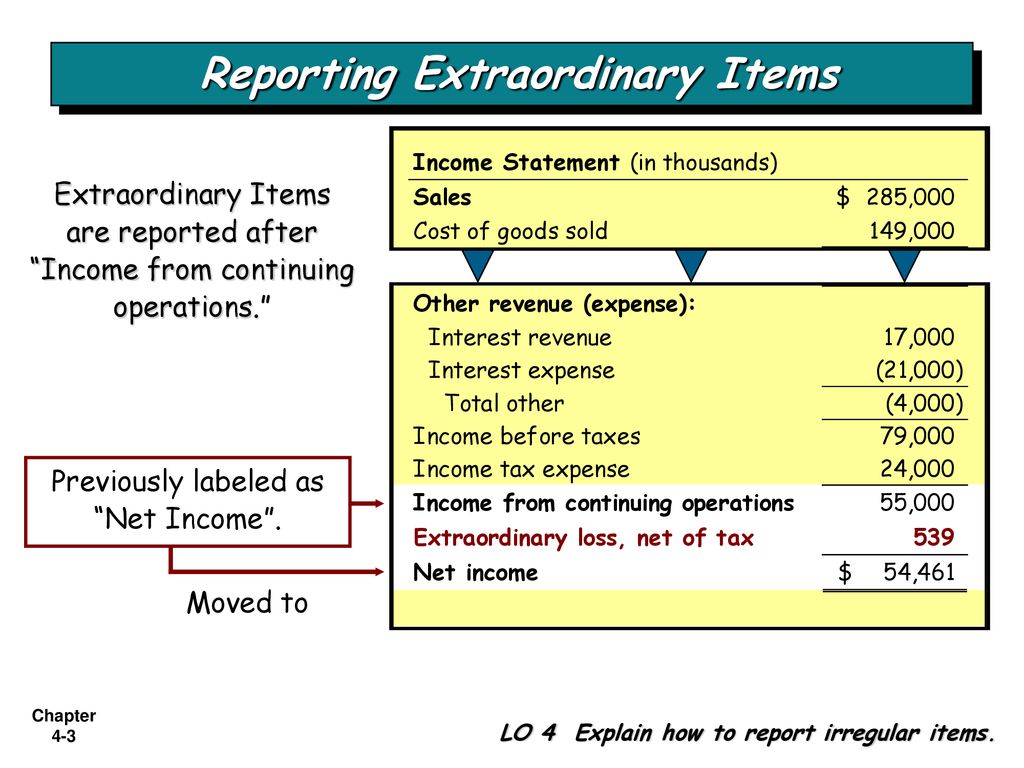

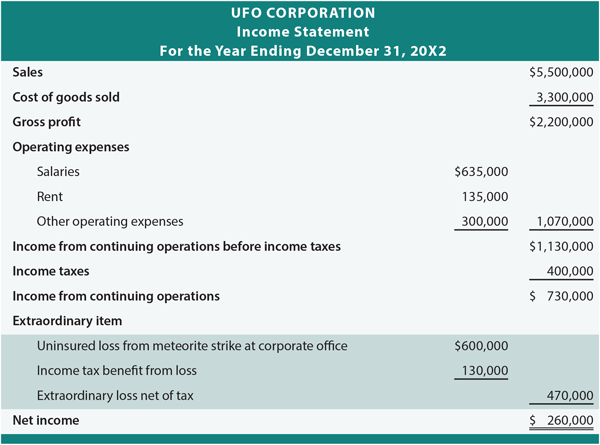

Us gaap extraordinary items. Earnings per share for extraordinary items-- presented in the income statement or in the notes The following items are not extraordinary items 1. And so material in amount that it cannot be reported in aggregate with other amounts. Under US GAAP such items should be reported.

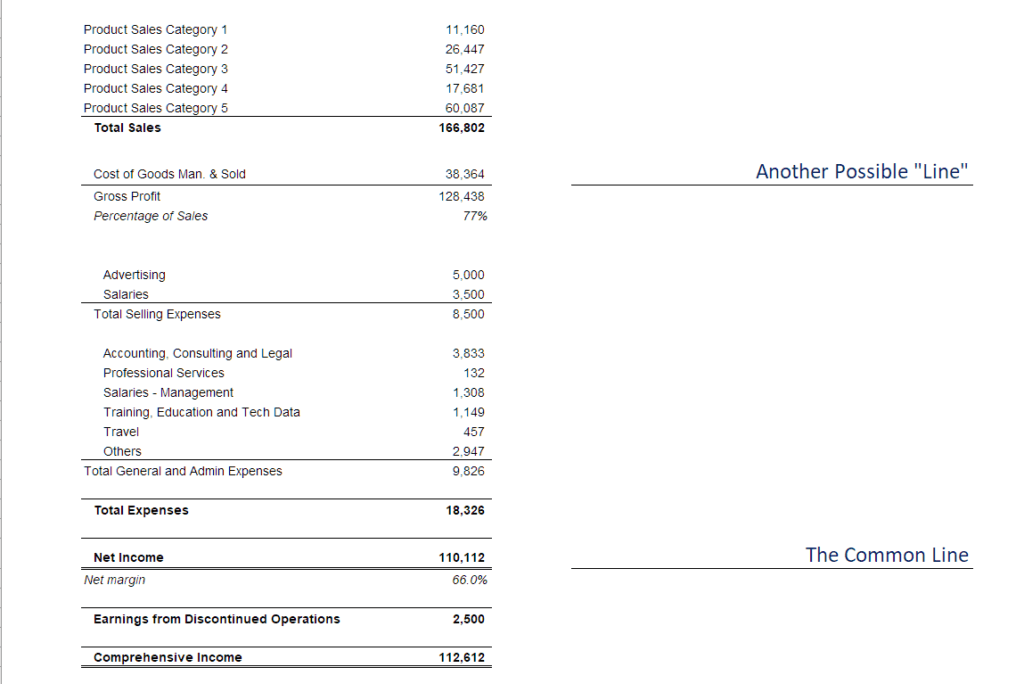

An extraordinary item in accounting is an event or transaction that is considered abnormal not related to ordinary company activities and unlikely to recur in the foreseeable future. However companies are not allowed to describe such items as extraordinary. The companies and auditors do not have to identify whether a certain event or transaction is.

January 13 2015. Thus both of the following criteria should be met to classify an event or transaction as an extraordinary item. Labeling income and expenses that relate to COVID-19 as unusual or exceptional may be acceptable.

Unusual or Infrequent Item or Both Earnings Per Share Impact Gross. Under US GAAP items of unusual andor infrequent nature are presented in the income statement as a separate component of income from continuing operations or disclosed in the notes. The FASB recently published an ASU to eliminate the concept of extraordinary items from US.

Infrequency of occurrence Presentation of extraordinary items 1. Extraordinary items are-- presented separately in the income statement 2. The FASB on January 9 2015 eliminated the seldom-used concept of extraordinary items from US.

IAS 1 does not prohibit companies from presenting unusual or exceptional items. Common extraordinary items include damage from natural disasters such as earthquakes and hurricanes damages caused by fires gains or losses from the early repayment of. Criteria for extraordinary items 1.

:max_bytes(150000):strip_icc()/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1153850516-c94af82d74404d5a8d458a9fcb34bc50.jpg)