Fantastic Revenue Over Expenses

Under normal circumstances operating expenses are incurred through business operations.

Revenue over expenses. Effective YA 2013 the amount of RR costs that qualify for tax deduction as a business expense is capped at 300000 for every relevant three-year period starting from the year in which the RR costs are incurred. With Odoo Expenses youll always have a clear overview of your teams expenses. It is calculated by dividing a.

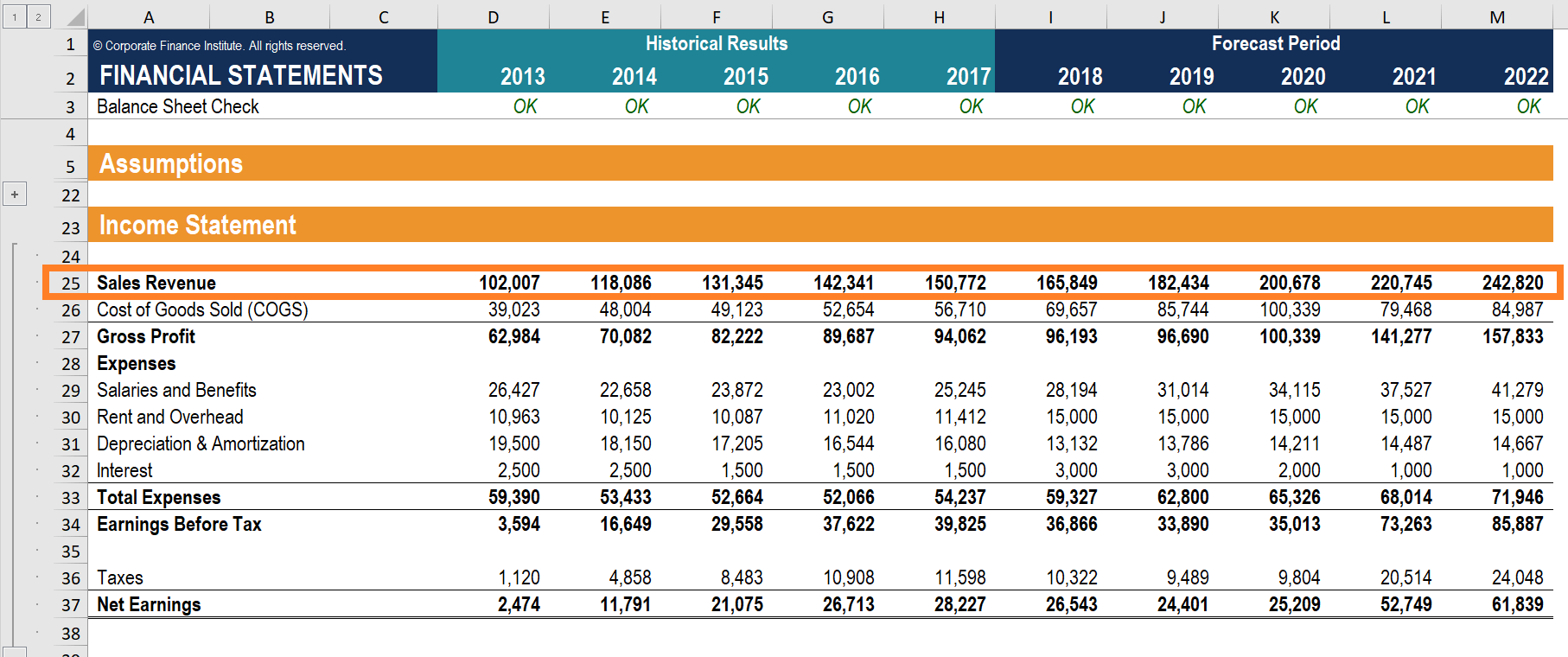

It is possible to reduce expenses by making cuts in one or more areas. Profit margins the percentage of revenue left over after expenses crumble in most recessions as overall sales fall but fixed costs like infrastructure commodities and rent remain the same. Expenses also will often fluctuate during any period of time but are more under the direct control of a company.

Prior to YA 2013 the cap was 150000 for every relevant three-year period. Ad Managing your expenses has never been easier. 900000 yield net income of Rs.

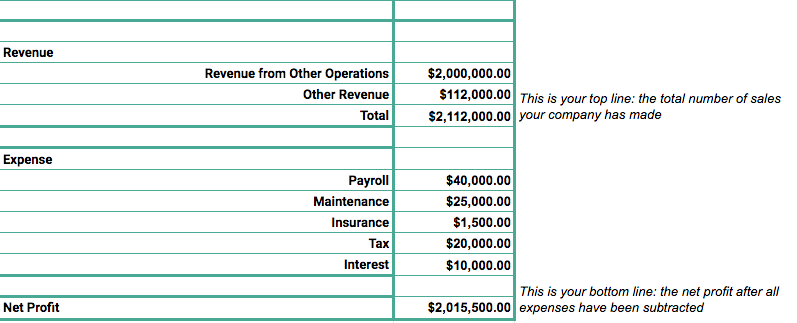

This measurement is one of the key indicators of company profitability along with gross margin and before tax income. For example - revenue of Rs. You can pay your employees expenses when they travel on business journeys.

You can also pay subsistence if employees are working away from their normal place of work. Validate or refuse with just one click. Also contributing to that 1 trillion shortfall.

Cost of revenue is different from cost of goods sold COGS because the former also includes costs outside of production such as distribution and marketing. This plan should be adjusted based on actual expenses and produced gross profit. Revenue expenditure or operating expenses constitute those costs which do not lead to asset creation.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)