Glory Tangible Assets On The Balance Sheet Should Include

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

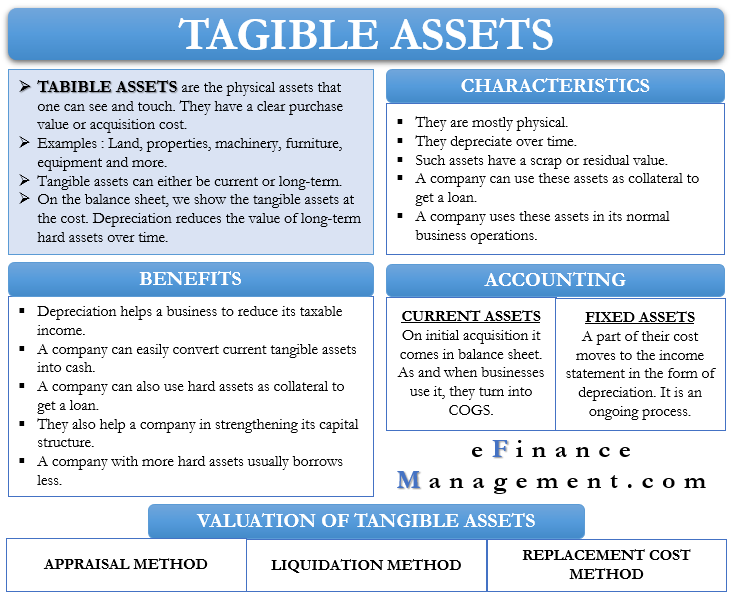

Tangible assets are everything that are physical and either contribute to the income stream or have an obvious value.

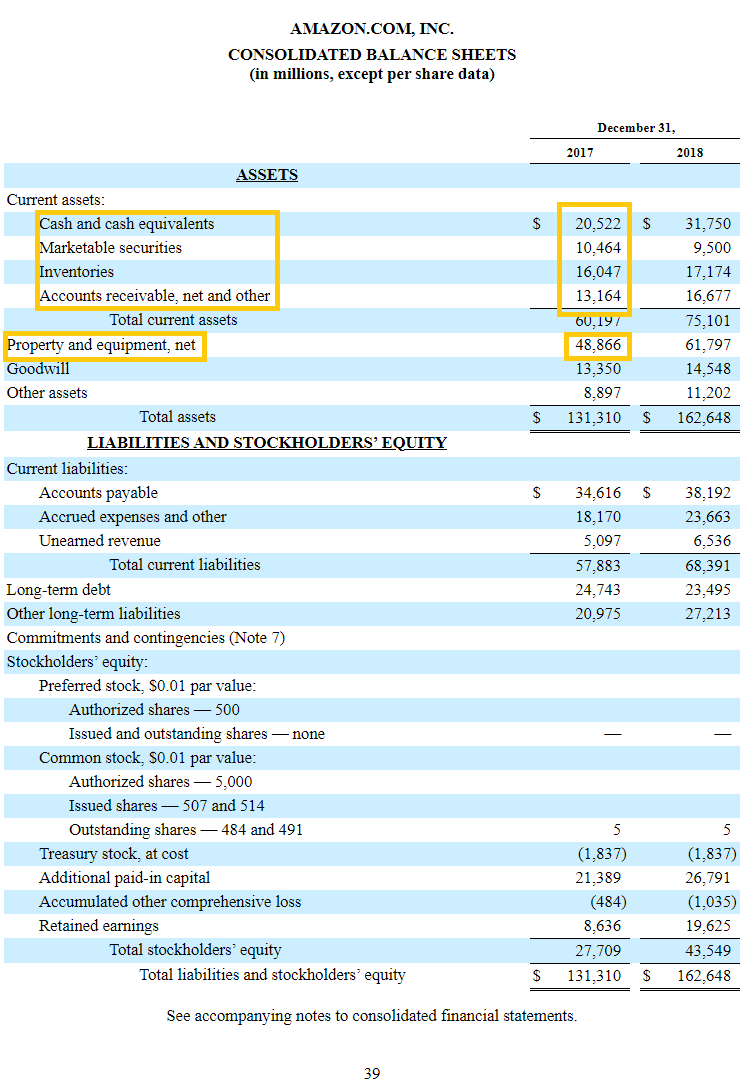

Tangible assets on the balance sheet should include. 350 would show up on the income statement as a sale. Tangible assets are assets with a physical form and that hold value. The Assets Liabilities Gains And Losses For A Period Of Time.

At the end of your balance sheet your assets are totaled. 350 would show up on the statement of cash flows as a cash outflow. You do not record PPE at its market value.

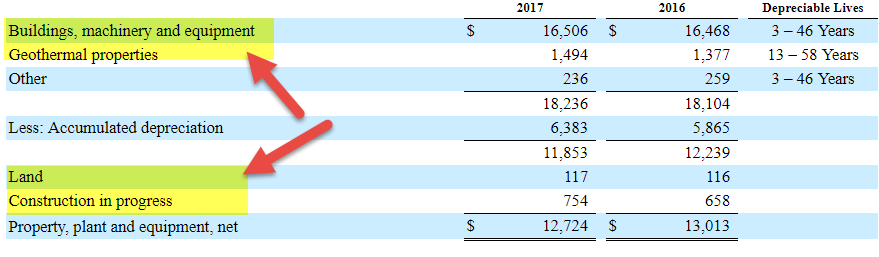

Examples include property plant and equipment. Total assets include tangible and intangible assets and can be found on a companys balance sheet. The Changes In Assets Liabilities And Equity For A Period Of Time.

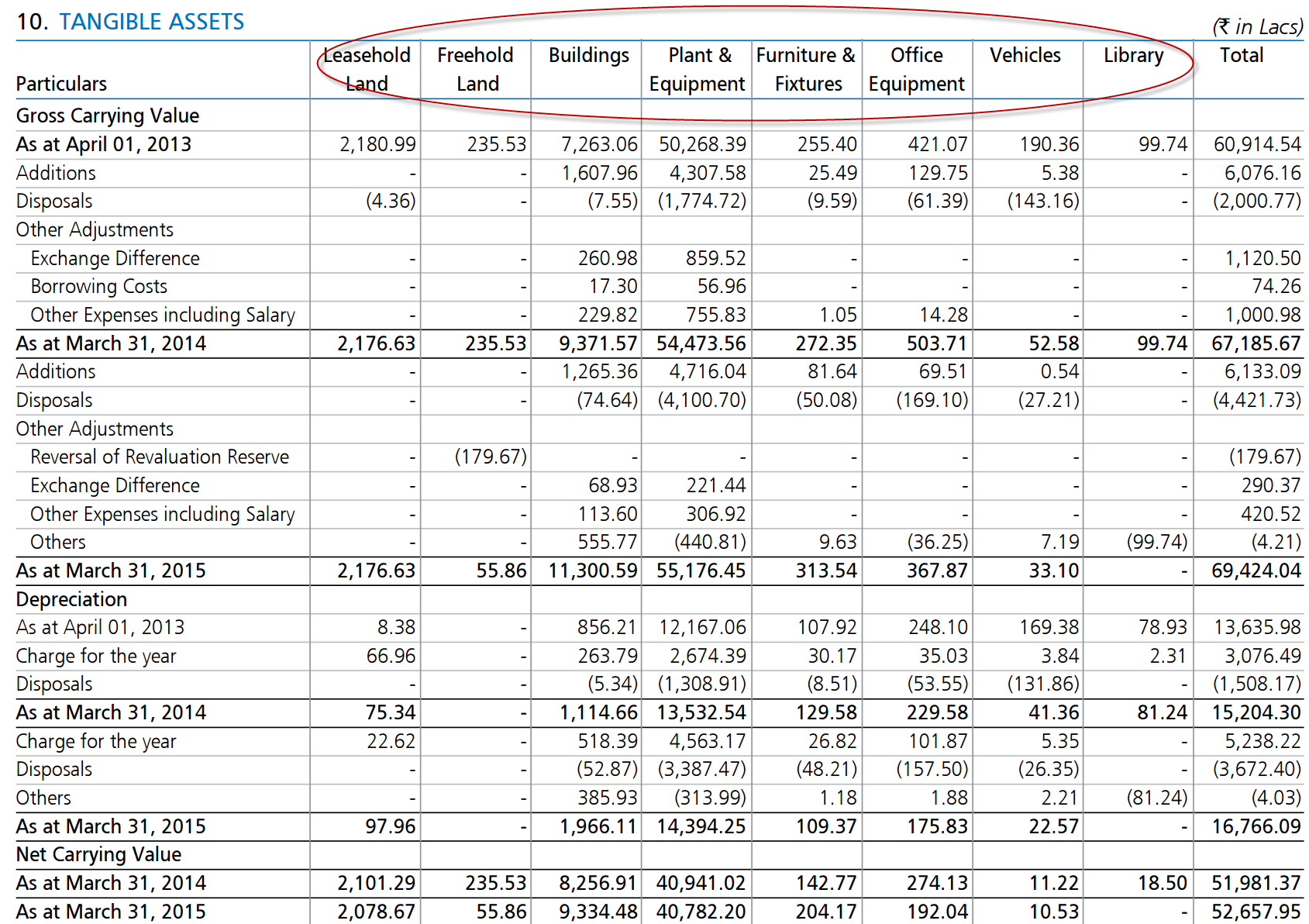

In the balance sheet of a companys 10-k. Data Is a Tangible Asset. If entity financial statements are prepared based on IFRS the recognition of assets in the balance sheet.

The transaction would not be reported because the cash was not exchanged. Basically assets including cash account receivables cars computers equipment land building and any other resources. However they will eventually move onto an income statement through one of two ways.

Intangible asset that are listed on a companys balance sheet should be those of an acquired asset. The idea is compelling. Much talk is swirling around the need to value a companys data as a business asset on its balance sheet.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Tangible_and_Intangible_Assets_Differ_Sep_2020-01-9b5bbac8d4e34db598936af62d5d55cb.jpg)

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)