Formidable Comprehensive Income Is Equal To

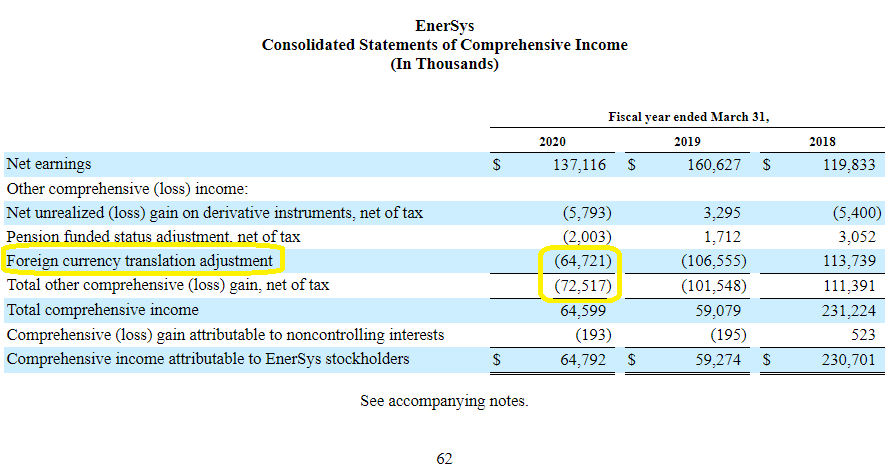

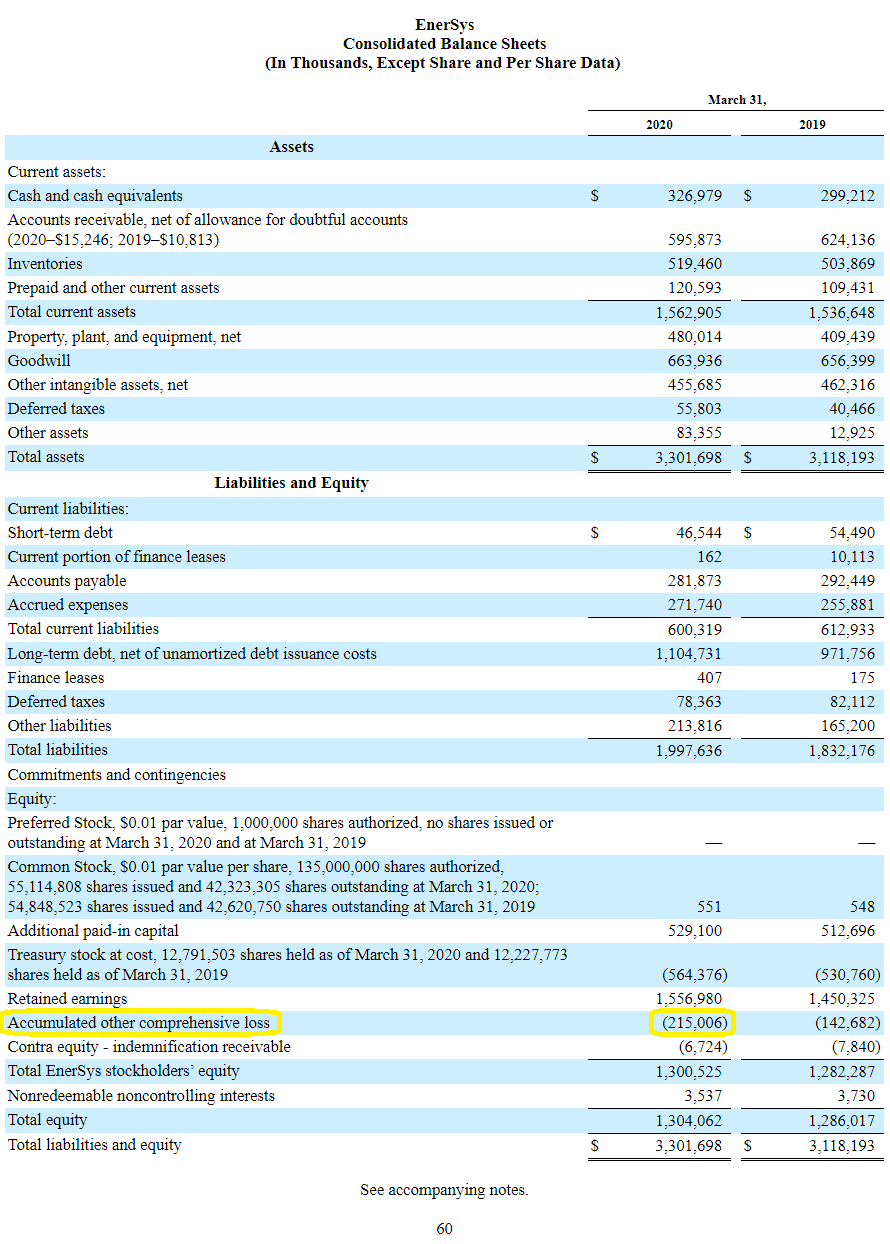

Other comprehensive income consists of revenues expenses gains and losses that according to the GAAP and IFRS standards are excluded from net income on the income statement.

Comprehensive income is equal to. The amount representing the credit loss and the amount related to all other factors. Instead these changes are reported on the statement of comprehensive income along with the amount of net income from the income statement. These amounts cannot be included on a companys income statement because the investments are still in play.

As described in Statement of Financial Accounting Concepts No. Comprehensive income is the variation in a companys net assets from non-owner sources during a specific period. No investments by owners and distribution to owners.

The amount of profitability reported in the income statement plus paid-in capital. Comprehensive income includes net income and. Revenues minus expenses plus gains minus losses plus investments by owners minus distributions to owners.

Comprehensive income also known as all-inclusive concept of income is the change in equity net assets of an entity during a period from transactions and other events and circumstances from non-owner sources. Cash flow refers to the net cash generated by the company during the specified period of time and it is calculated by subtracting the total value of the cash outflow from the total value of the cash inflow whereas net Income refers to earnings of the business which is earned during the period after considering all the expenses incurred by the company during that period. Income from continuing operations plus income from discontinued operations.

Knowing these figures allows a company to measure changes in the businesses it has interests in. Other comprehensive income or OCI consists of items that have an effect on the balance sheet amounts but the effect is not reported on the companys income statement. Is separated into two components.

6 Elements of Financial Statements comprehensive income is equal to. Revenues expenses gains and losses that are reported as other comprehensive income are amounts that have not been realized yet. Defination of Comprehensive income change in equity net assets of a business enterprise during a period from transactions and other events and circumstances from non-owner sources.