Unique Is Cost Of Goods Sold Closed To Income Summary

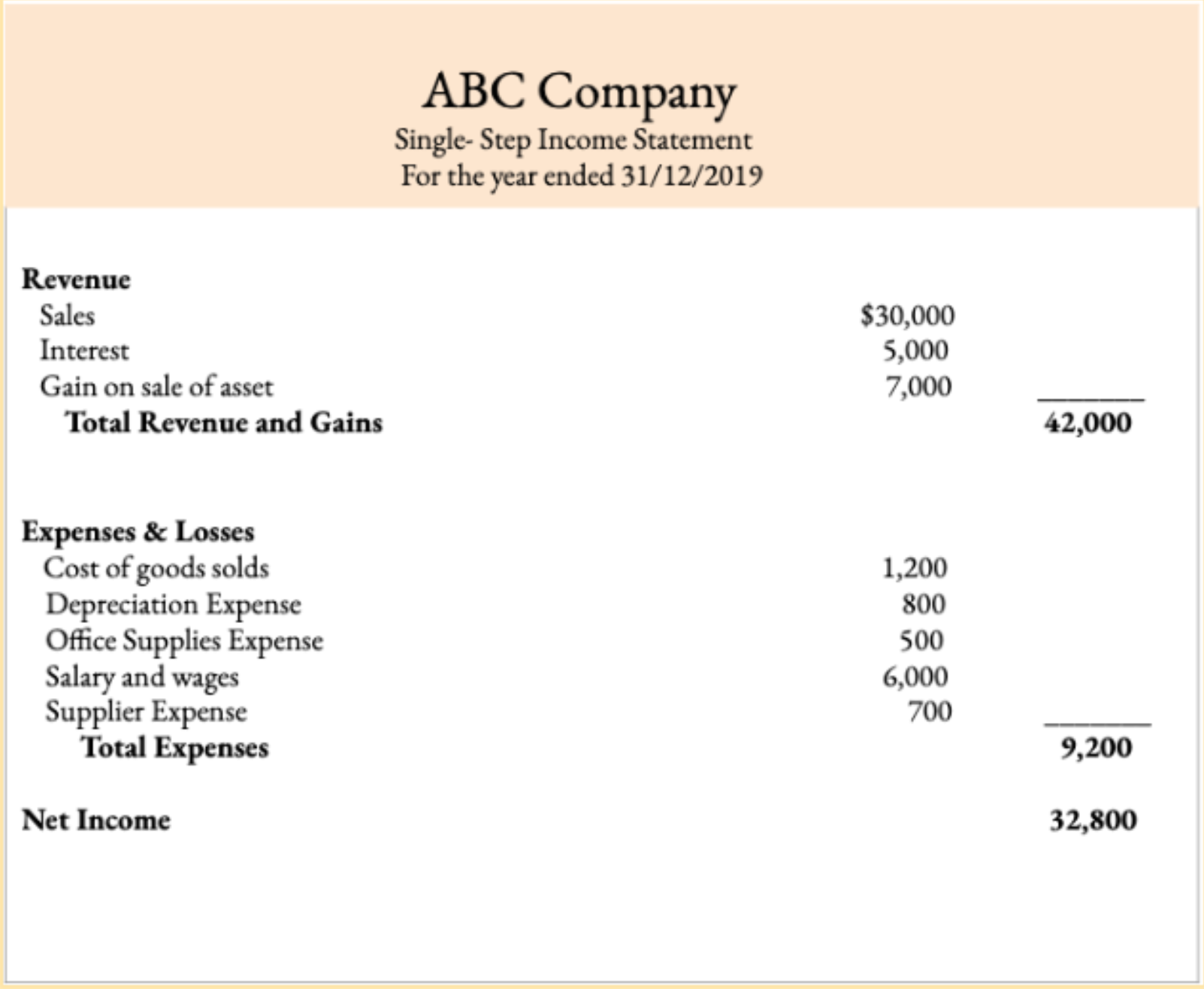

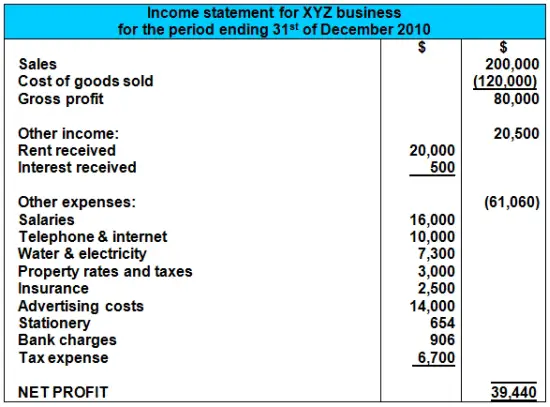

Cost of goods sold on an income statement.

Is cost of goods sold closed to income summary. Debiting Income Summary and crediting Cost of Goods Sold. Cost of goods sold based on item group. Both operating expenses and cost of goods sold COGS are expenditures that companies incur with running their business.

Debiting Cost of Goods Sold and crediting Income Summary. At the top of the income statement is your sales revenue from which you subtract the cost of goods sold. Cost of goods sold is closed into the income summary account.

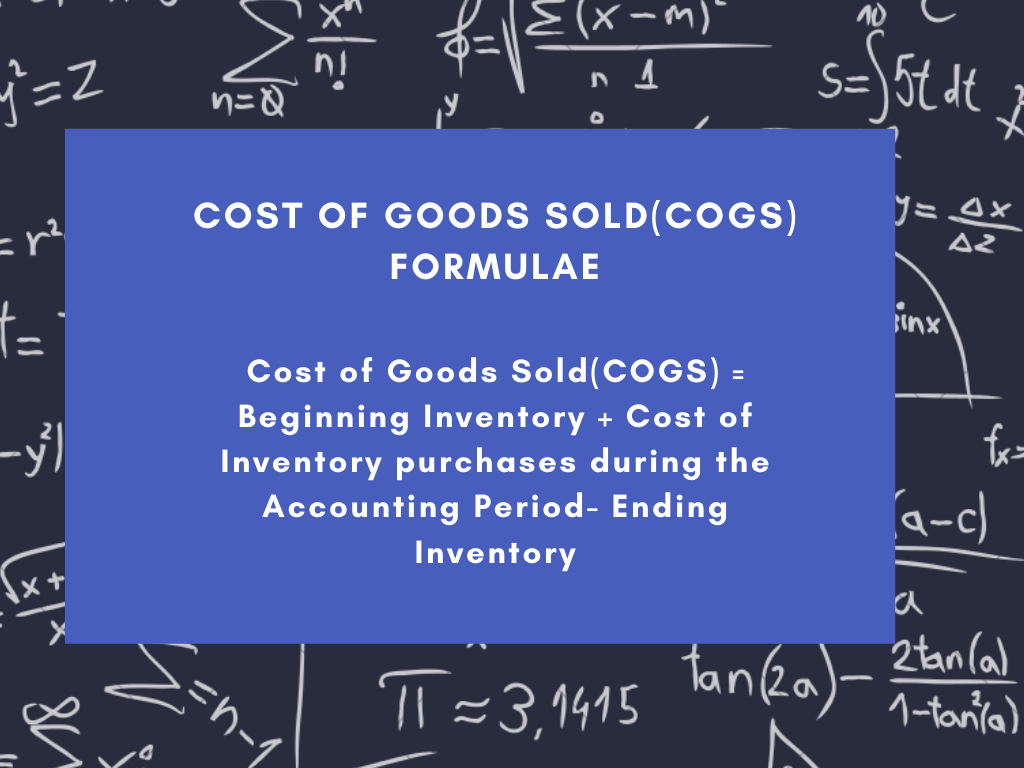

Margin or profit made minus items discounted at the POS. This is what the inventory you sold in the accounting period cost to purchase or manufacture. To close these debit balance accounts a credit is required with a corresponding debit to the income summary.

Please check my answers below and correct me if i am wrong please 1. The sales revenue and cost of goods sold will be shown in the Income Statement. Sales Gross profit Cost of goods sold 1800-300 1500.

Cost of goods sold is an important figure for investors to consider because it has a direct impact on profits. Then subtract all other business expenses to get net income which is the amount used to calculate business income taxes and self-employment tax. Cost of Goods Sold Summary Report.

The Cost of Goods Sold account is closed by. The net balance of the income summary account is closed to the retained earnings account. These accounts are usually named based on the source of the revenue or expense -- examples include interest expense cost of goods sold supplies expense sales revenue and investment income.