Out Of This World Pro Forma Financial Model Income Statement And Balance Sheet Practice Questions With Solutions

The following trial balance is prepared after preparation of income statement for F.

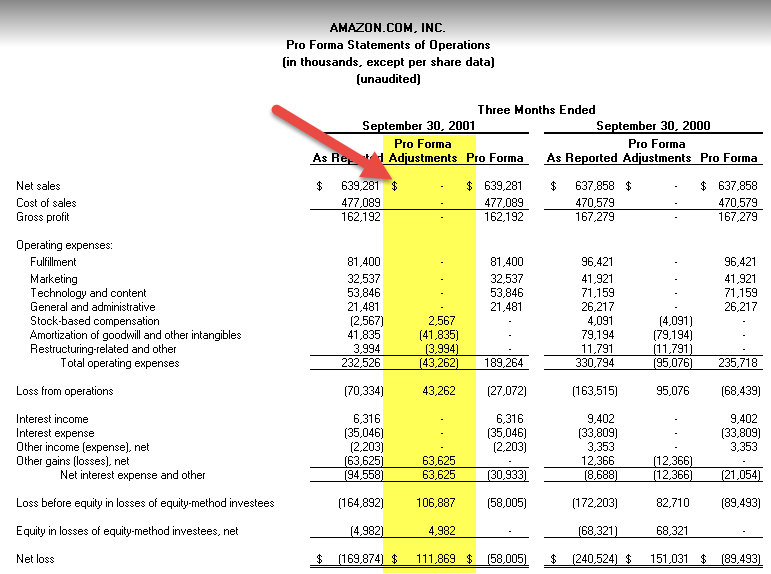

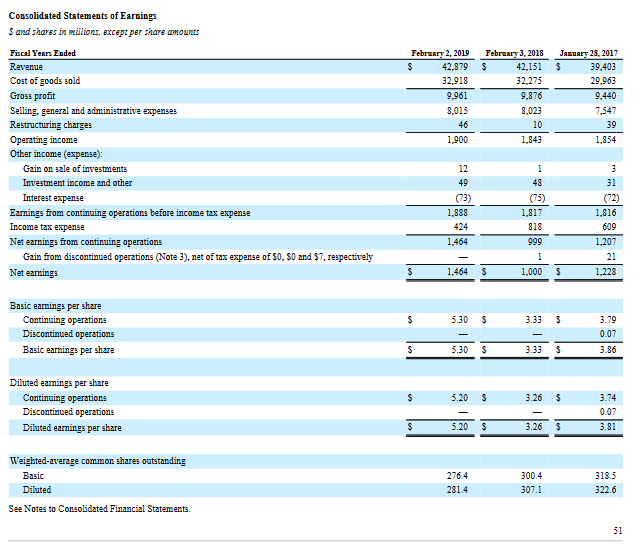

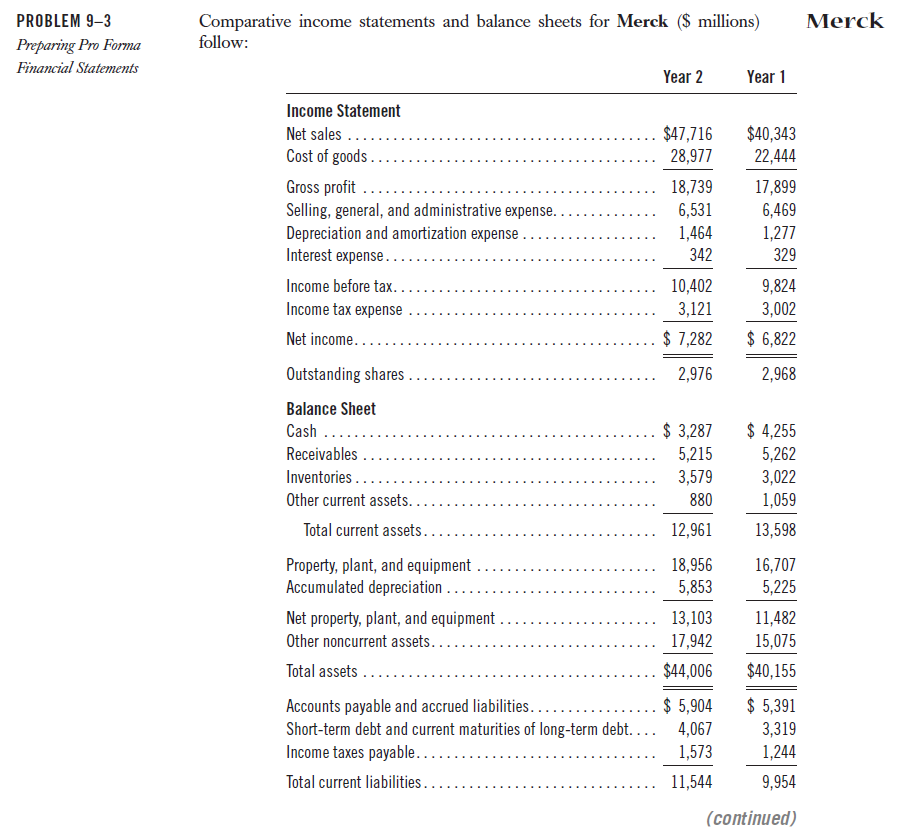

Pro forma financial model income statement and balance sheet practice questions with solutions. A pro forma financial statement is a report that makes use of estimates assumptions and projections to forecast the financial statements. The Monthly Income Statement Yearly Income Statement Balance Sheet and Cashflow Statement. The income statement is probably the most commonly pro forma-ed financial statement because management investors and creditors all want to see what happens to profits if certain business deals take place in the future.

While accounting enables us to understand a companys historical financial statements forecasting those financial statements enables us to explore how a company will perform under a variety of. An integrated 3-statement financial model is a type of model that forecasts a companys income statement balance sheet and cash flow statement. Based on the adjustments in the pro forma income statement other balances in the pro forma balance sheet should also be adjusted.

In the absence of information about the date of repayment of a liability then it may be assumed. A 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model. Types of Pro Forma Financial Statements.

Preparation of Balance Sheet Horizontal and Vertical Style. When building pro forma financial statements be sure to use realistic conservative figures. DCF Model Training Free Guide A DCF model is a specific type of financial.

Make the following assumptions in making your forecast of the firms balance sheet for 2016. By comparing your pro forma balance sheet to previous balance sheets youll be able to draw conclusions and ensure your practice is headed in the right financial direction. Pro Forma Balance Sheet.

Pro-forma financial statements are a consolidation of line items from the balance sheet and income statement. Think of it this way. For example if the business based its pro forma income statement on a 20 expected increase in its revenues then it is highly likely that the debtor balances of the business will also go up.