Ideal Ifrs 16 Balance Sheet Example

An appendix illustrating example disclosures for the early adoption of IFRS 9 Financial Instruments taking into account the amendments arising from IFRS 9 Financial Instruments 2010 and Mandatory Effective Date and Transition Disclosures Amendments to IFRS 9 and IFRS 7 2011.

Ifrs 16 balance sheet example. Below we present the entry recorded as of 112021 for our example. Financial assets financial liabilities subject to offsetting These examples represent how some of the disclosures required by IFRS 7 in paragraphs 13C and IG40D in relation to offsetting financial assets and financial liabilities might be tagged using detailed XBRL tagging. Balance sheet 52 Cash flows 113 VALUE IFRS Plc Illustrative IFRS consolidated financial statements December 2019 Financial statements 6 Statement of profit or loss 9 Statement of comprehensive income 10 Balance sheet 17 Statement of changes in equity 21 Statement of cash flows 24 Appendices 201 Independent auditors report 200.

IFRS 16 Example Disclosures How early adopters disclosed IFRS 16 in the 2018 Financial Statements. In my understanding we will have to. Balance Sheet Tax purposes.

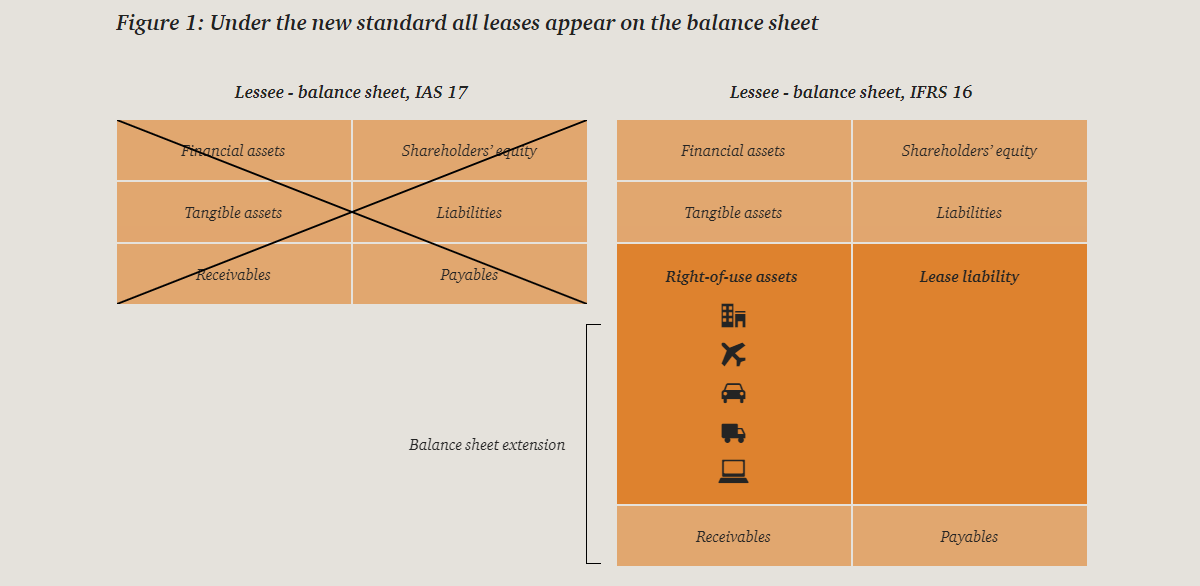

This means that if a company has control over or right to use an asset they are renting it is classified as a lease for accounting purposes and under the new rules must be recognised on the companys balance sheet. The initial journal entry under IFRS 16 records the asset and liability on the balance sheet as of the lease commencement date. IFRS 16 allows a lessee to present lease liabilities separately on the statement of financial position or within other liabilities this includes borrowings trade.

These illustrative IFRS financial statements are intended to be used as a source of general technical reference as they show suggested disclosures together with their sources. Balance Sheet Accounting Debit. Lease IFRS 16 should automatically be applied to the contract Implications for Corporates Overview The IASB expects that companies with immaterial or minimal off balance sheet leases transitioning from IAS 17 will not be significantly affected by IFRS 16 regardless of the terms and conditions of.

This operating lease-style accounting treatment is no longer available except for short-term leases lease term 12 months or less and. IFRS 16 requires lessees to recognise most leases on the balance sheet. The balance sheet the right-of-use assets are in.

IFRS 1653 f Not required under IAS 17 New Total cash out flows for leases IFRS 1653 g Required under IAS 7 IAS 717 No change Additions to right-of-use assets IFRS 1653 h General requirements under IAS 16 IAS 1673 Modified Gains or losses arising from sale and leaseback transactions IFRS 1653 i Not required under. Let us assume that ifrs 16 was applied from 2017 on and that the lease concerns a car that gets wrecked in the second year beginning 2018. Right-of-use asset disclosed as a separate financial statement caption in the balance sheet.