Fantastic Loan Advanced In Trial Balance

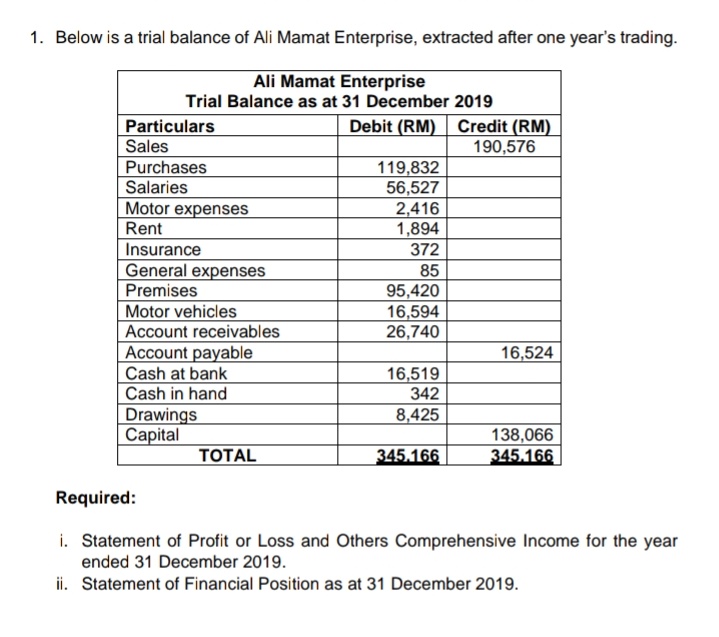

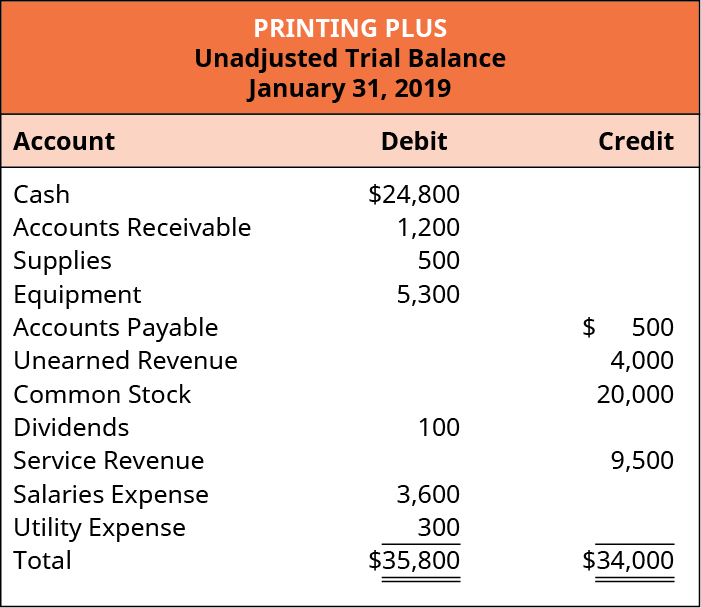

In addition it should state the final date of the accounting period for which the report is created.

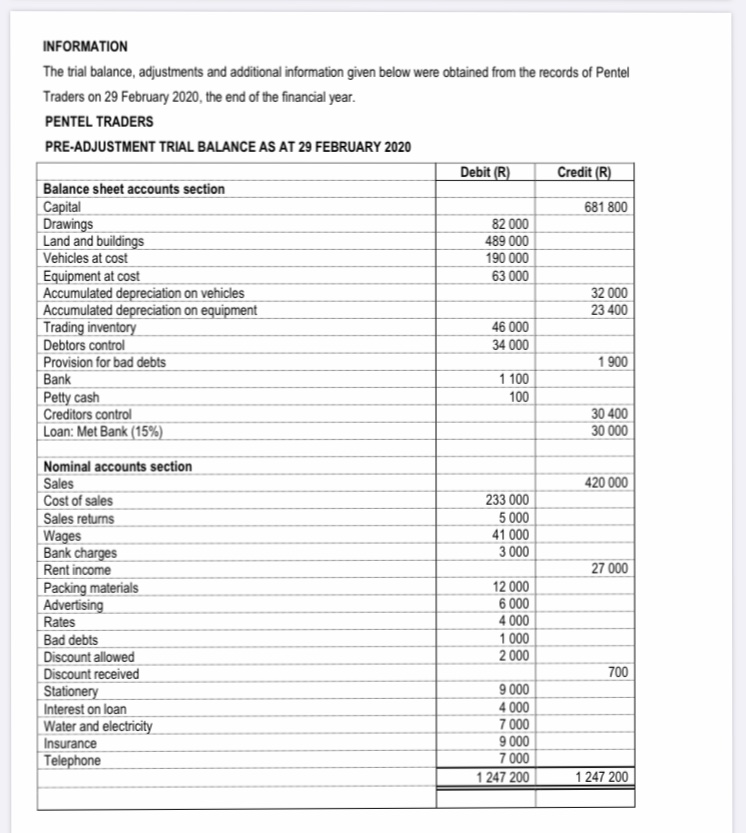

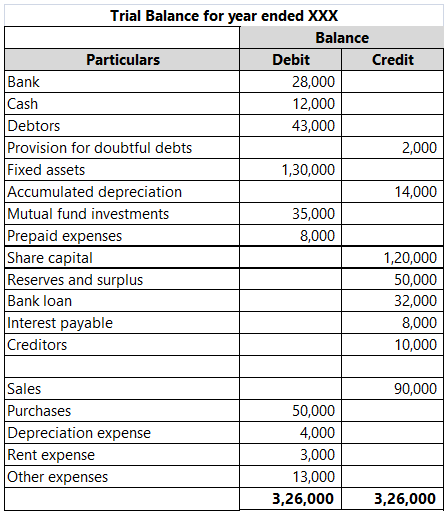

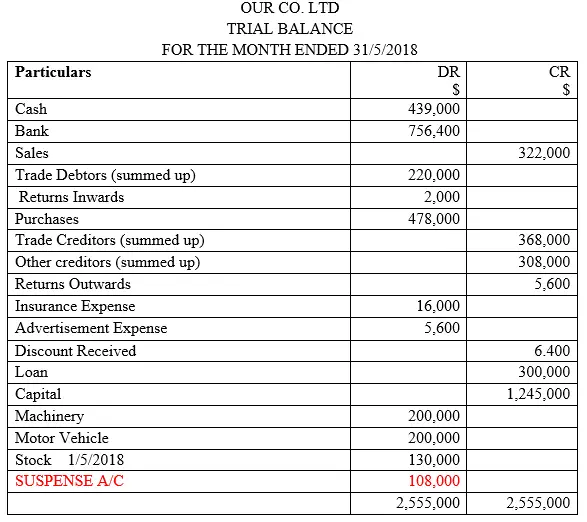

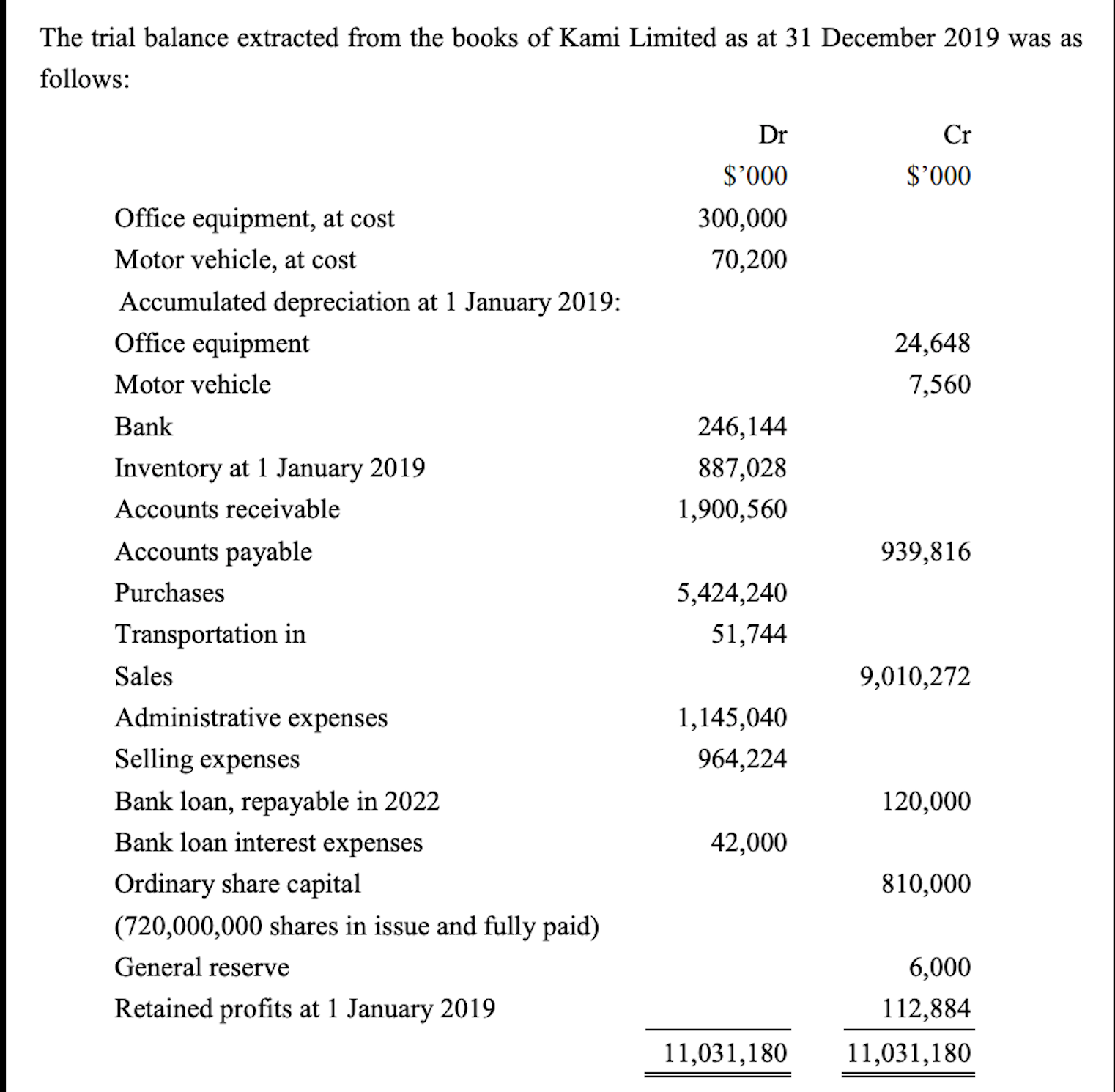

Loan advanced in trial balance. The rule to prepare trial balance is that the total of the debit balances and credit balances. As such sometimes a debit account is referred to as a cash account. Under loan you would record the 15000 principal.

On which side of Trial Balance Loan Advanced is written 1 See answer sakshampatidar1 is waiting for your help. It is generally utilized as the first step in the closing process for interim and annual reporting. These loans can be short-term where the loan repayment is processed in less than a year or a long-term loan which can be paid back in over a years time.

Loan taken ---- Cr Side. This increases your cash balance on your balance sheet and how much you have available to spend. On the other hand if you never get an EIDL loan your advance payment will be considered as a tax-free gift and may account for income but not taxable.

An advance paid to an employee is essentially a short-term loan from the employer. Why Trial Balance is important. If the two columns do not have the same total something is wrong in the accounting.

The year-end trial balance is typically asked for by auditors when they begin an audit so that they can transfer the account balances on the report into their auditing software. Any loan you take out will carry a balance until its fully paid. Its primary purpose is verification of account balances and compliance to the dual entry system debits equal credits.

Here are four steps to record loan and loan repayment in your accounts. Add your answer and earn points. This article uses a small business scenario to suggest ways to help you successfully extend a Trial Balance ETB and is the culmination of the knowledge and understanding previously covered in both basic and advanced.