Glory Compute Cash Flow From Operating Activities

It is useful for measuring the cash margin that is generated by the organizations operations.

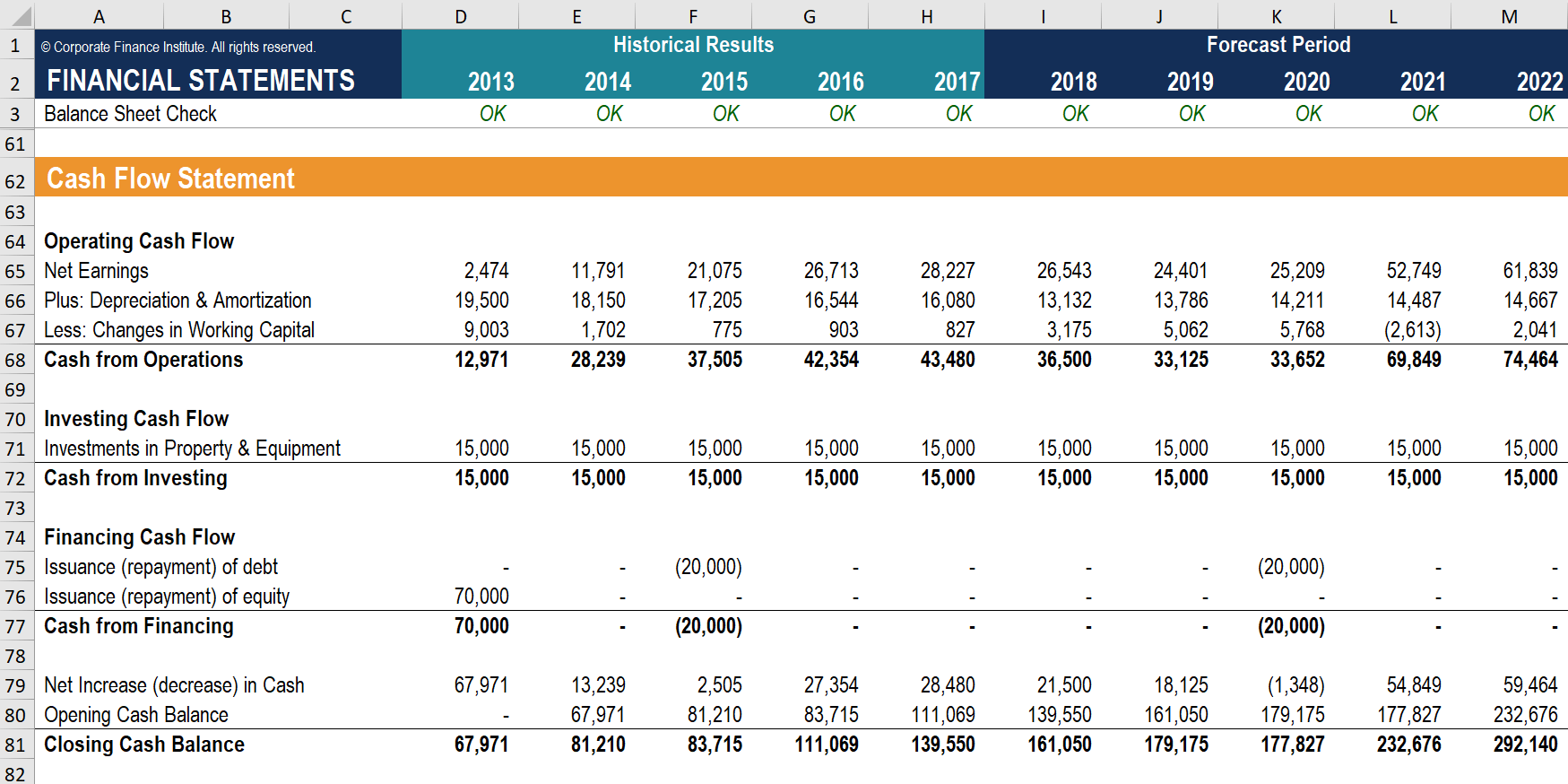

Compute cash flow from operating activities. In 2017 free cash flow is calculated as 18343 million minus 11955 million which equals 6479 million. In indirect method the net income figure from the income statement is used to calculate the amount of net cash flow from operating activities. Finance questions and answers.

Net cash flow cash inflows cash outflows. Net Cash Flow CFOCFICFF. If you wonder how to calculate net cash flow the formula is.

Here we will study the indirect method to calculate cash flows from operating activities. Cash Flows from Operating Activities Indirect Method For the following two independent cases show the cash flows from operating activities section of the statement of cash flows. While the exact formula will be different for every company depending on the items they have on their income statement and balance sheet there is a generic cash flow from operations formula that can be used.

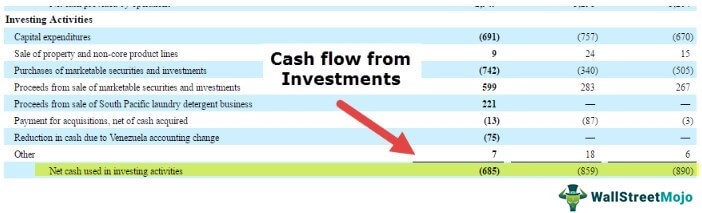

The FCF formula is Free Cash Flow Operating Cash Flow Capital Expenditures. Compute total cash flow from operating activitiescompute total cash flow from investing activitiescompute total cash flow from financing activitiescompute the change in net working capitalcompute cash flow from assets in 2020. If youre not youll need to add up.

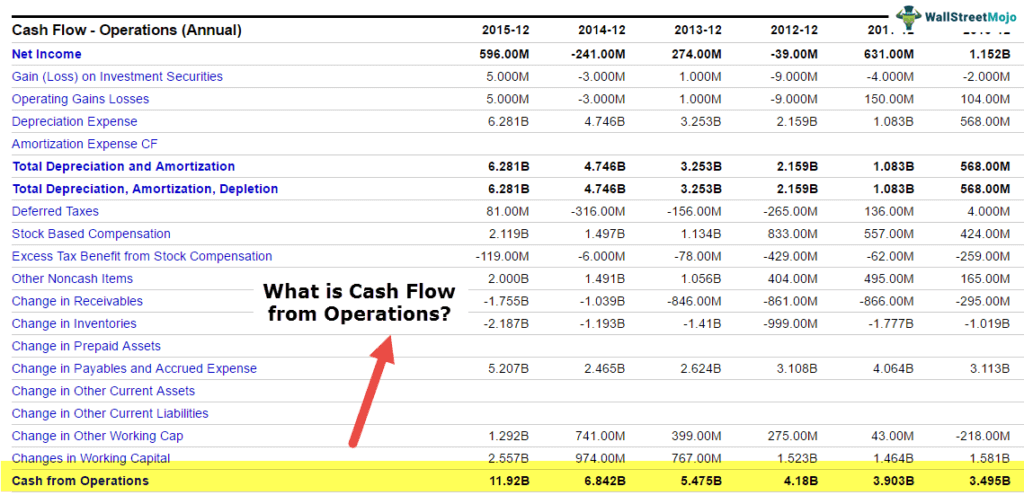

When you include the three areas of cash flow we discussed aboveOperating Activities CFO Investing Activities CFI and Financing Activities CFFthe formula can be expanded to look like this. Cash flow from operating activities is an important benchmark to determine the financial success of a companys core business activities. Cash flow from operating activities on the other hand is a measure of the cash going in and out due to a companys day-to-day operations.

Cash Flow from Operations Net Income Non-Cash Items. Cash flow from operating activities is the first section. The operating cash flow is calculated by summing the Net income Noncash Expenses Usually Depreciation Expense and Changes in Working Capital.