Breathtaking Objectives Of Comparative Income Statement

Experience has shown that the rules for measuring the amount of income are complex and far from unanimously accepted among users and preparers.

Objectives of comparative income statement. The objective of IAS 1 2007 is to prescribe the basis for presentation of general purpose financial statements to ensure comparability both with the entitys financial statements of previous periods and with the financial statements of other entities. The basic objective of the income statement is to describe the income achieved by the reporting entity during a specific accounting period. Definition of the Income Statement.

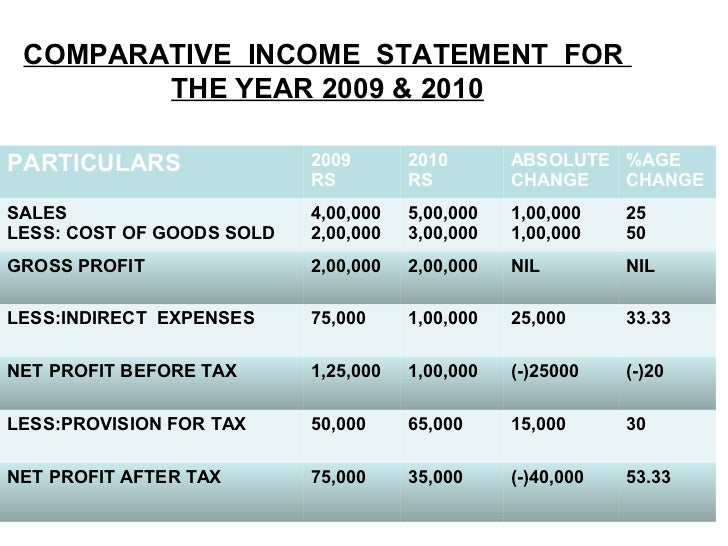

To make a comparative study of the profitability of the entity with other entities engaged in the same trade financial statements help the management to adopt sound business policy by making intra firm comparison. On the income statement each income and expense may be listed as a percentage of the total income. Opening Stock XXX XXXAdd.

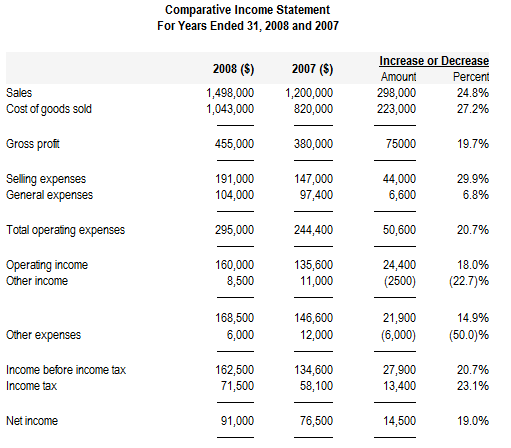

COMPARATIVE REVENUE STATEMENT 1st 2nd Increase PARTICULARS Year Year Decrease Rs. To study the income earning and expenditure spending pattern of the firm for two or more years. NET SALES A XXX XXXLess.

The main reason for presenting comparative financial statements is for trend analysis. Objectives of common-size income statement are to analyse change in individual items of statement of profit and loss to study the trend in different items of revenues and. The primary purpose of preparing financial statements is to get an idea about the financial soundness of the organisation.

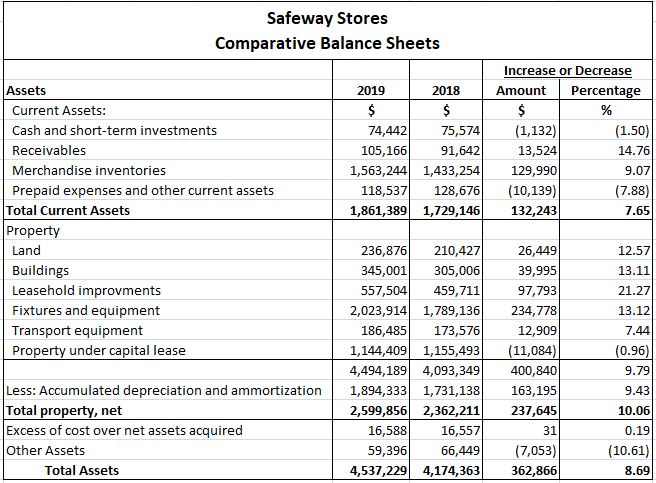

Now given this lets try to understand how a comparative statement is interpreted using an example. This percentage change in items is mentioned in Column V of the comparative income statement. The ultimate purpose of the comparative Income financial statement analysis is as follows.

This shows the contribution of each kind of income to the total and thus the diversification of income. Vi Forecasting and Preparing Budgets. To identify the changing pattern of the income and expenditure of the firms.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)