Outrageous Cra Form T776

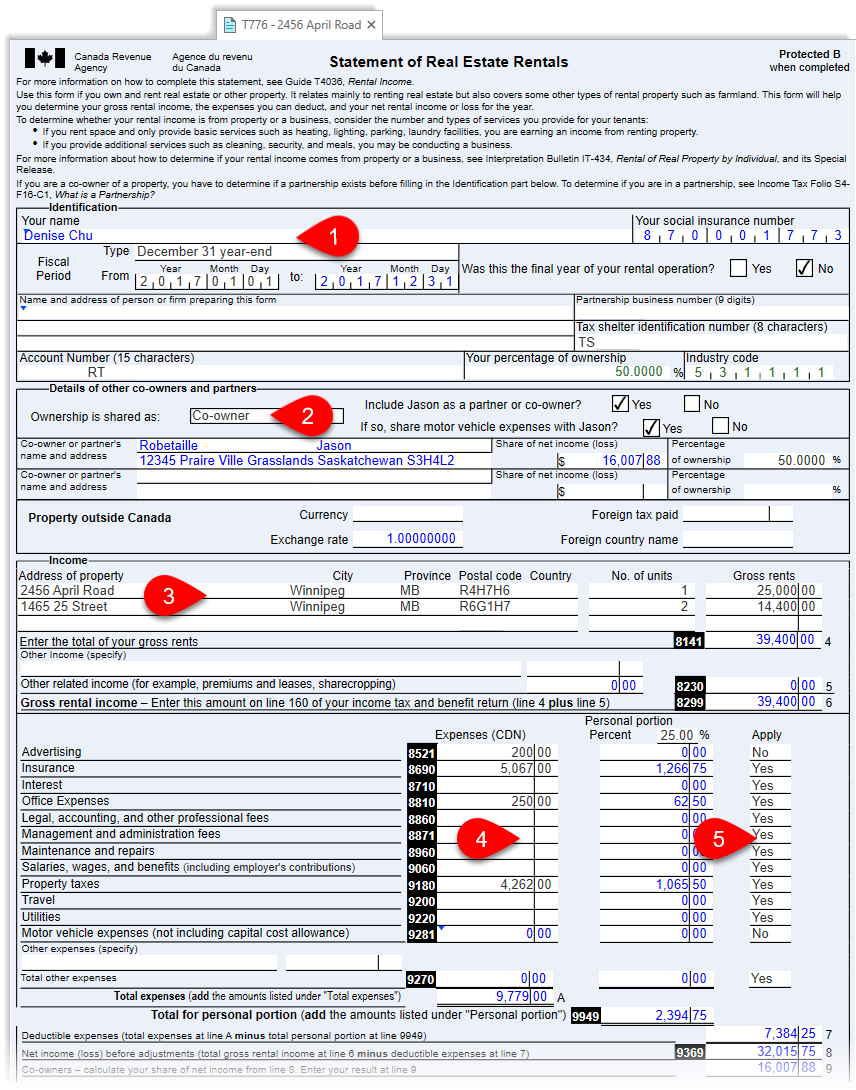

The T776Asset and T776CCA forms copy from one taxpayer to the other.

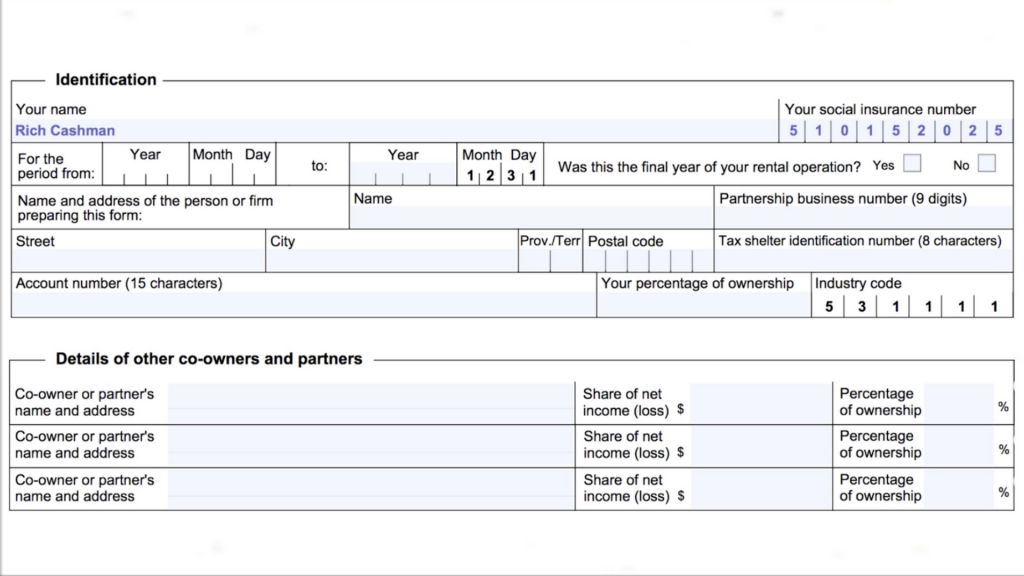

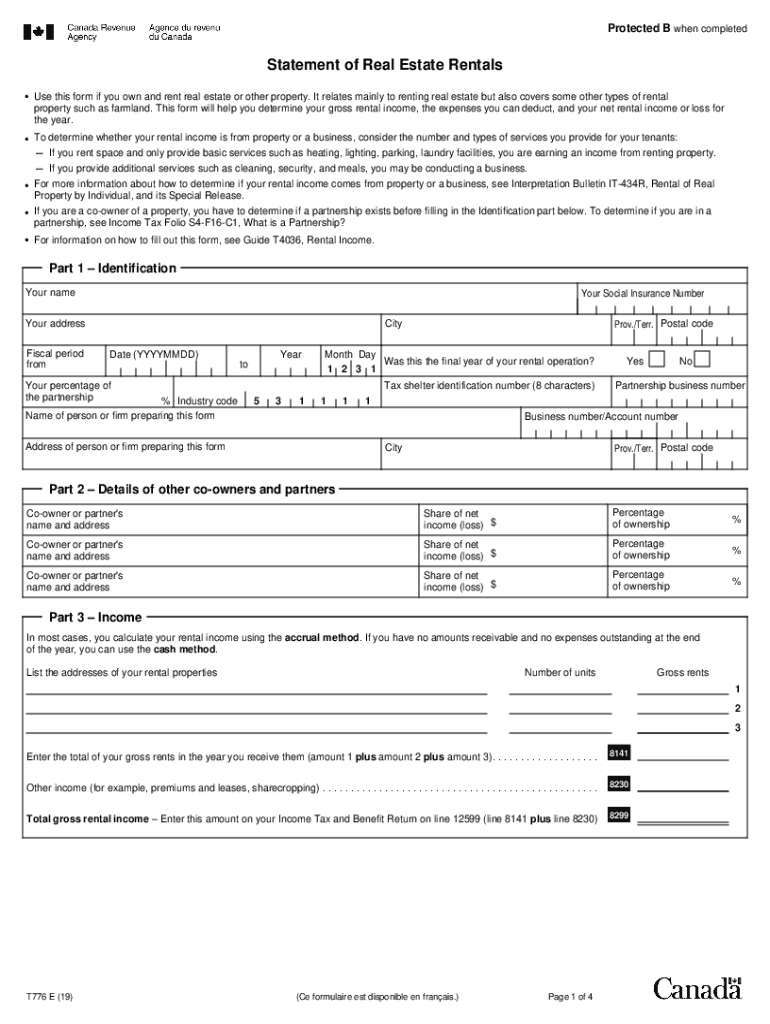

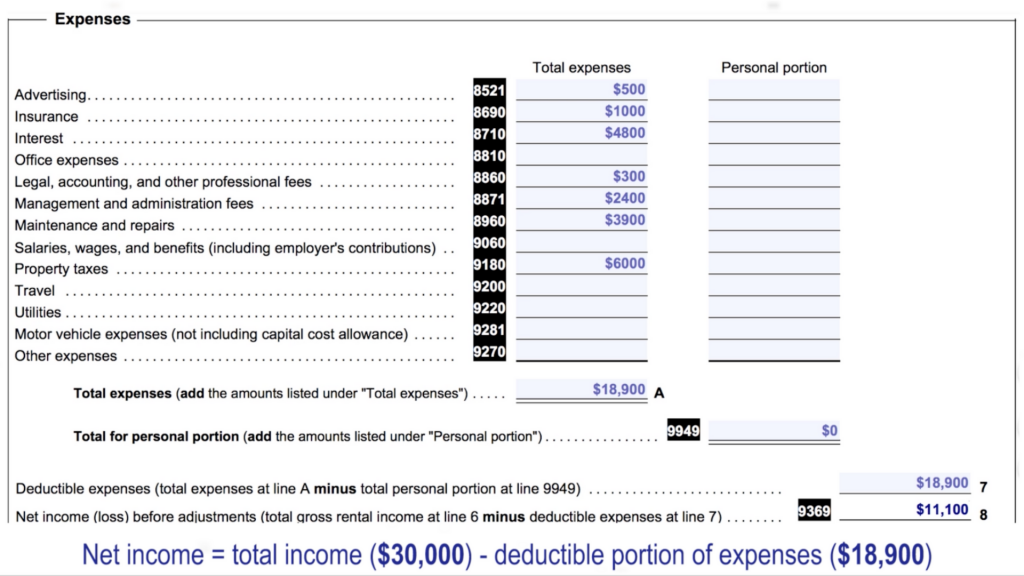

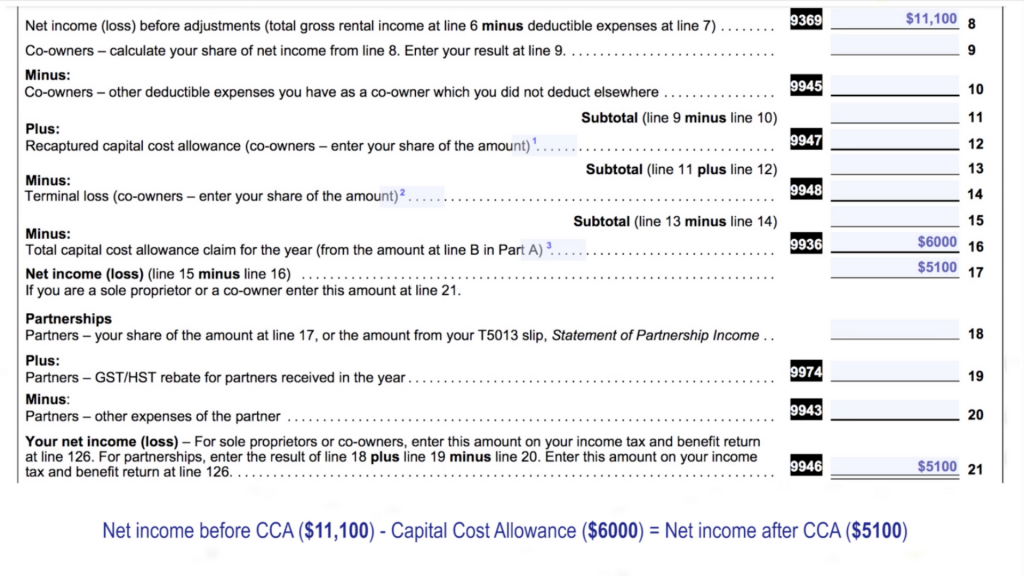

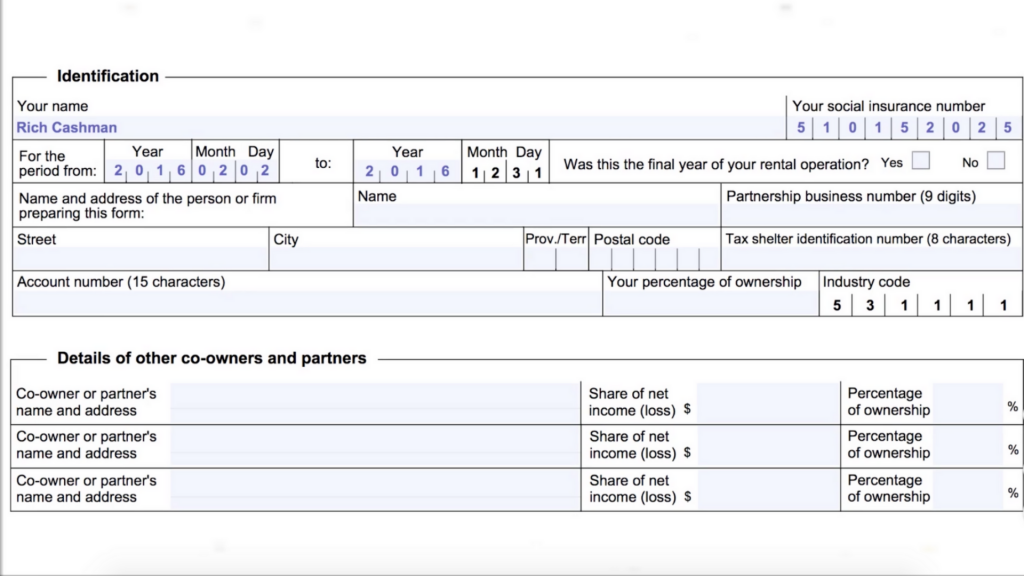

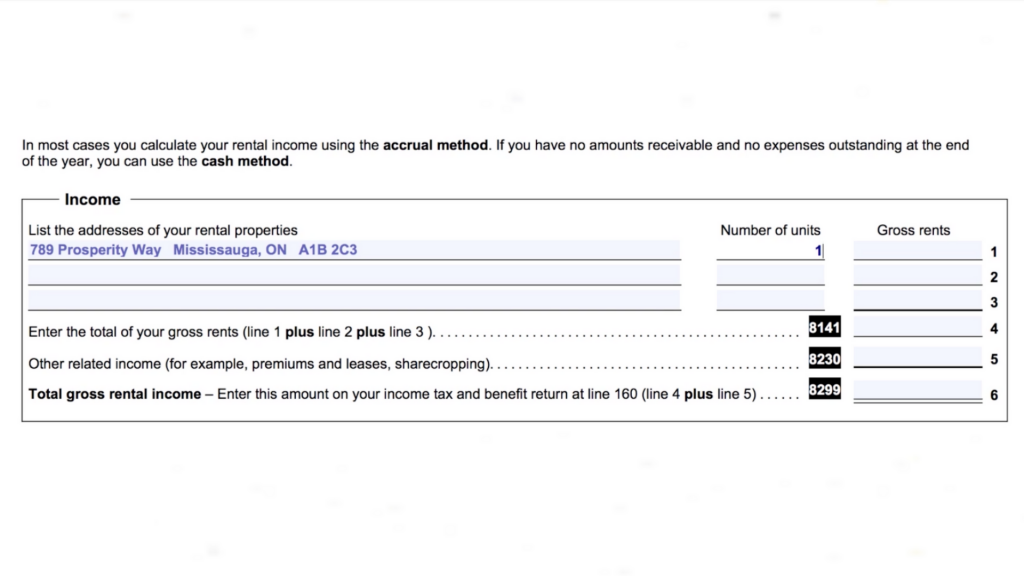

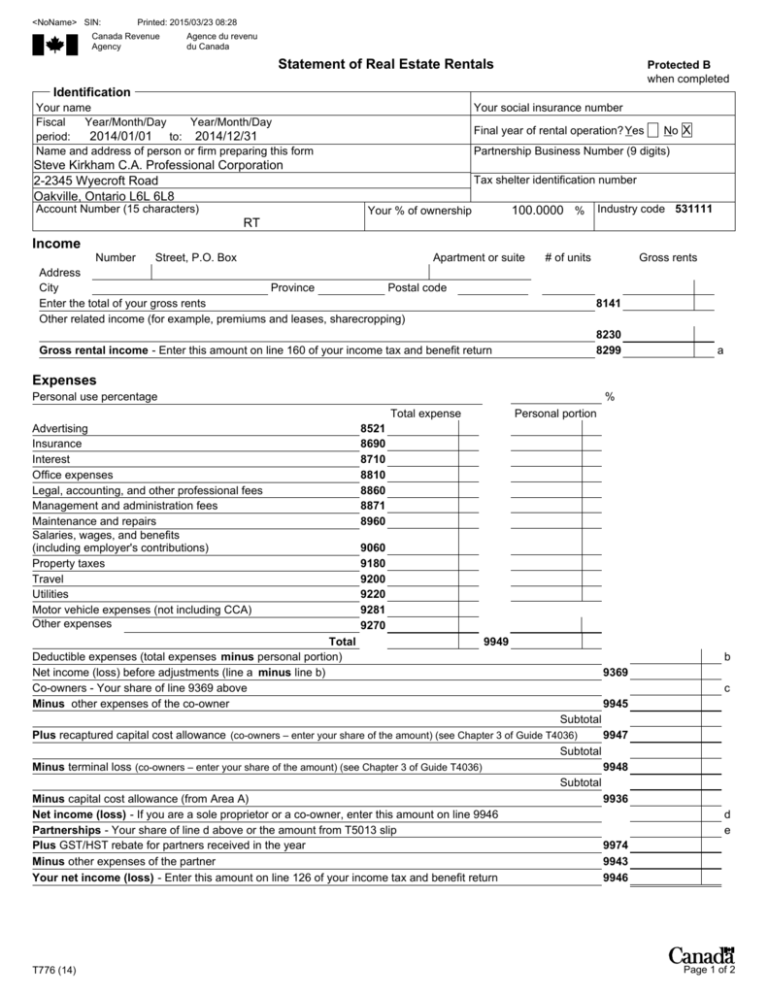

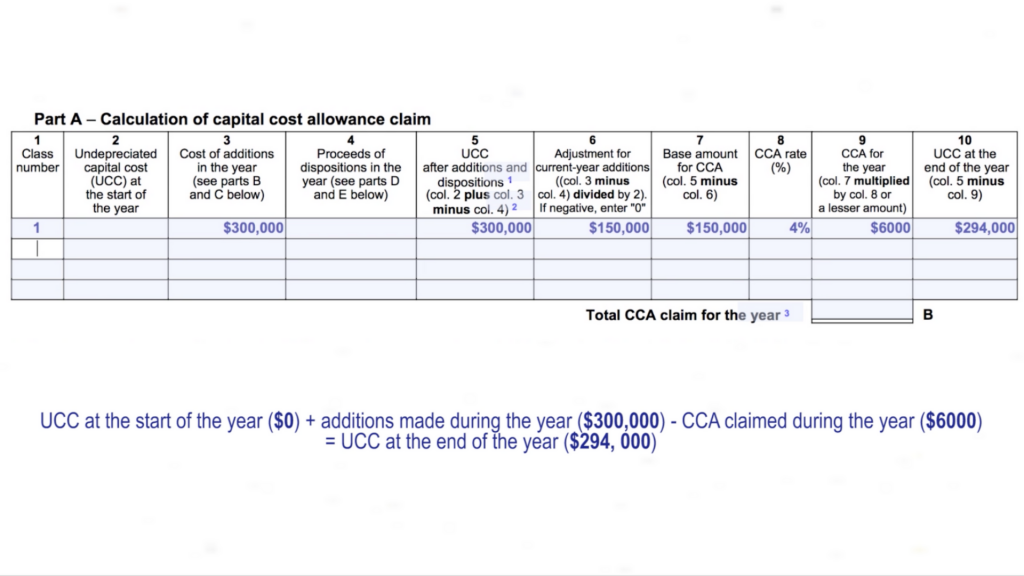

Cra form t776. Each property would be listed separately on each T776. Use this form to enter rental income and expenses. Navigate to the line 9936 of the T776.

2012-01-09 Available in print. You must submit this T776 if you provide lots of useful additional services such as parking cleaning security. From the CRA T4036 Rental Income Guide.

Information for individuals or partnerships owning rental property including information on completing Form T776 Statement of Real Estate Rentals. Fill out securely sign print or email your form t776 2013-2020 instantly with SignNow. Could rental income be considered business income.

All of the income from the properties is in the T776 so the T2125 would be shown as a loss. Use a separate form for each property if you have multiple rental properties. Available for PC iOS and Android.

How to complete the T776 tax form - Statement of Real Estate Rentals - YouTube. If you received income from renting real estate or other real property you have to file a statement of income and expenses. E-text t776-11etxt 7 KB Braille t776-11ebrf 8 KB Large print t776-lp-11epdf 84 KB.

The data is always combined on the T1 general for CRAs purposes. Or loss for the year. T776 Buildings Dispositions question.