Breathtaking Common Size Analysis Pdf

In this way elements of a companys operations like debt shareholder equity and cost of goods sold can be measured against the financial operations as a whole.

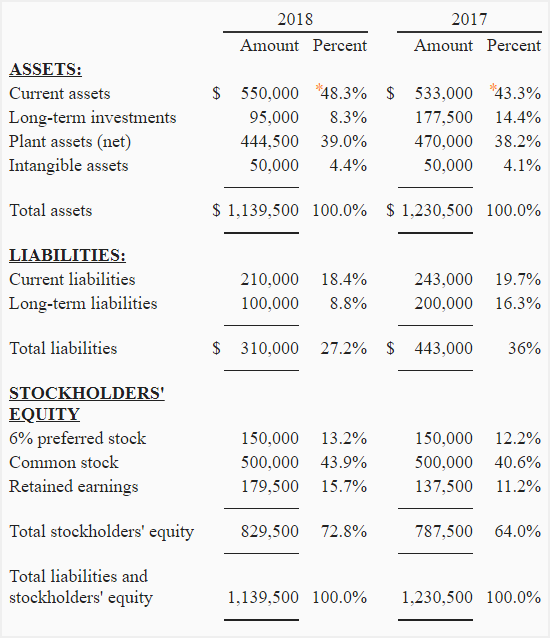

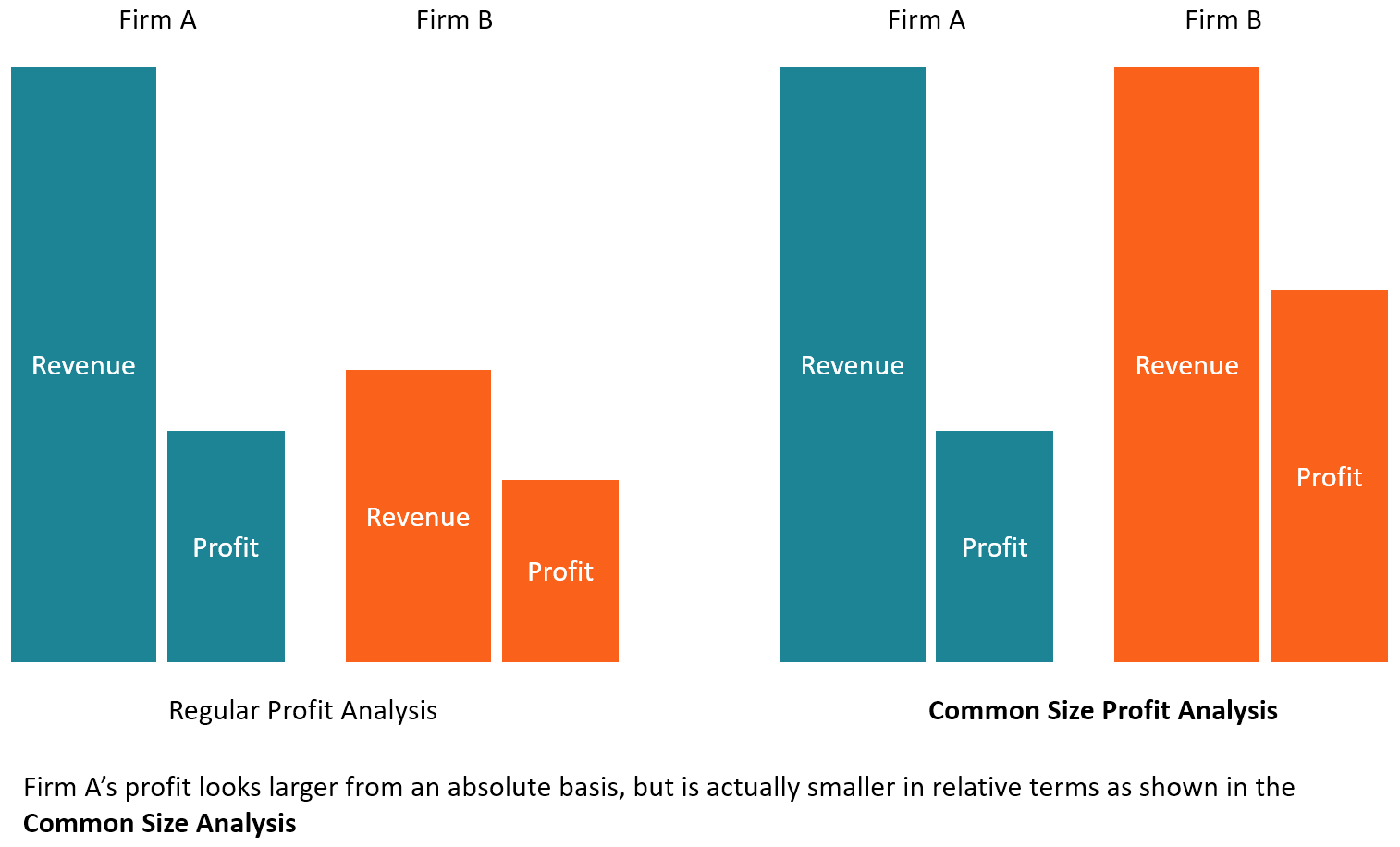

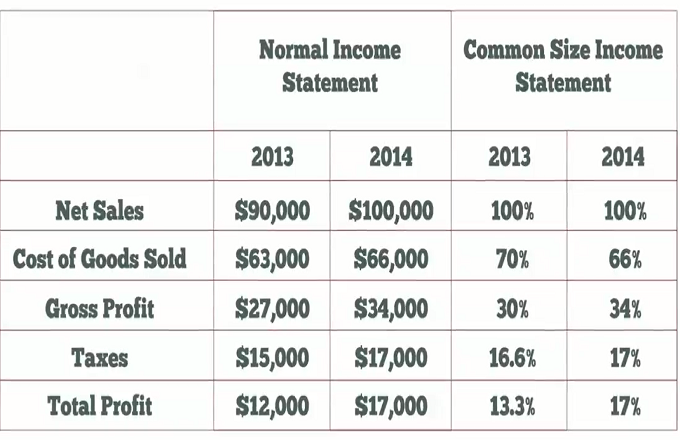

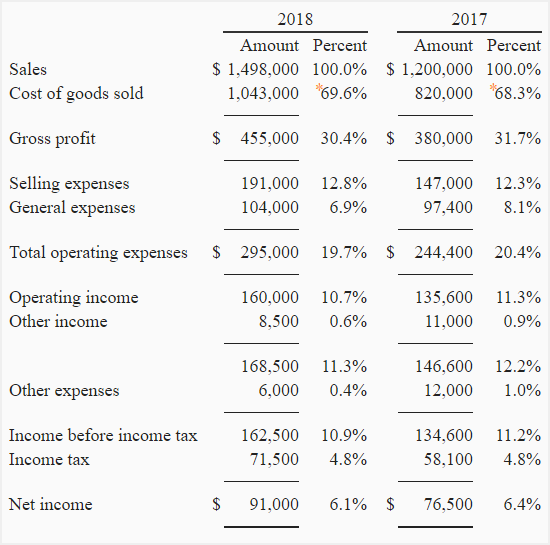

Common size analysis pdf. For balance sheets all assets are expressed as a percentage of total assets while Financial statement analysis applies analytical tools and techniques to fi nancial statements to determine the operating and fi nancial. Income from other sources has initiated this year. Common size analysis is an excellent tool to compare companies of different sizes or to compare different years of data for the same company as in the example below.

Amount of income loss from continuing operations including income loss from equity method investments before deduction of income tax expense benefit and income loss attributable to. To see the trend in the financials of the last three years. Inventory Inventory is a current asset.

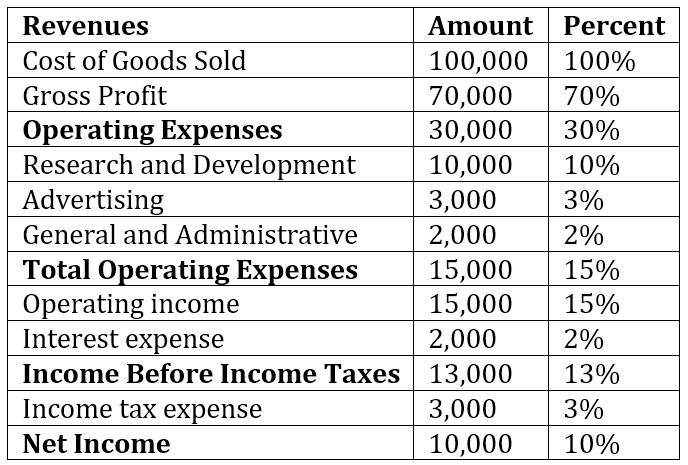

Common Size Income Statement. Applying Common Size Analysis. Examples of Common Size Balance Sheet Analysis.

Common-Size Statement fails to recognise the qualitative elements eg. All amount in Millions. It is the same as a ratio analysis when looking at the profit and loss statement.

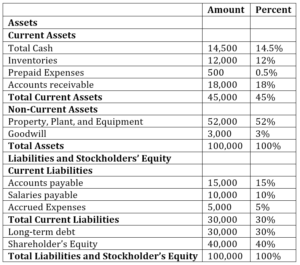

A common size analysis can also be performed on the liabilities that a company has or it can be performed on its balance sheet as a whole. Common Size Statements Common size statements examine the proportion of a single line item to the total statement. It is the analysis of changes in different components of the financial statements over different periods with help of a series of statements.

Viz comparative statements common size statements and trend analysis. 7dvn 3uhsduh d yhuwlfdo dqg frpprq vlh dqdovlv ri qfrph 6wdwhphqw 3uhsduh d yhuwlfdo dqg frpprq vlh dqdovlv ri dodqfh 6khhw 3uhsduh d yhuwlfdo dqg frpprq vlh dqdovlv ri dvk orz 6wdwhphqw. By preparation of common size statements of the two similar units By preparing common size statement of different years of the same business unit.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)