Divine Ratio Analysis Of Coca Cola

However the firm would.

Ratio analysis of coca cola. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Coca-Cola Cos latest. One of the best place to work- This would attract a pool of workers of the highest caliber thus leading to more value induced into the company. A liquidity ratio calculated as cash plus short-term marketable investments plus receivables divided by current liabilities.

Looking back at the last five years Coca-Colas current ratio peaked in December 2017 at 13x. Coca-Colas operated at median current ratio of 13x from fiscal years ending December 2016 to 2020. Cokes current ratio ended 2016 at 128.

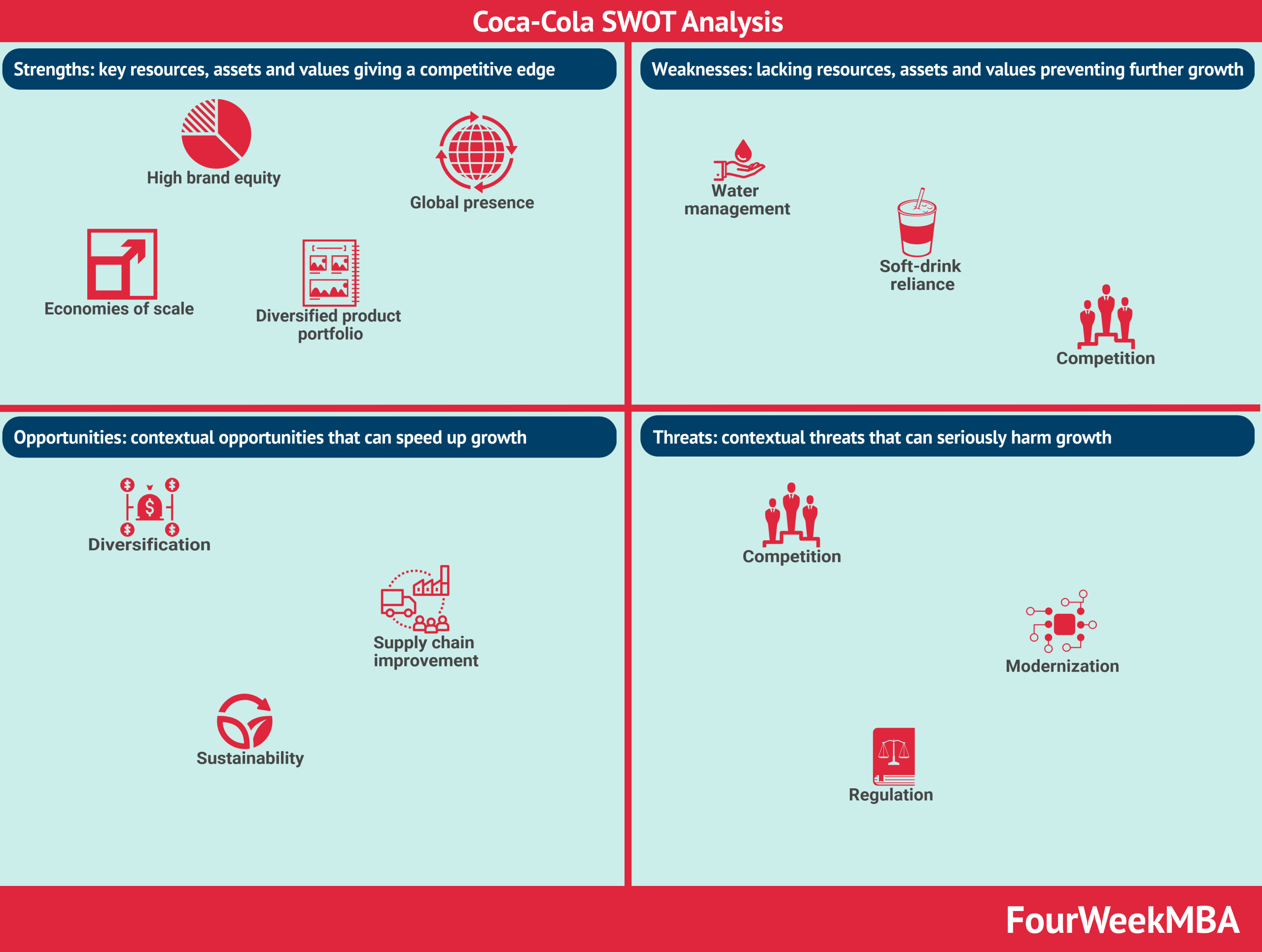

In terms of advertising coca cola gains from its advertising equally as Pepsi. Coca-Cola Cos quick ratio deteriorated from 2018 to 2019 but then improved from 2019 to 2020 exceeding 2018 level. Coca-Cola has created differentiation using a soft sell approach and has positioned itself on the following standards.

This paper looks at a Fortune 500 company specifically Coca Cola and analyses its financial statements using ratio analysis. COCA-COLA HBC Financial Ratios for Analysis 2015-2021 CCHGY. Are carefully analyzed using financial ratios of Coca Cola.

The purpose of this report is to provide the reader with an understanding of the financial position of coca cola. 2 above the third quartile. 0 the ratio value deviates from the median by no more than 5 of the difference between the median and the quartile closest to the ratio value.

Factors like profitability liquidity gearingrisk etc. From this point the organizations current ratio would continually fall over the next two years ending 2019 at76. Coca-Colas current ratio hit its five-year low in December 2019 of 08x.