Unique Treatment Of Deferred Tax In Cash Flow Statement

Therefore you record this deferred revenue as a cash inflow in the operating section.

Treatment of deferred tax in cash flow statement. Deferred tax is an accounting measurement of future tax consequences for an enterprise. Classification of certain cash payments and receipts in the statement of cash flows which has led to diversity in practice. The first method is if you start the Cash flow statement.

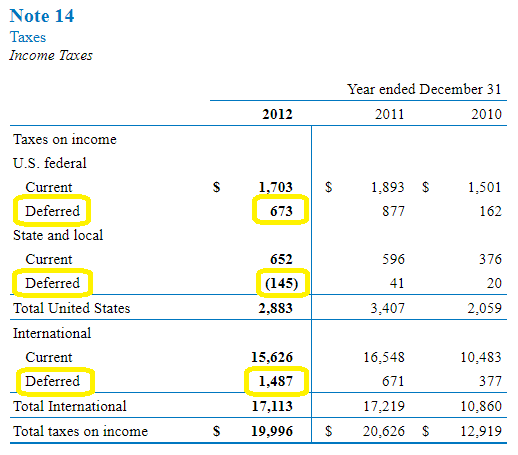

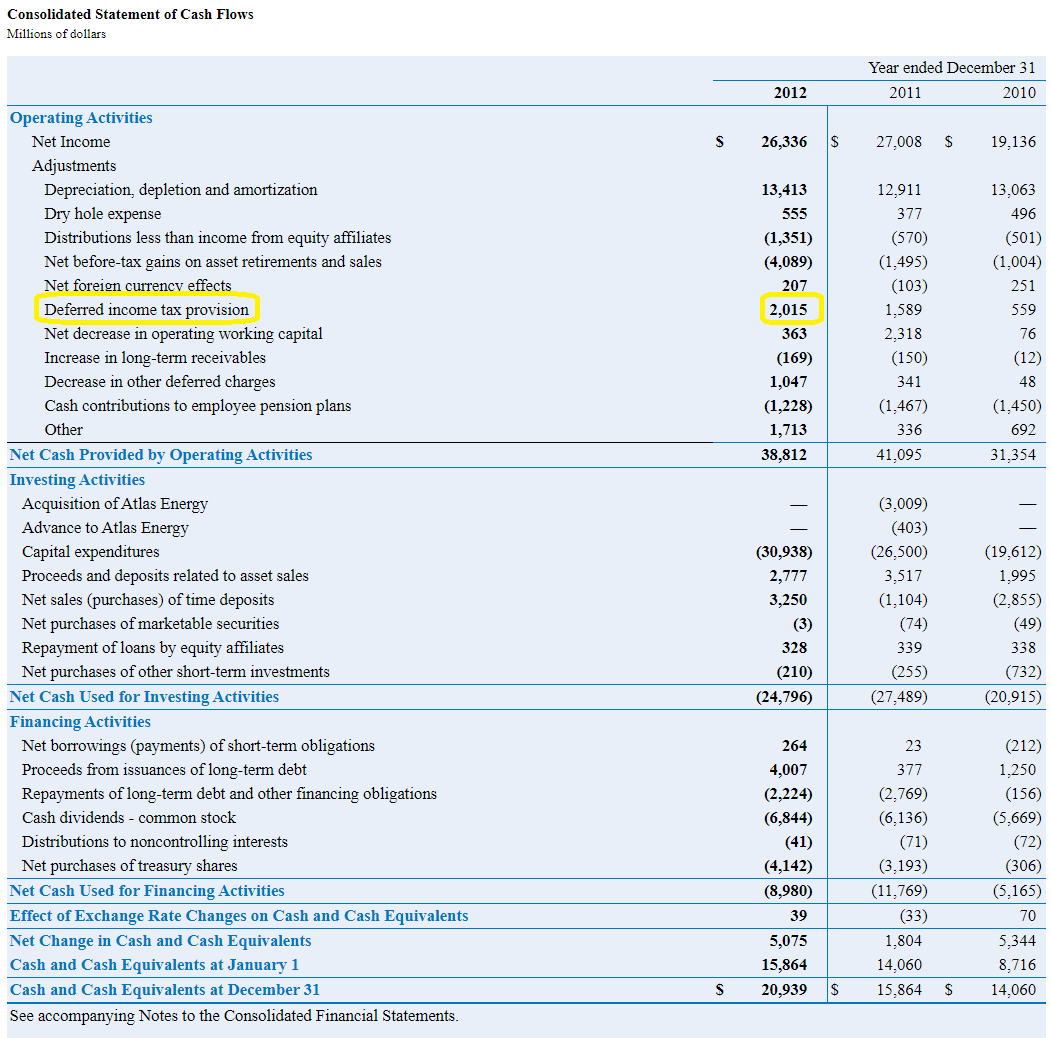

Under the indirect method deferred taxes are shown in the operating cash flow section as an adjustment to the profit loss before tax. Increase in a DTA - decrease in cash balance Decrease in a DTA - increase in cash balance. Assuming a deferred tax liability of 10.

The part of the payment that is considered payment for interest is recorded as outgoing cash from operations. The balance sheet the income statement and the cash flow statement. Decrease in deferred tax.

The primary objective of cash flow statement is to provide useful information about cash flows inflows and. Similarly deferred tax is a non-cash item and shall be treated accordingly in the operating activities section of the cash flow statement. Taxes appear in some form in all three of the major financial statements.

However under the indirect method the deferred tax will be adjusted to profit in the operating activities as the following rule. The liability is reversed when the higher payment is made to the IRS in 2010. If I want to start a Cashflow of a particular year from PAT Whereas in the same I have a Deferred Tax Liability Could anyone help me how to go about it.

In the operations section of the statement of cash flow we record the cash expenses and income. 29 September 2009 there are 2 treatments as follows- 1 income tax paid paid is part of tax expensesand should be part of tax expenses after working capital expenses. Assuming only noncash items are Depreciation of.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)