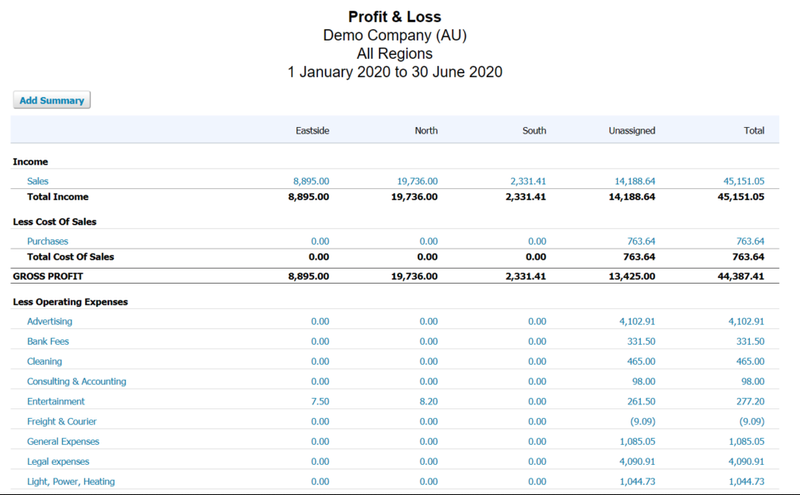

Outrageous Stock Adjustment In Profit And Loss Statement

Treatment of Closing Stock Adjustment in Financial Statements.

Stock adjustment in profit and loss statement. Let the Savings Begin. Apart from the usual items of gains incomes losses and expenses which will appear in the profit and loss accounts of both the holding and the subsidiary companies and which will therefore be aggregated some adjustments will be required. Reported on the income statement as an unrealized holding gain or loss.

In the case of an increase in the fair value the journal entry will be. This problem is happening only when we choose a. The figures in the trial balance will usually be the amounts paid in the period and they need adjusting for outstanding amounts and amounts paid which relate to other periods to obtain the correct charge in the statement of profit or loss.

Ad Find Profit And Loss Statement. Dr Fair value adjustment valuation accountX Cr Unrealized holding gain on income statement. Ad Find Profit And Loss Statement.

Ad Find Profit Loss Statement. Thereafter all those expenses or losses which have not been debited to the Trading Account are debited to the Profit and Loss Account. Show on the assets side usually under the head current assets Example.

Stock adjustments can be made for many reasons but here are some common ones. Outstanding Expenses refer to the expenses relating to current year but whichhave not been paid during the current year. When an adjustment entry is made to add the omitted stock this increases the amount of closing stock and reduces the COGS.

More than 11 million clients choose FBS as their reliable partner make the proven choice. Ad Find Profit And Loss Statement. Ad Choose from the leading companies and make profit by buying and selling their stocks.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)