Awesome Calculation Of Owners Equity

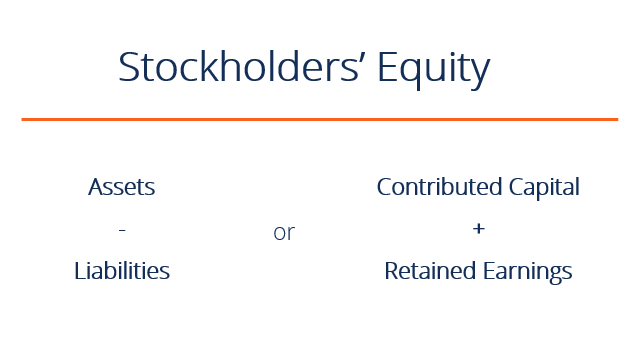

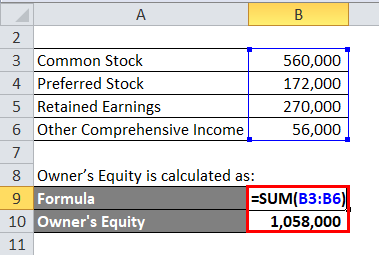

The owners equity formula or basic accounting equation is simply.

Calculation of owners equity. To calculate equity value from enterprise value subtract debt and debt equivalents non-controlling interest and preferred stock and add cash and cash equivalents. 100400 Now a company is. Owners Equity Initial Investment of the Owner Donated Capital If any Subsequent Gains Subsequent Losses Withdrawals by the owner.

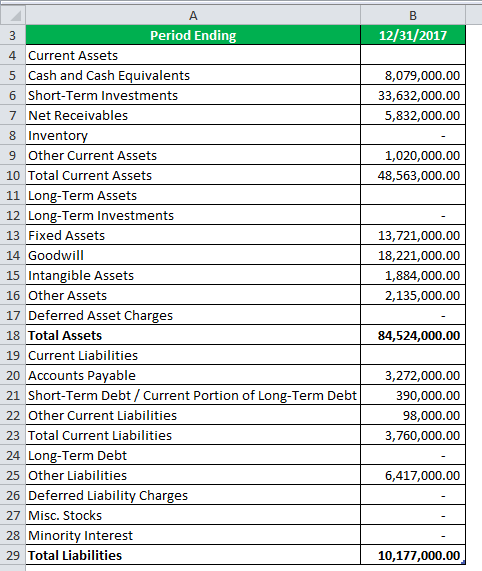

Owners equity is calculated by adding up all of the business assets and deducting all of its liabilities. Equity Formula states that the total value of the equity of the company is equal to the sum of the total assets minus the sum of the total liabilities. To calculate the return on equity ratio simply divide the net income usually measured on an annual basis by the companys shareholders equity.

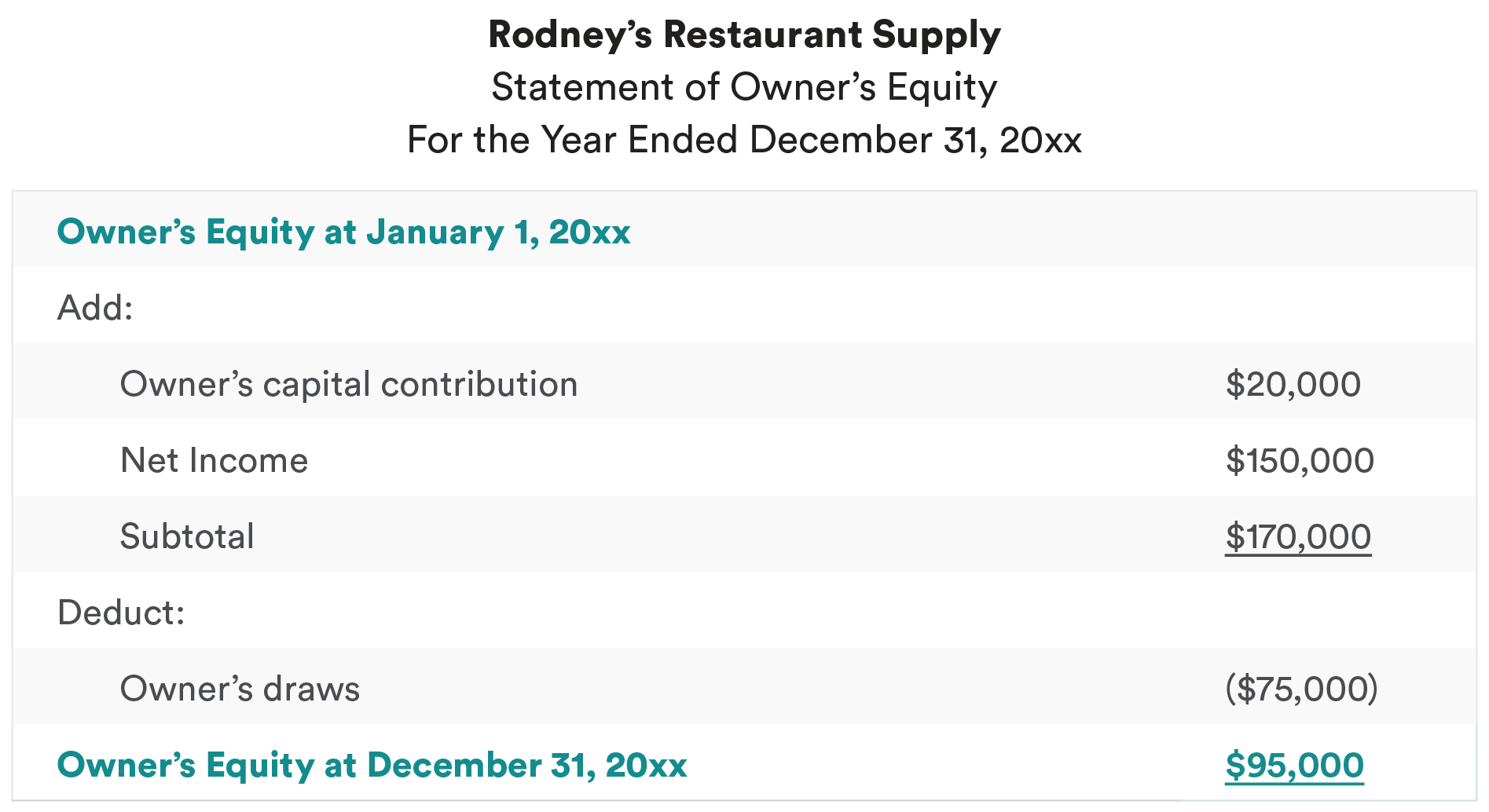

This can be calculated by adding following values together. Next calculate all the businesss liabilities things such as loans wages salaries and bills. For example lets look at a fictional company Rodneys Restaurant Supply.

Assets liabilities and subsequently the owners equity can be derived from a balance sheet. Equity dilution occurs when the company that you own stock in issues new shares hence reducing the percentage amount of the company that you own. Equity value is concerned with what is available to equity shareholders.

To better understand the return on equity ratio it may be helpful to refresh yourself on what equity is. How to Calculate Owners Equity To calculate owners equity first add the value of all the businesss assets which include real estate equipment inventory retained earnings and capital goods the Corporate Finance Institute notes. Enter the total assets and total liabilities of the owner into the calculator.

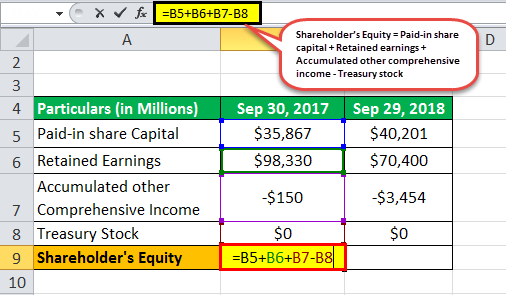

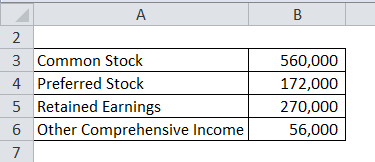

The higher the ROE the more efficient a companys management is at generating income and growth from its equity financing. The table is the normal calculation and format for the Statement of Changes in Owners Equity and the subject in that table is always the closing balance of owners equity. Owners Equity Common Stock Retained Earnings Preferred Stock Other Comprehensive Income Other Comprehensive Income Other comprehensive income refers to income expenses revenue or loss not being realized while preparing the companys financial statements during an accounting period.

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)