Out Of This World Important Ratios For Credit Analysis

As a corporation Corporation A corporation is a legal entity created by individuals stockholders or shareholders with the purpose of operating for profit.

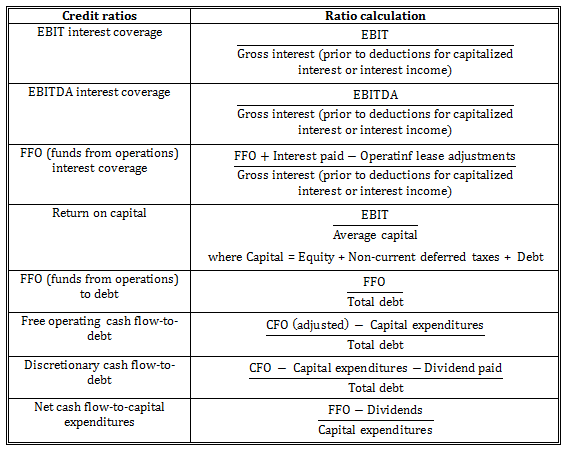

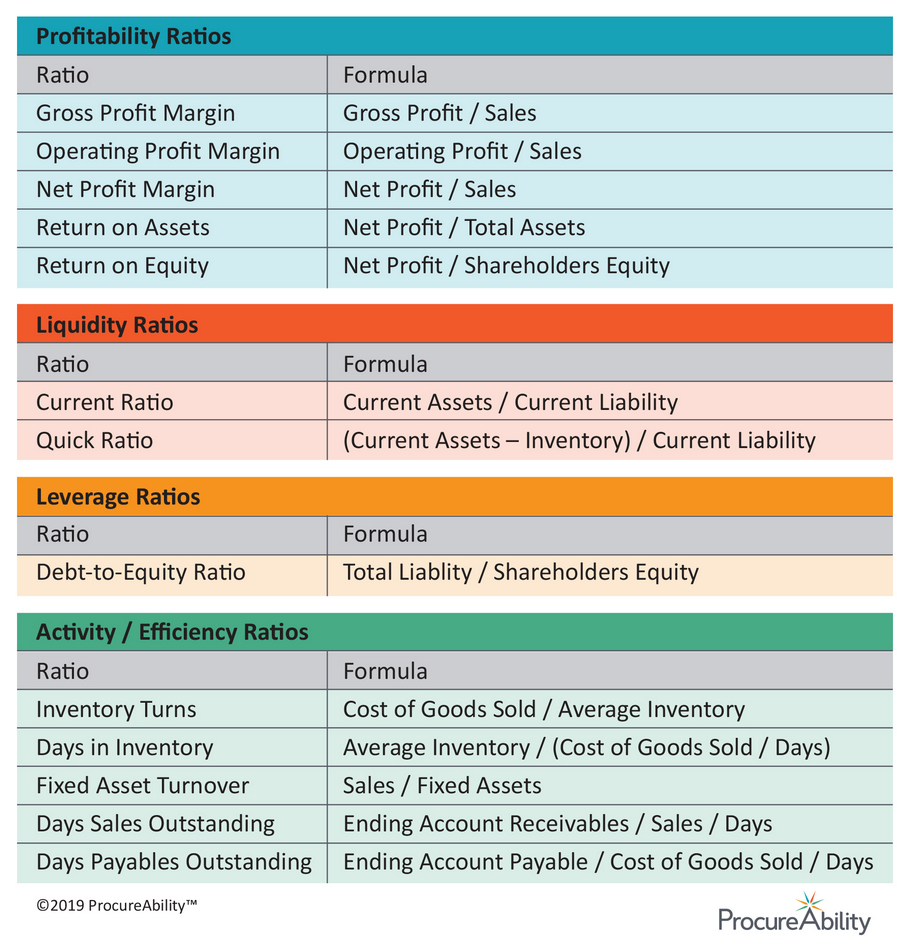

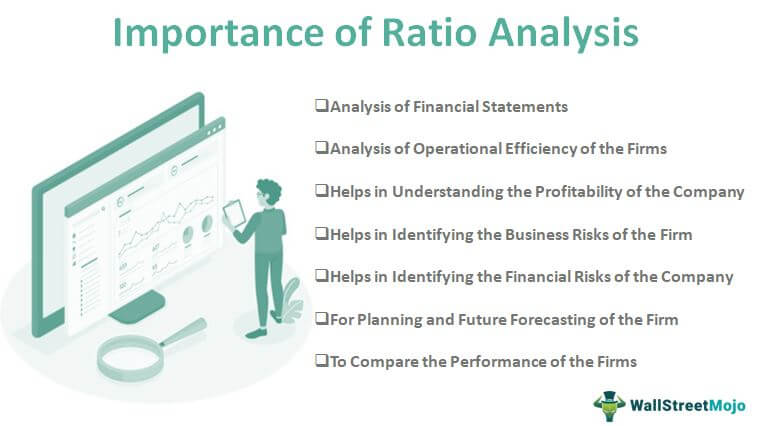

Important ratios for credit analysis. Important Financial Ratios for Credit Analysis Credit analysis covers the area of analyzing the character of the borrowers capacity to use the loan amount condition of capital objectives of taking a loan planning for uses probable repayment schedule so on. A detailed discussion on each of the eight parameters is presented below. Since debt is in the denominator here a higher ratio means a greater ability to pay debts.

Understanding the basics of credit analysis is important when raising debt financing for commercial real estate projects. Credit analysis is one step in the credit approval process a bank goes through to evaluate a corporate borrower but it also comes in handy when evaluating the financial strength of tenants corporate guarantors and other individual operating businesses. Credit rating agencies often use this leverage ratio.

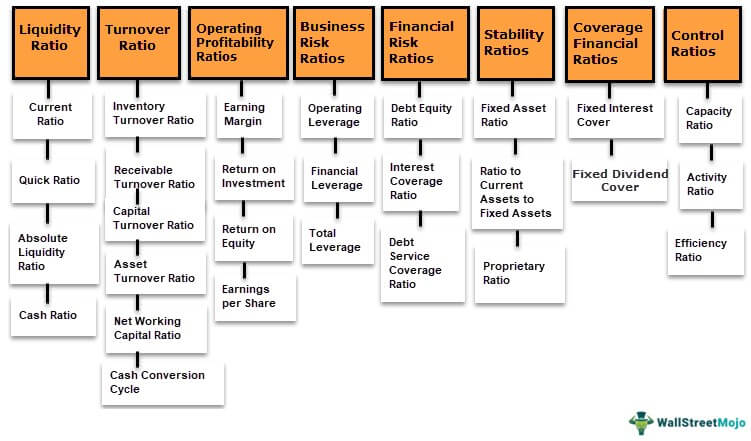

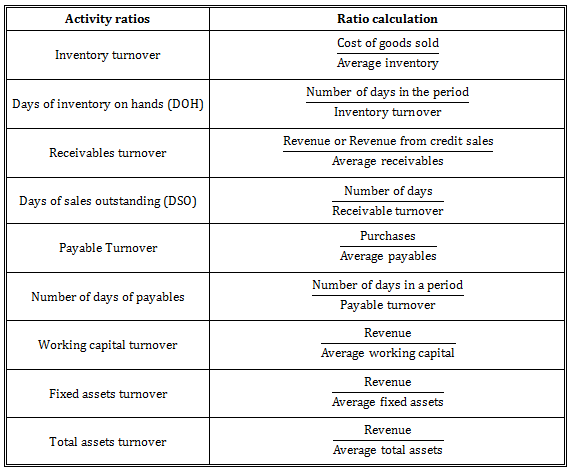

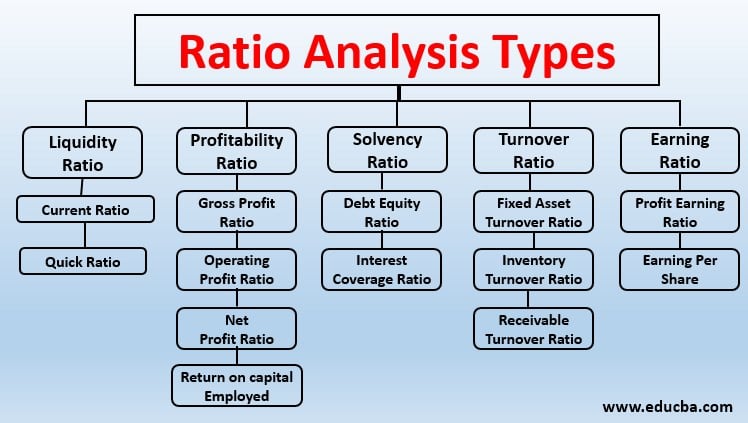

There are five basic ratios that are often used to pick stocks for investment. Instead CRISIL makes a subjective assessment of the importance of the ratios for each credit. Analysts consider various ratios and financial instruments to arrive at the true picture of the company.

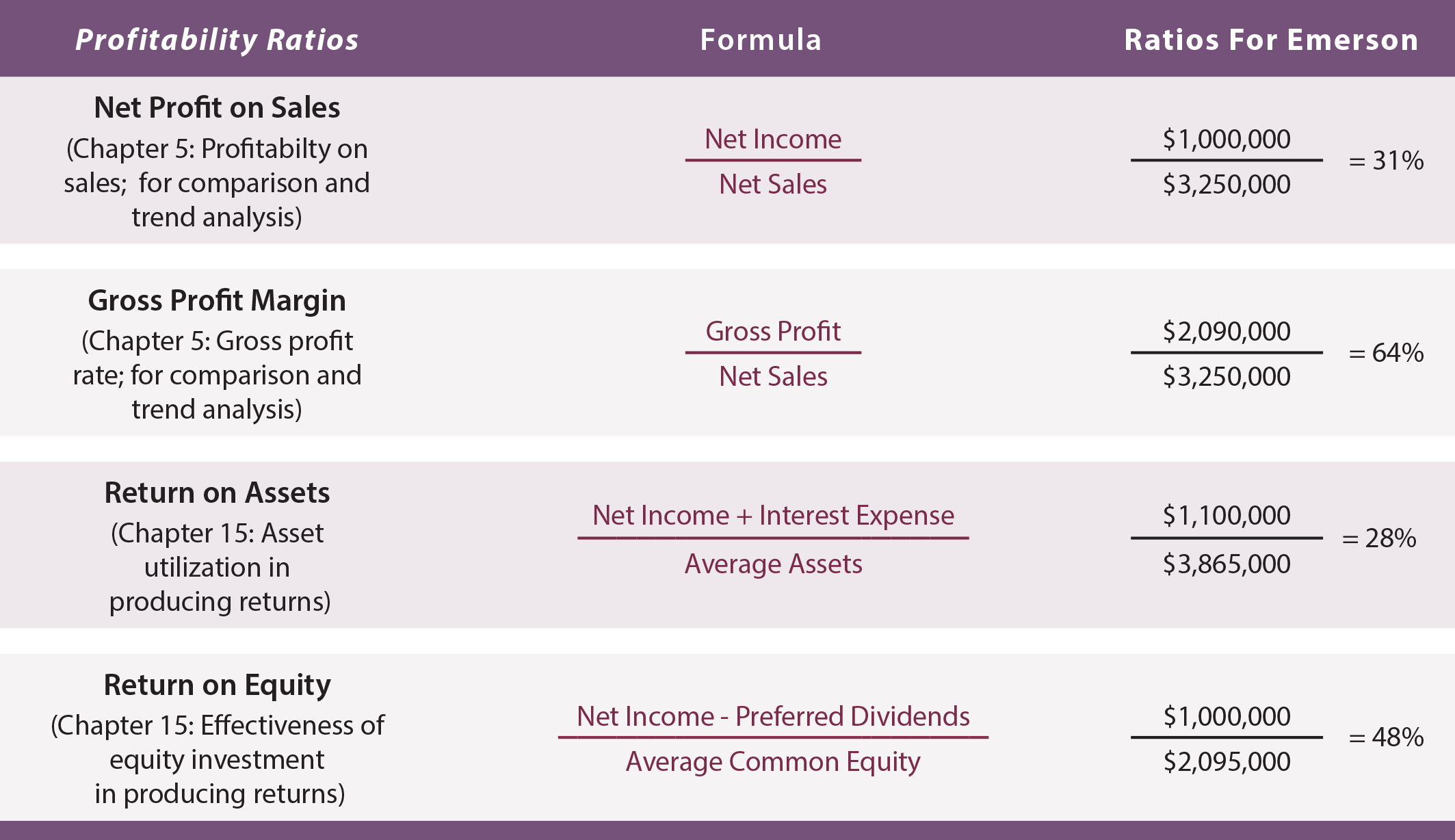

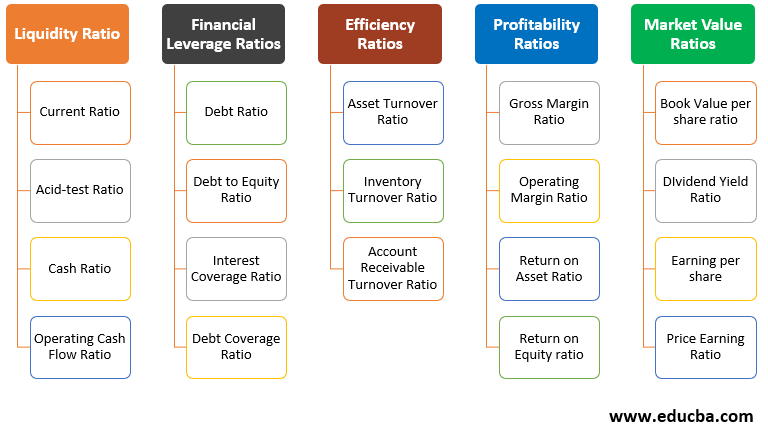

The formula used for computing current ratio is. A higher current ratio indicates the higher capability of a company to pay back its debts. Fundamental analysis relies on extracting data from corporate financial statements to compute various ratios.

A higher ratio implies more leverage and thus higher credit risk. Credit analysis is important for banks investors and investment funds. Debt to EBITDA - The ratio of total debt to EBITDA also known as the Leverage Ratio is the most basic measurement of the debt level a company holds.

Uses for Credit Analysis. Debt-to-Cash Flow Ratio typically called the Leverage Ratio Debt Service Coverage Ratio and. This ratio is also known as cash asset ratio cash ratio and liquidity ratio.