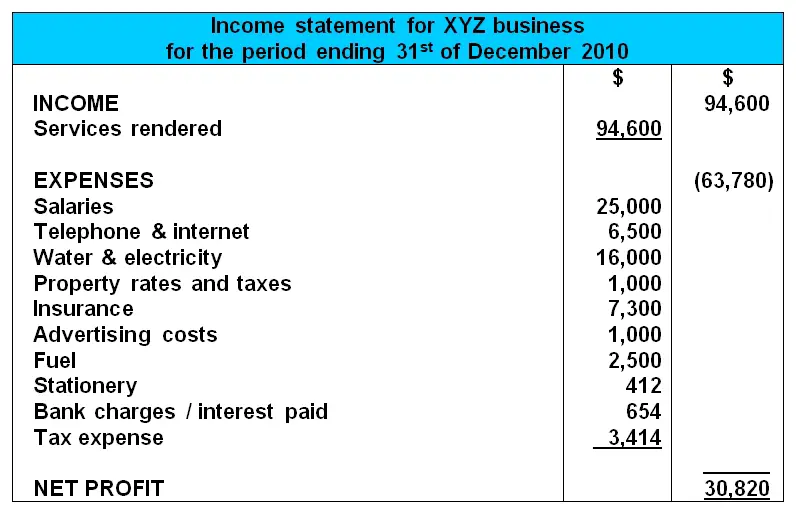

Best Income Tax Basis Financial Statements Example

GAAP does not require the recognition of deferred taxes.

Income tax basis financial statements example. For example the income tax basis of accounting requires the recognition of rent paid or to be paid. This special purpose framework unlike US. Conversely GAAP recognizes rent expense on a straight-line basis over the term of the lease thereby resulting in a liability or deferred rent on the balance sheet for the difference between rent paid and rent expensed.

By Talwar Akshay K. Finally calculate the net income by subtracting the tax from the Pre-Tax Income. Abstract- Tax basis financial statements are prepared on a comprehensive basis of accounting based on the Internal Revenue Code regulations for accounting for transactions rather than Generally Accepted Accounting Practices GAAPUsers interested in the tax aspects of their relationship with an entity will find the.

These illustrative financial statements which are examples for bank holding companies including community banks thrifts and other financial institutions contain common disclosures as required under US. We have chosen the option to recognize only current income tax assets and liabilities. As discussed in Note A to the financial statements in 20X4 the Company adopted a policy of preparing its financial statements on the accrual method of accounting used for federal income tax purposes which is a comprehensive basis of accounting.

It also means less work in preparing the tax return and limited reconciliation to calculate taxable income. Generally a financial statement audit on the income tax basis requires less time to complete than an audit under a GAAP basis. Entity financial statements based on the needs of the financial statement users and cost and benefit considerations.

If a financial statement audit is required investors and lenders may be willing to accept financial statements on the income tax basis of reporting. Note 2 - Property and Equipment. If allowed by creditors investors and other financial statement users accounting under Tax.

Practice Aid - OCBOA Financial Statements March 28 2019 This Practice Aid is intended to provide preparers of cash and taxbasis financial statements with guidelines and best practices to promote consistency and for resolving the often difficult questions regarding the preparation of such financial statements. Securities and Exchange Commission SEC including financial statement. Management is responsible for the accompanying financial statements of XYZ Partnership which comprise the statements of assets liabilities and partners capital tax basis as of December 31 20X2 and 20X1 and the related statements of revenue and expenses tax basis and changes in partners capital tax basis.