Impressive Pro Forma Income Statement Definition

Pro forma Latin for as a matter of form or by form is a method of calculating financial results using a specific projection or assumption.

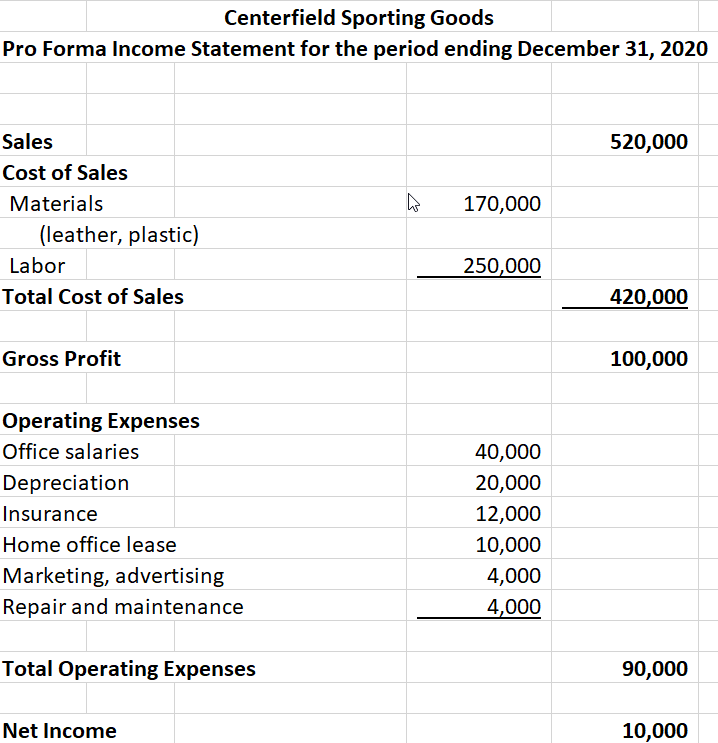

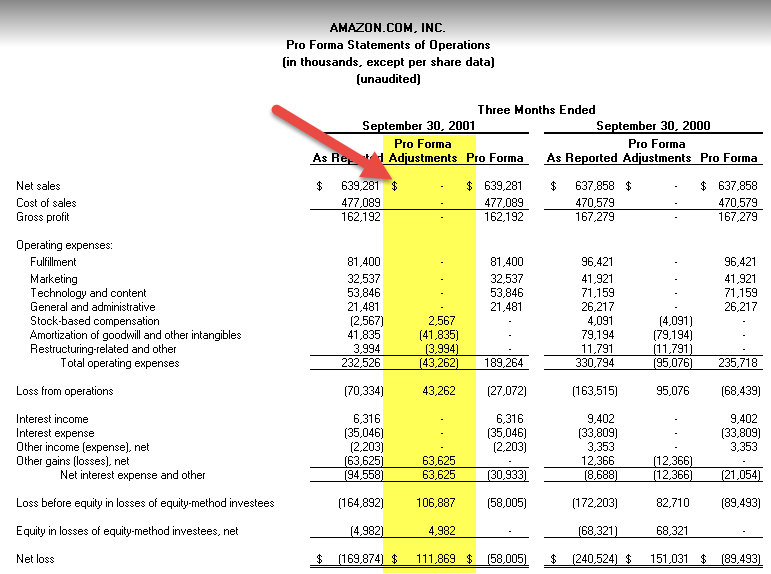

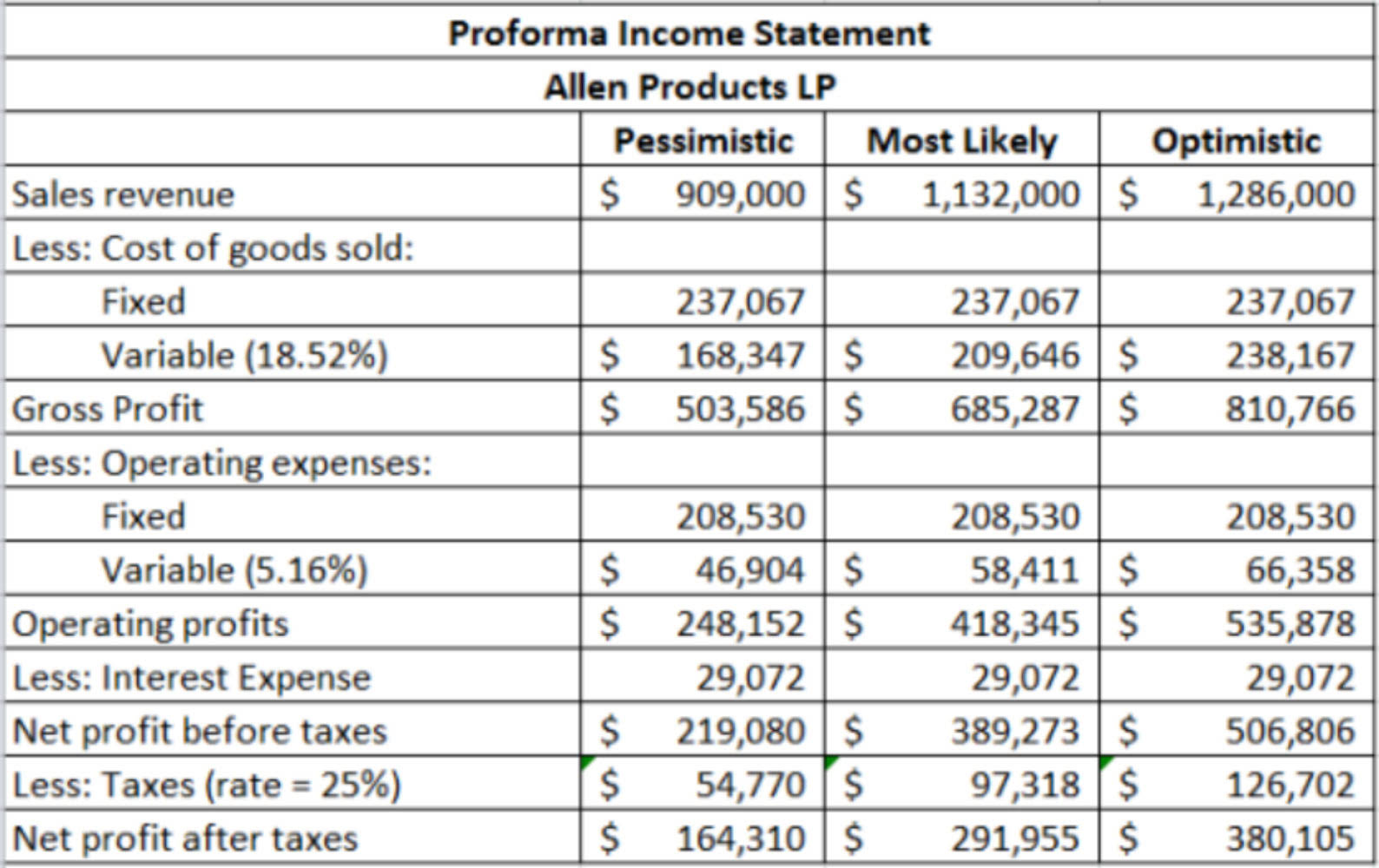

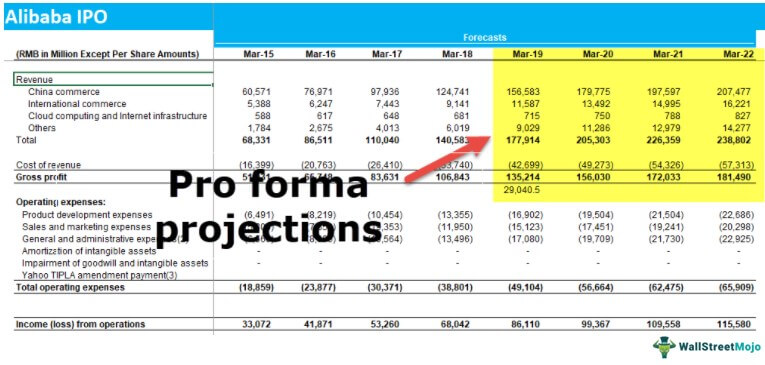

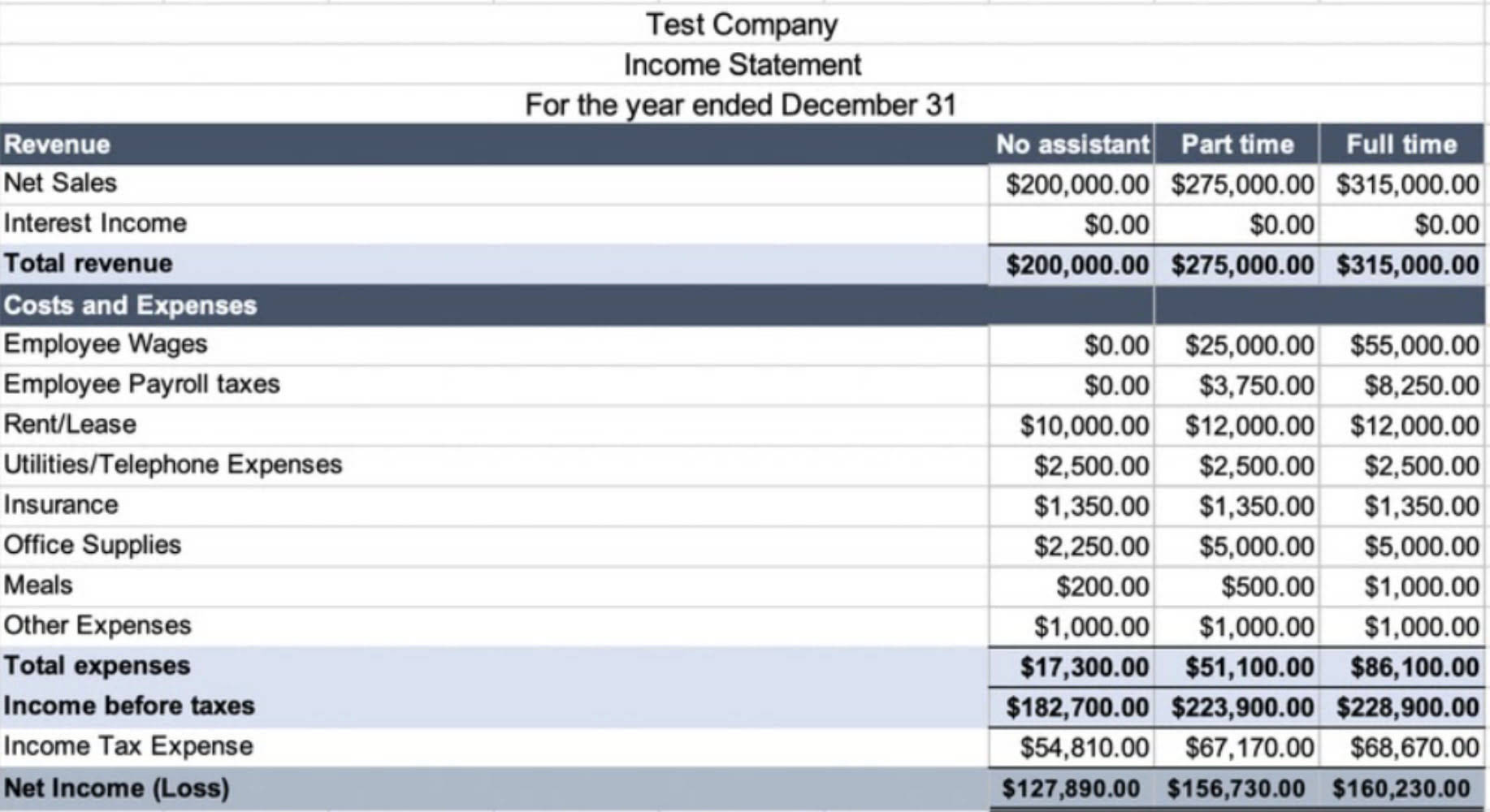

Pro forma income statement definition. These financial statements projections are known financial modeling as Pro. When it comes to accounting pro forma statements are financial reports for your business based on hypothetical scenarios. Likewise a firm may wish to develop a set of pro forma statements to determine the effect of a projected stock buyback.

Pro forma balance sheet. A pro forma income statement combines the historical income statement of the acquiring company and a pro forma income statement of the business to be acquired for the previous five years if. For example they can determine whether expenses can be expected to run higher in the first quarter of the year than in the second.

A firm might construct a pro forma income statement based on projected revenues and costs for the following year. Pro forma financial statement A financial statement constructed from projected amounts. A budgeted or pro forma balance sheet manifests the estimated assets liabilities and capital it expects to hold at the end of the coming year.

For example a business may use a pro forma financial statement to show what a businesses profit was if it sold off an arm of the company. Finally with the pro forma income statement and balance sheet compete we can knock out the cash flow statement as well. What is operating income.

The projections are achieved by using historical sales accounting data and assumptions on future sales and costs. What are pro forma financial statements. A pro forma income statement is a document that shows a businesss adjusted income if certain financial inputs were removed.

Pro forma income statements provide an important benchmark or budget for operating a business throughout the year. Entrepreneurship Small Business. Definition of Pro Forma Financial Statement A pro forma financial statement is one based on certain assumptions and projections as opposed to the typical financial statement based on actual past transactions.