Out Of This World Treatment Of Non Current Investment In Cash Flow Statement

During the year 2018 the company sold 80 of its original investments at a profit of 20 on book value.

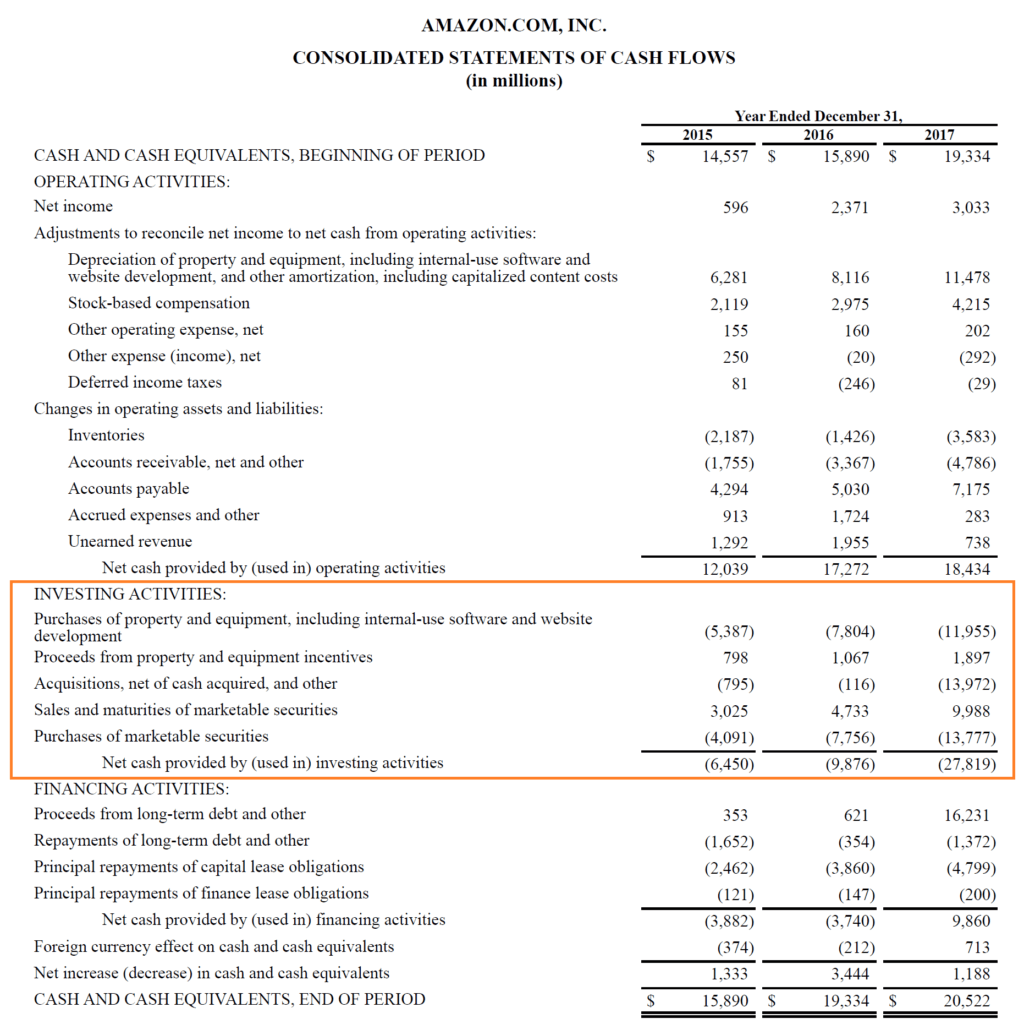

Treatment of non current investment in cash flow statement. Use the following four categories of activities to classify cash transactions. Classification of certain cash payments and receipts in the statement of cash flows which has led to diversity in practice. Lets review the cash flow statement for the seven months of January through July 2020.

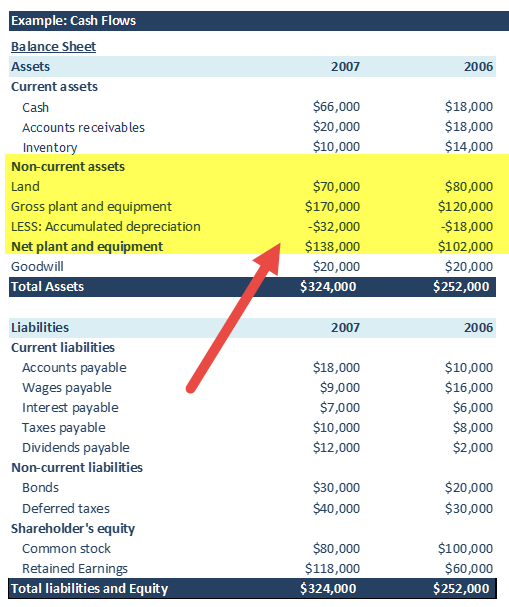

Capital and related financing. Deferrals of future receipts. Investing cash flows typically include the cash flows associated with buying or selling property plant and equipment PPE other non-current assets and other financial assets.

Add back the depreciation charged. Types of activities that this may. Non-Current Investments as on 31-03-2017 Rs.

When the indirect method of presenting the statement of cash flows is used the net profit or loss for the period is adjusted for the following items. Offsetting cash inflows and outflows in the statement of cash flows 51. The main drawback includes the fact that when each non cash transaction is added to the Income Statement - it builds a distance between the Net Income and Real Cash number of the Business.

Effect of bank overdrafts on the carrying amount of cash and cash equivalents 52. Statement of Cash Flows Categories for Classifying Cash Transactions. Generally cash receipts and cash payments are reported as gross rather than net.

February 19 2020. An item on the cash flow statement belongs in the investing activities section if it is the result of any gains or losses from investments in financial markets and operating subsidiaries. Capitalized development costs Intangible assets opening balance in Balance Sheet Intangible assets added from acquisition of Subs Cash investment in intangible assets in Cash Flow Statement Impairment or Amortization in Income Statement.

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)