Smart Debt Investments Balance Sheet Classification

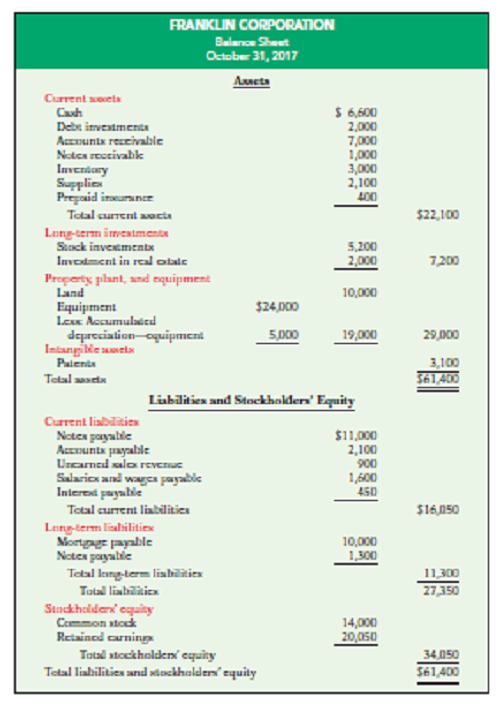

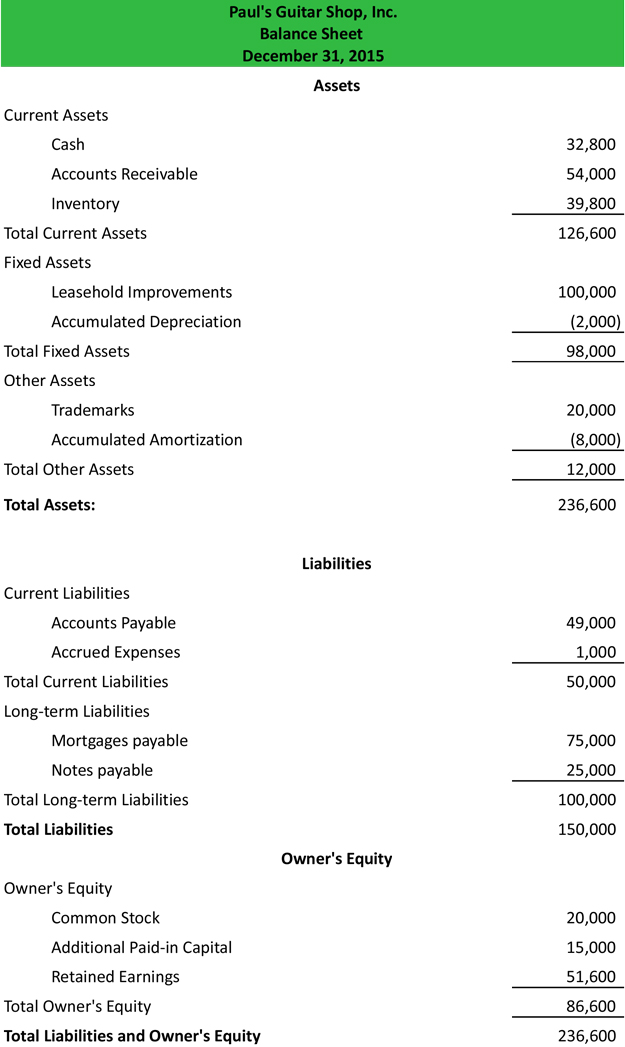

A classified balance sheet presents information about an entitys assets liabilities and shareholders equity that is aggregated or classified into subcategories of accounts.

Debt investments balance sheet classification. What is a Classified Balance Sheet. In accounting for investments in debt securities that are classified as trading securities athey are reported on the balance sheet at amortized costbthe intention is to hold the security for many years cthey are periodically adjusted to fair value. Suzanne Stephani PwC director and debt classification specialist joins Heather Horn to decipher the guidance discuss common questions and provide an update on the FASBs related project.

Debt classification is an important factor in the balance sheet as it represents a companys overall financial health. For each of the accounts below indicate the proper balance sheet classification 1. Too much short-term debt can be seen as a risk that investors may not want to take as the company may not be able to shoulder any additional debt.

The current guidance is complex but help is on the way. Refinancing debt but not quite sure how it will impact your balance sheet classification. A debt investment classified as heldtomaturity means the business has the intent and ability to hold the bond until it matures.

Accumulated Depreciation - Equipment 6. As a result the FASB has decided to take a look at FASB Accounting Standards Codification Topic 470 Debt. Companies can classify debt securities as follows.

Under GAAP short-term debt thats refinanced after the balance sheet date but prior to the financial statements being issued is recorded as a noncurrent liability. Such investments are recorded on the asset side of the balance sheet. H Interest Payable b Treasury Stock.

Instead GAAP includes a. Presented below are a number of balance sheet accounts of Deep Blue Something Inc. Proper classification of debt as current or noncurrent is important for a variety of reasons.