Breathtaking Net Working Capital Ratio Analysis

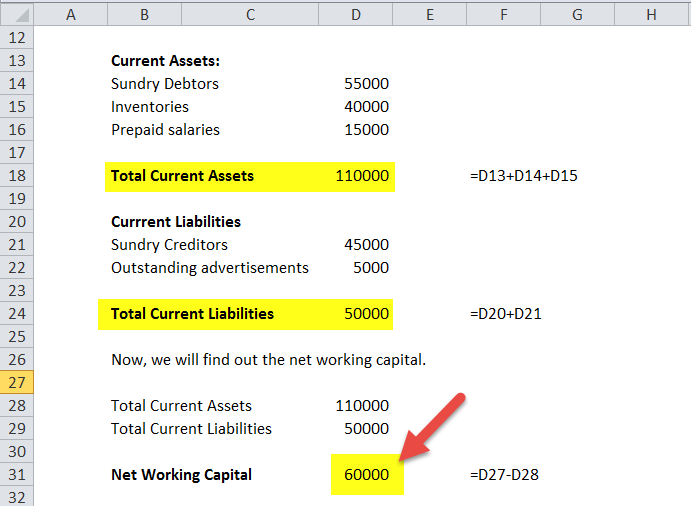

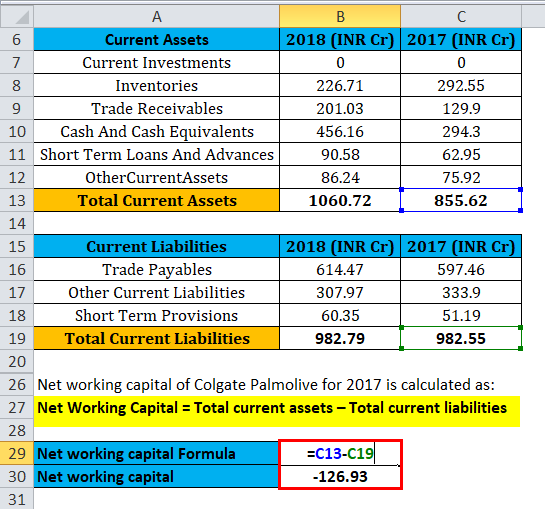

Use the following formula to calculate the net working capital ratio.

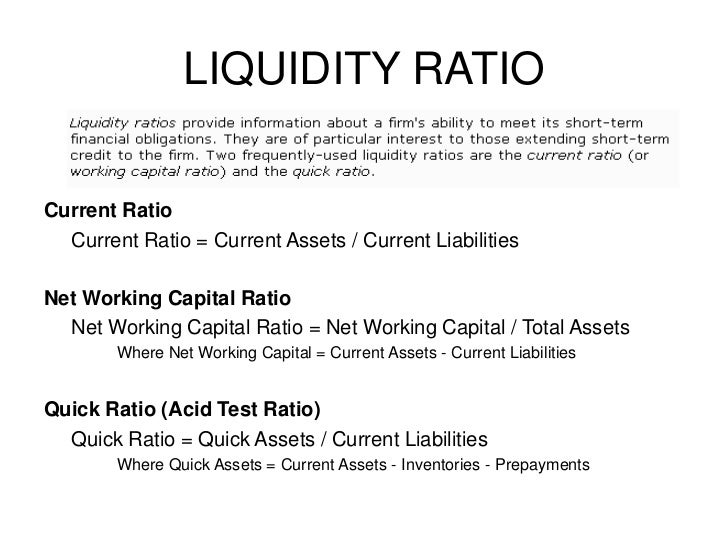

Net working capital ratio analysis. WC Current assets Current liabilities. A high amount indicates that it has available buffer to accommodate additional short-term liabilities. Working Capital Analysis Formula.

Working Capital WC or Net Working Capital is a measure of a companys liquidity and operational efficiency and its financial health. Or Working capital Abbreviated WC is a rough measure of a companys operational efficiency as it involves the operational assets at the short term level in its make-up. Current assets - Current liabilities net working capital ratio.

Working Capital Analysis Definition. A healthy ratio for WCR is between 12 20. A ratio of 1 is usually considered the middle ground.

Calculation of the Sales to Working Capital Ratio The sales to working capital ratio is calculated by dividing annualized net sales by average working capital. In the extended example provided you can see that if the business has fewer credit customers accounts receivable than anticipated or if it has less inventory cash or marketable securities than expected the net working capital ratio can fall below 10. As mentioned above the net working capital ratio is a measure of a firms liquidity or how quickly it can convert its assets to cash.

Most Wanted Financial Terms. It is intended to reveal whether a business has a sufficient amount of net funds available in the short term to stay in operation. This ratio shows the firms ability to pay off its current liabilities with current assets.

In general the more working capital the less financial difficulties a company has. Start free Ready Ratios financial analysis now. Working capital WC also known as net working capital indicates the total amount of liquid assets a company has available to run its business.