Casual Unadjusted Trial Balance To Adjusted Trial Balance Cash Flow Spreadsheet Example

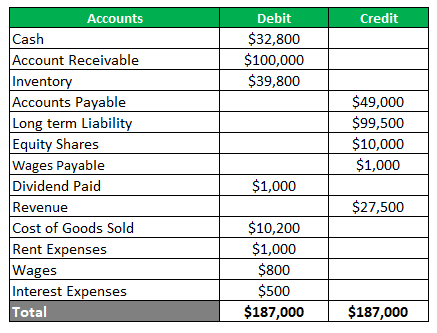

Trial balance normally lists down all closing account balances in debit and credit depending on the nature of accounts.

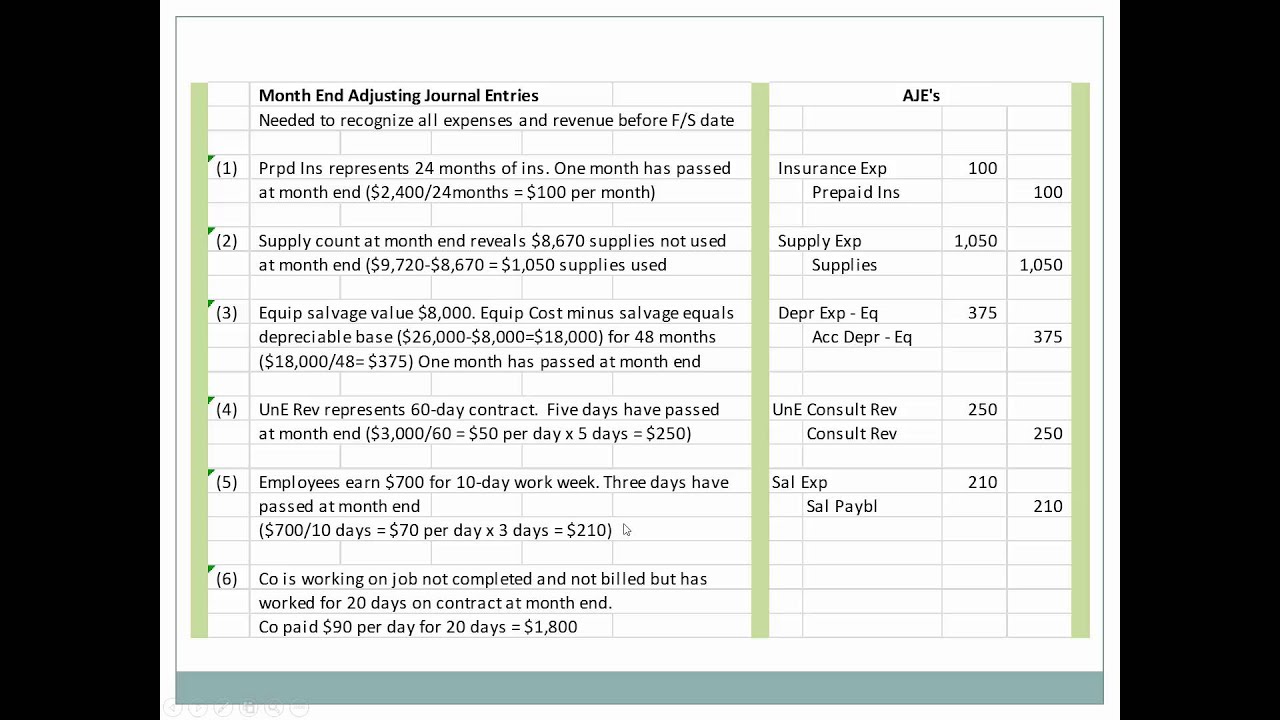

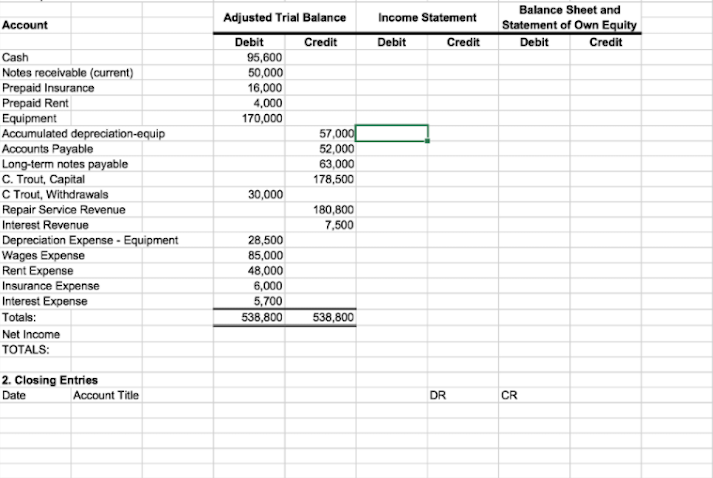

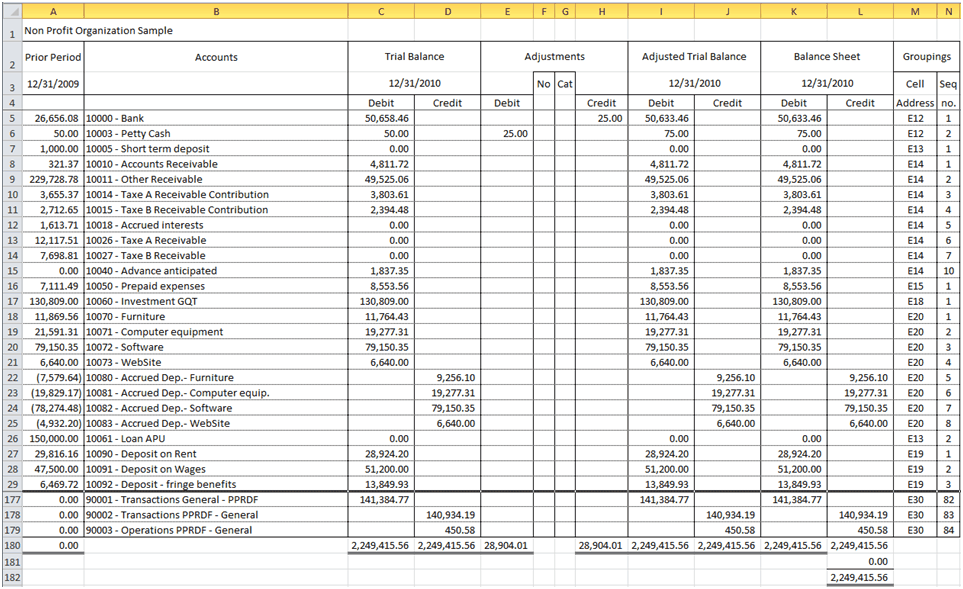

Unadjusted trial balance to adjusted trial balance cash flow spreadsheet example. Using information from the revenue and expense account sections of the trial balance you can create an income statement. Adjusted Trial Balance is made by combining the amount in the Unadjusted trial balance and the Adjustment column of the. 1000 refundable to shop-keeper when the premises are vacated Credit Unearned rent.

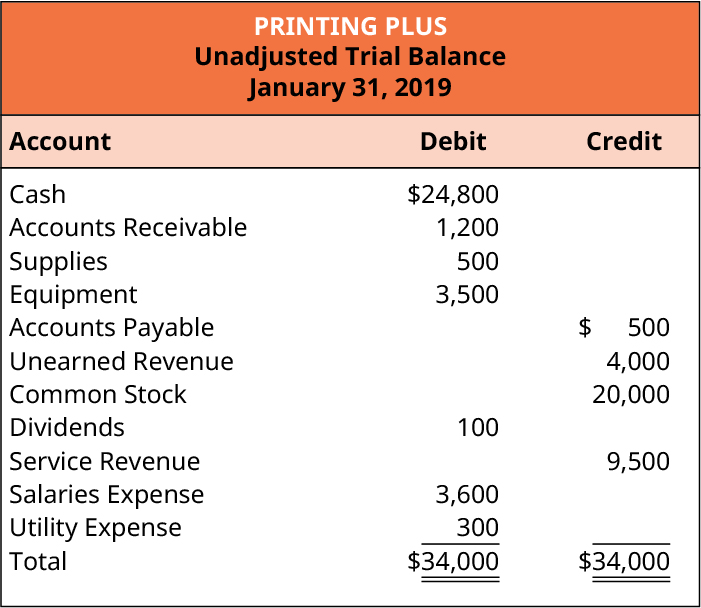

You can do this by comparing the balance totals. For example Cash shows an unadjusted balance of 24800. The final trial balance or post-closing trial balance will be run after closing entries are completed.

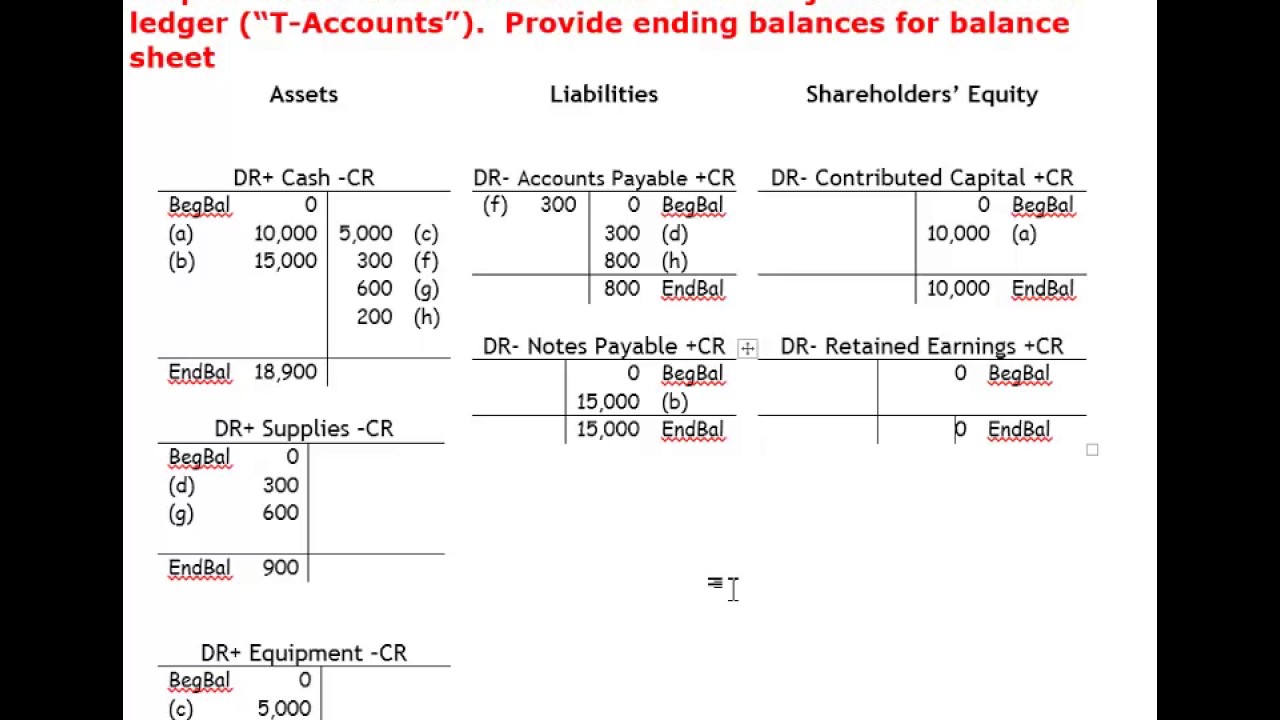

All the entry in you adjustments should be recorded in it Figure 3. After the all the journal entries are posted to the ledger accounts. AccountDebitCreditCash10000 Accounts receivable 10000Payroll expense4000 Accounts payable 4000Total1400014000In this unadjusted trial balance the accountant entered each transaction twice so the totals balance.

Adjusted entries can be prepayments debt expenses interest payroll etc. Adjustments are recorded in the second column of the worksheet. There is no adjustment in the adjustment columns so the Cash balance from the unadjusted balance column is transferred over to the adjusted trial balance columns at 24800.

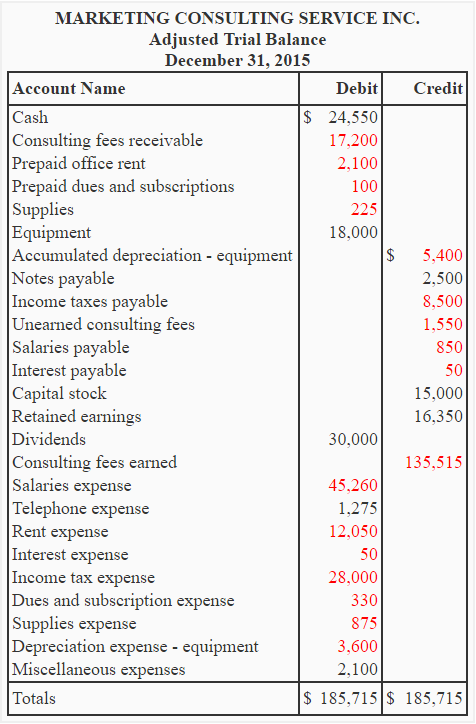

For example assets are posted in debit and liabilities are posted on the credit side of the trial balance. It makes sure the entries are made correctly. The unadjusted trial balance on December 31 2015 and adjusting entries for the month of December are given below.

Unadjusted trial balance list down all the closing balances before the adjustment and adjusted trial balance list down all closing accounts after adjusting. Three columns are used to display the account names debits and credits with the debit balances listed in the left column and the credit balances are listed on the right. The adjusting entries for the first 11 months of the year 2015 have already been made.