Cool Absorption Income Statement Format

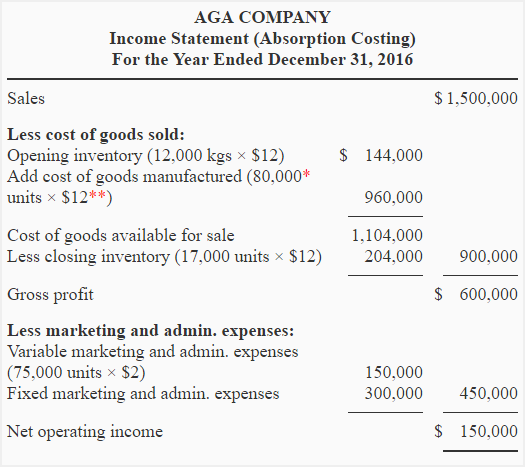

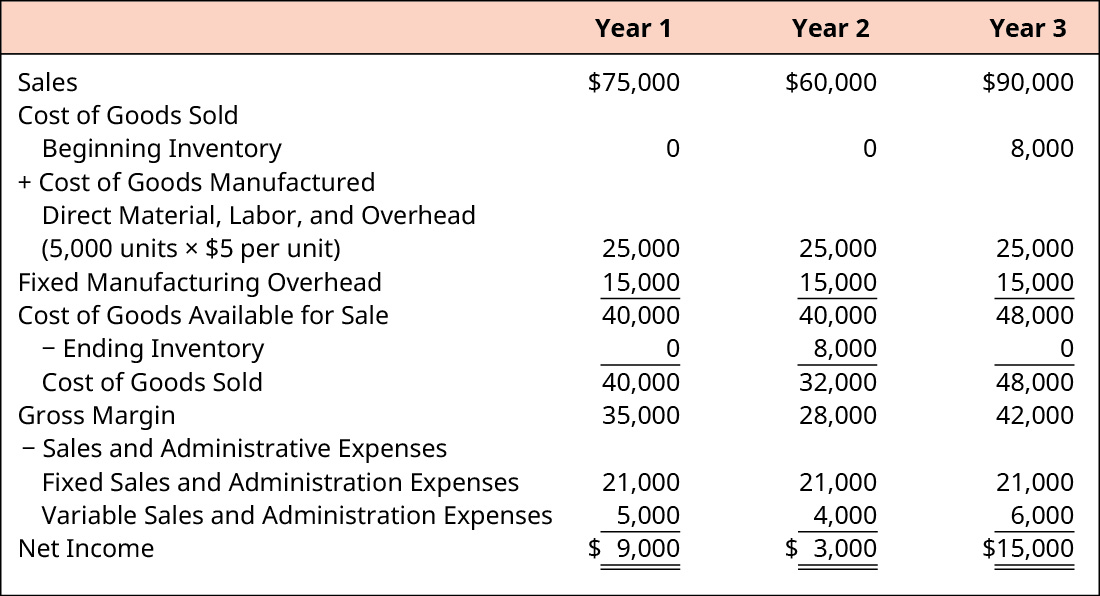

Absorption costing income statement format AGA company produces and sells a product for 20 per Kg.

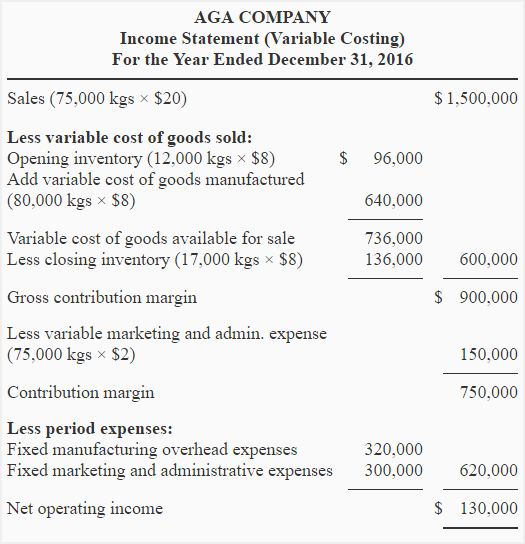

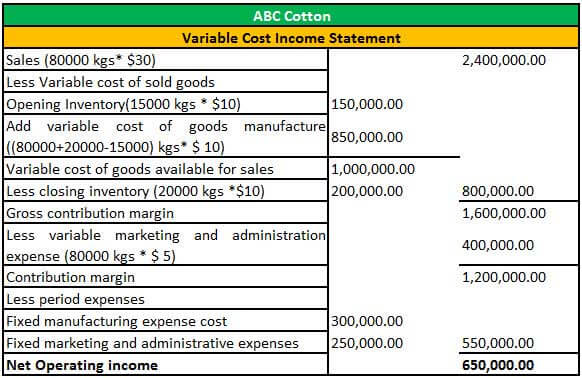

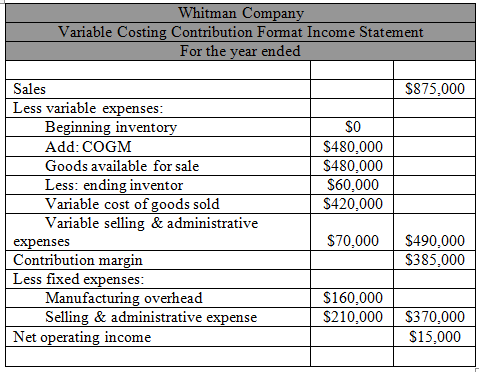

Absorption income statement format. Absorption costing is a very widely used costing system and public entities are bound by GAAP to use absorption costing when reporting their earnings to shareholders. On the Internet find a discussion of a company that uses variable costing. 8 per Kg Fixed production overhead cost.

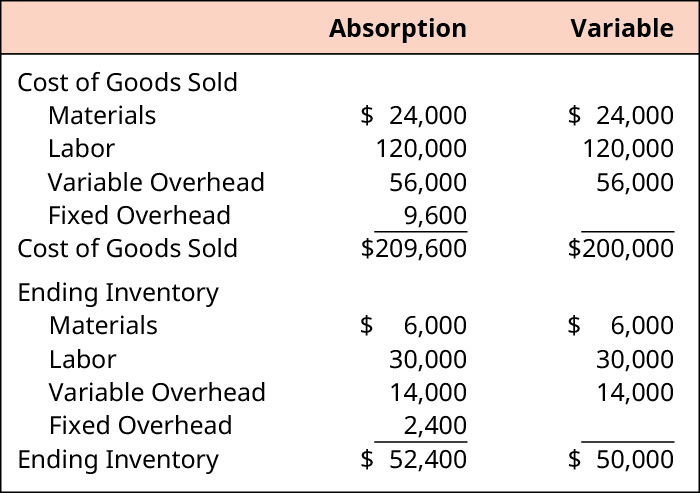

Opening inventory valued at absorption rate. Why do you think variable costing has also been called direct costing. In addition it shows the gross profit less than the distribution and administration costs which corresponds to the operating income.

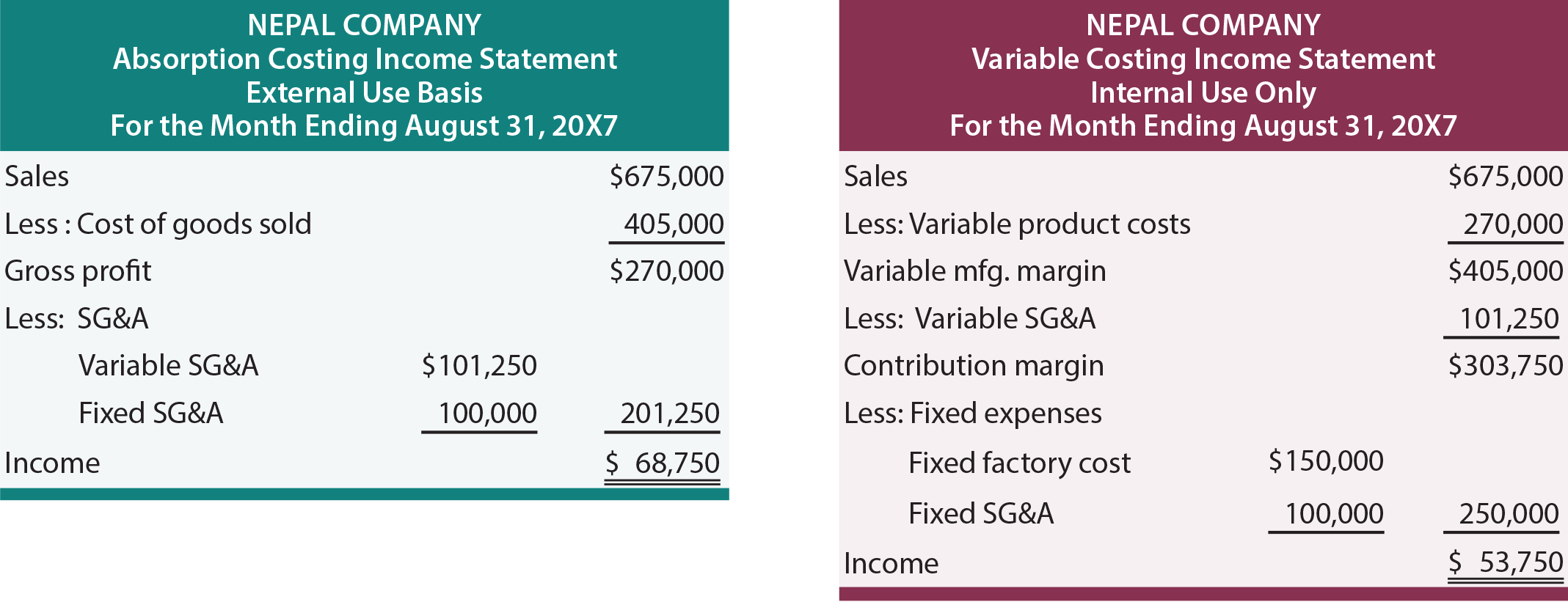

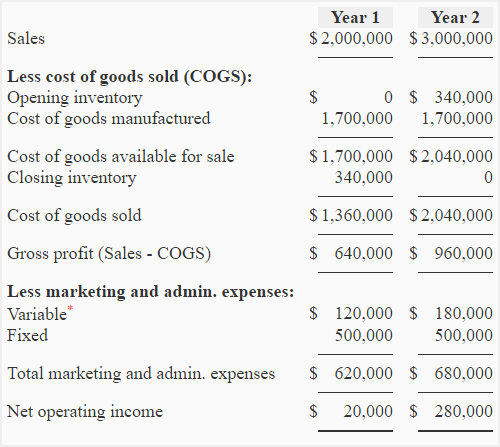

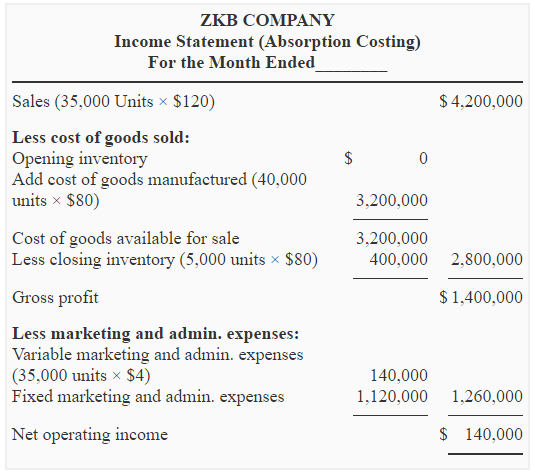

The basic absorption costing is calculating the cost of both direct and indirect expenses. Income Statement absorption For Month Ended May. H Ltd Income Statement Absorption Costing 2006 2007 000 000 Sales 3000 3600 Cost of Sales Beginning Inventory 0 400 Production Cost W5 W6 1400 1200 Ending Inventory W7 W8 400 240 1000 1360.

Gross profit at actual. The cost per unit is therefore 27. The traditional income statement also known as the absorption costing income statement is created using absorption costing.

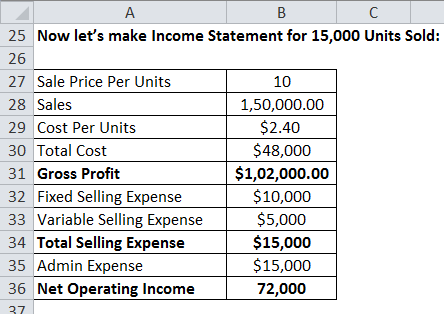

Prepare income statement for the year ended 30 June 2016 based on both marginal variable and absorption costing. Prepare an income statement for the month using the contribution format and the variable costing method. 3300 less over absorption.

1500 add production cost valued at absorption rate. The core format of absorption costing income statement demonstrates the sales less the expenses of products sold equivalent gross revenue. We can also create the Absorption Statements of Profit for both February and January.