Best Rent Paid In Advance Balance Sheet

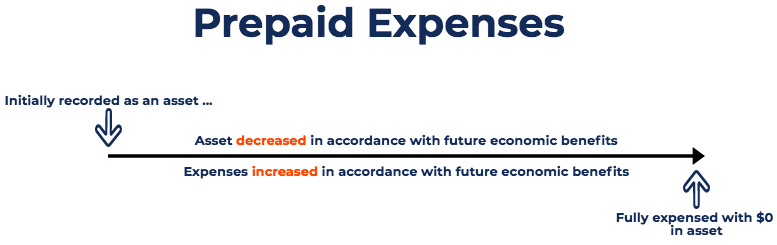

Likewise the company needs to record the rent paid in advance as the prepaid rent asset in the journal entry.

Rent paid in advance balance sheet. Likewise the remaining balance of unearned rent is 10000 15000 5000 as of January 31 2021. Prepaid rent is expense of future year paid in current year so for current year books of accounts it is an asset as it is paid in advance. There are two parts in the Balance Sheet where you can include rent.

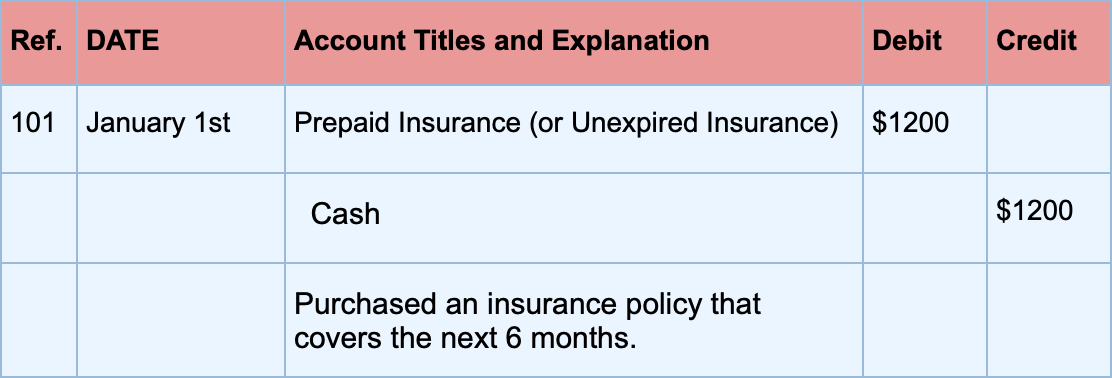

The other part is on Liability payables part if you missed the rent payment for a certain period. Ad Find Paid In Advance. Rent received in advance makes one asset cash and one liability unearned rent on the balance sheet increase in the same amount.

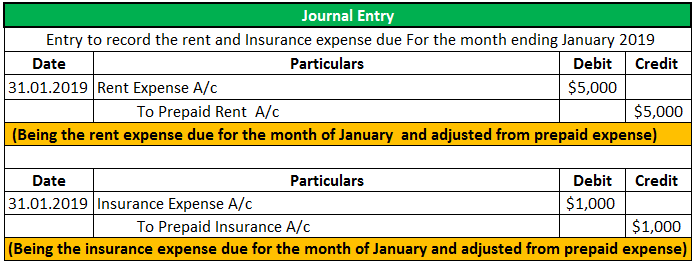

Adjusting journal entry as the prepaid rent expires. Thus when this pre-decided amount is paid for such factory even before availing the benefits. The Journal entry to record income received in advance is.

When an entity rents a factory it is liable to pay a pre-decided sum of money for using the premise or property of another person. Under the accrual basis of accounting revenues received in advance of being earned are reported as a liability. Initial journal entry for prepaid rent.

A rent paid in advance is nothing but the prepaid rent. If the monthly rent is 2000 the store would show the total advance rent payment of 24000 on its balance sheet under prepaid expenses. Prepaid insurance is insurance paid in advance and that has not yet expired on the date of the balance sheet Balance Sheet The balance.

The pre paid rent account is a balance sheet account shown under the heading of current assets. When a company receives money in advance of earning it the accounting entry is a debit to the asset Cash for the amount received and a credit to the liability account such as Customer Advances or Unearned. Credit What went out of the business Cash went out of the business to make the prepayment.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-06-7efbf5b828c64e319cca3507cd3210bf.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)