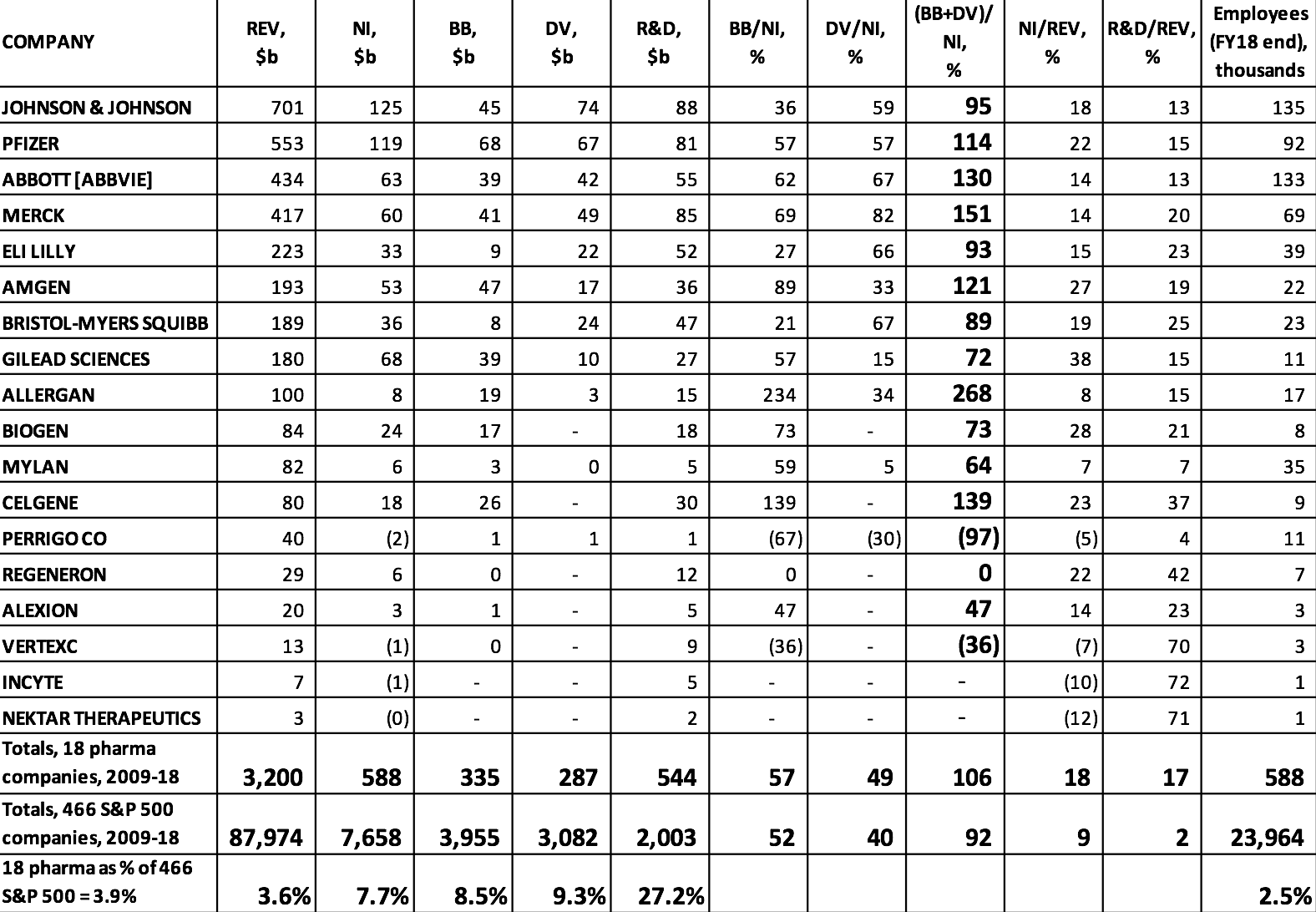

Recommendation Pharmaceutical Industry Average Financial Ratios

In other words Financial Ratios compare relationships among entries from a companys financial information.

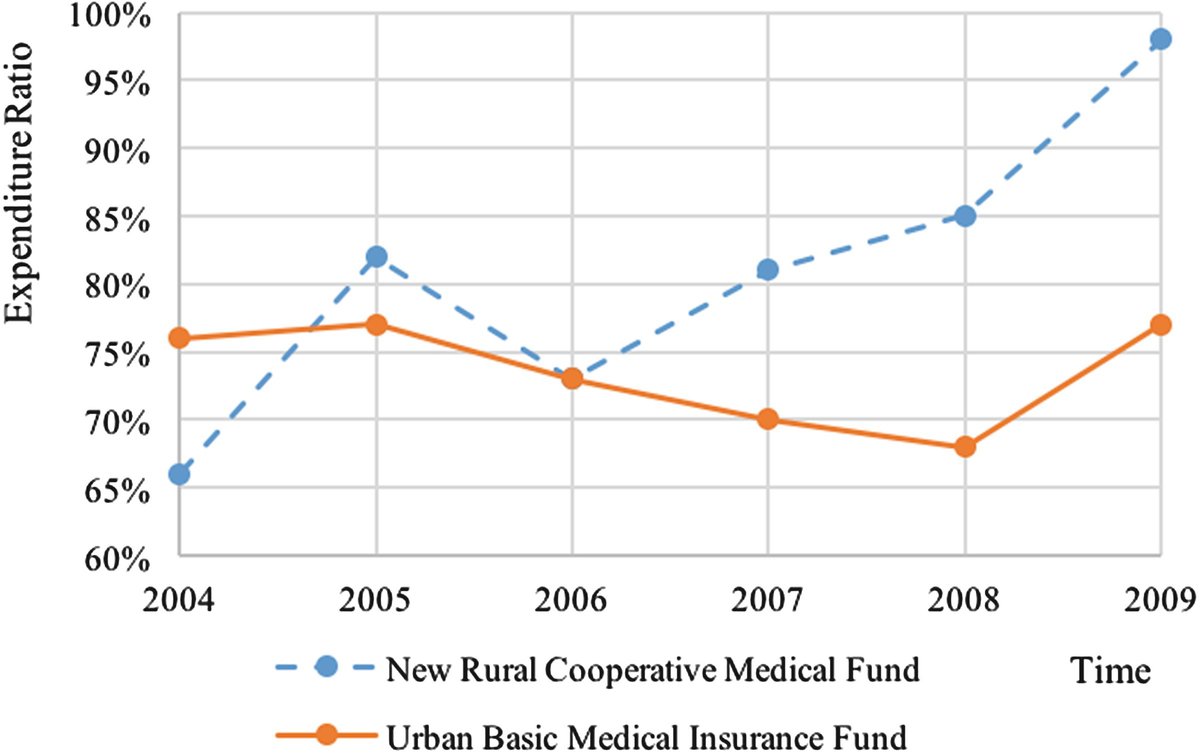

Pharmaceutical industry average financial ratios. Asset Management Asset Quality b. Square pharmaceutical companies in 2007 to 2008Different financial ratio are evaluated such liquidity ratios asset management ratios profitability ratios market value ratios debt management ratios and finally measure the best performance between two. Median recommended average Financial ratio.

Novo Nordisk heads the list with a sales to assets ratio of 1. Key Financial Ratios of Sun Pharmaceutical Industries in Rs. 10 or 110 10 or 10.

Efficiency Productivity Capital Strength d. This corresponds to a value of 1 or little higher than 1. Get Your Custom Essay on Pharmaceutical Industry Average Financial Ratios 2018 Just from 139Page.

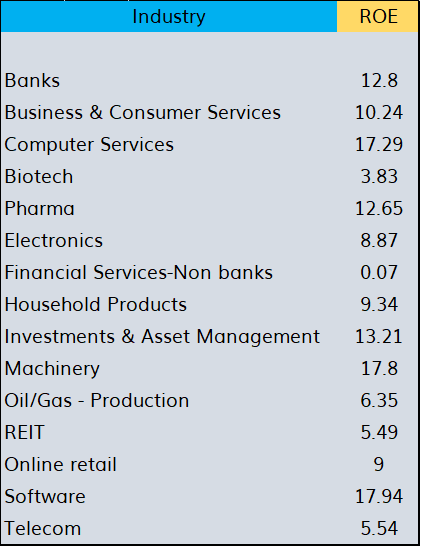

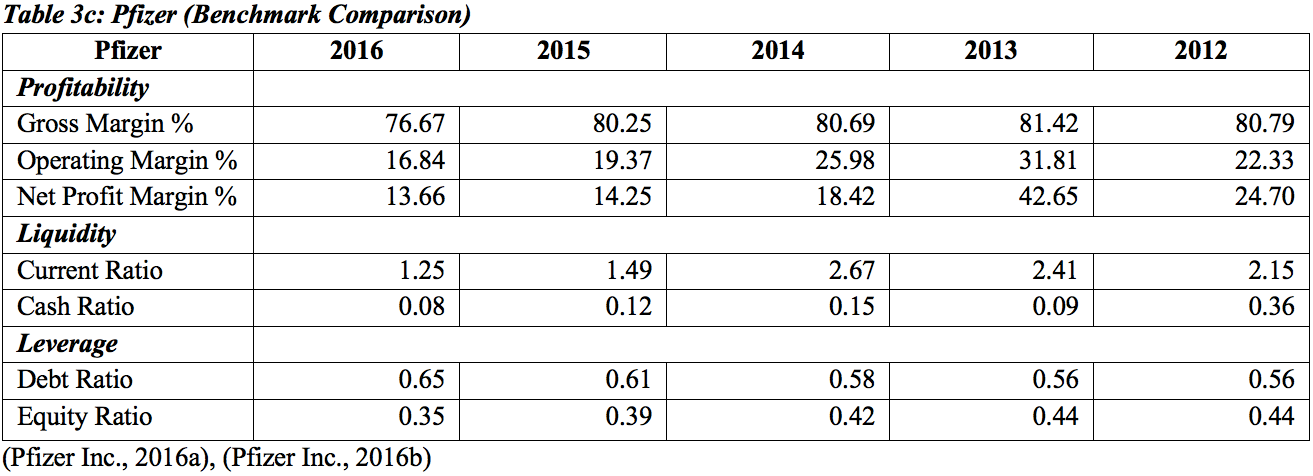

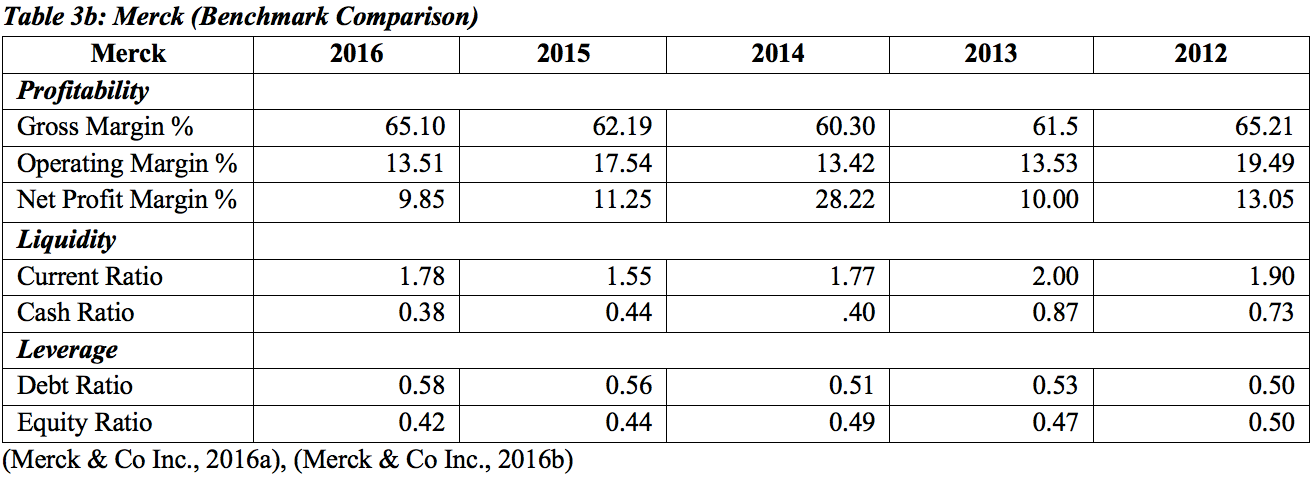

Benchmark Ratios Pharmaceuticals Healthcare Industry Comparisons The definition of this ratio is different for banks and insurance companies Valuations per Share Price to book value 139 283 607 142 307 703 Price to sales 135 340 1150 126 415 2540 Enterprise valueEBITDA-1031 3239 10332 -2553 1597 6690 Earnings and Distributions. Say you have 100000 in Total Assets and 1000000 in Net Sales your Assets to Sales would be 100000 1000000 or 1. Key financial ratios for pharmaceutical companies are those related to RD costs and the companys ability to manage high levels of debt and profitability.

Dont use plagiarized sources. Calculating the Price-to-Earnings Ratio The PE ratio of a company is calculated by dividing its. In 2020 the federal government spent a total of 21420759281 on Pharmaceutical Medicine Manufacturing.

Basic EPS Rs 892. It has awarded 28973 contracts to 1096 companies with an average value of 19544488 per company. Average industry financial ratios for US.

:max_bytes(150000):strip_icc()/GettyImages-941395072-ff92e929f7494d9286d50006505262cf.jpg)