Fun Calculate Effective Tax Rate From Income Statement

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

Non-deductible fines for pollution appear as an expense of 15000 on the income statement.

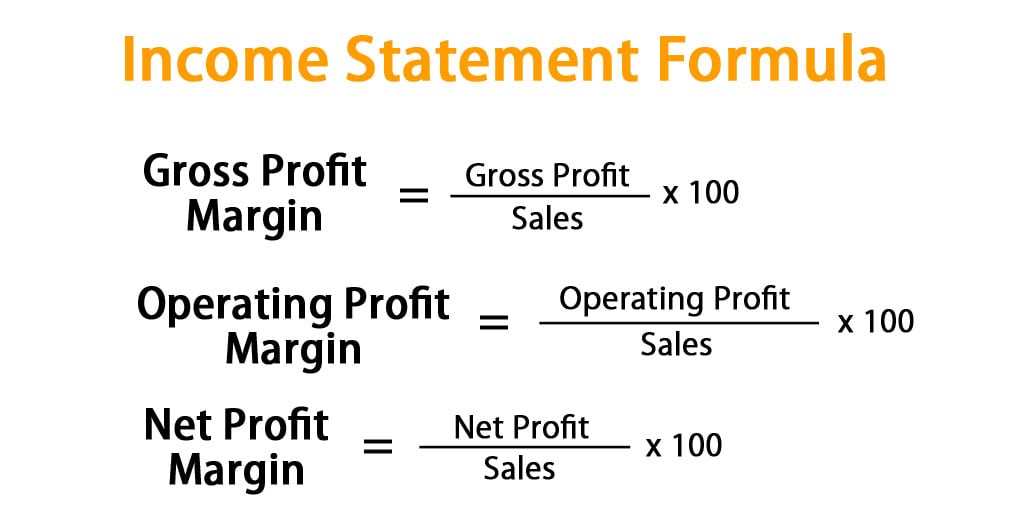

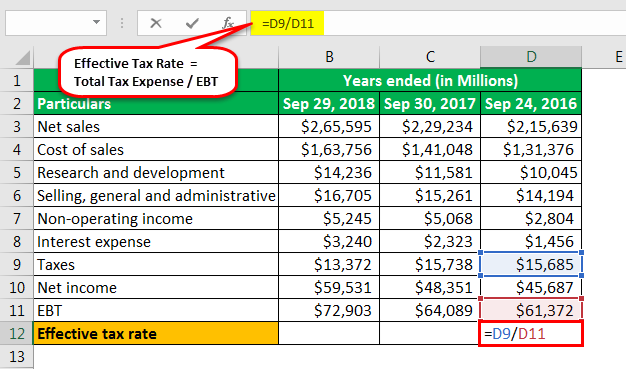

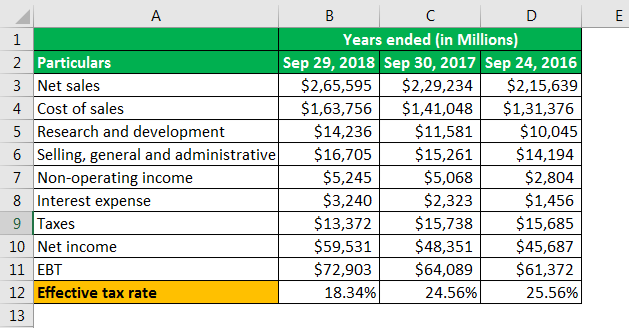

Calculate effective tax rate from income statement. Melissas tax rate is 30 for all years and the company expects to report taxable income in all future years. What makes effective tax tricky is that two people in the same tax. Effective income tax rate is the ratio of income tax to total income.

To calculate your effective tax rate you divide your income by the taxes you paid. Investopedia explains effective tax rate as the net rate paid by a taxpayer if all forms of taxes are included. Effective Tax Rate refers to the average taxation rate for an individual or a corporation wherein for an individual it is calculated by dividing total tax expense by the total taxable income during the period and for the corporation it is calculated by dividing total tax expense by the total earning before tax during the period.

Formulas for effective tax rate. Total Expense Taxable Income. Rent reported on the tax return is 24000 higher than rent earned on the income statement.

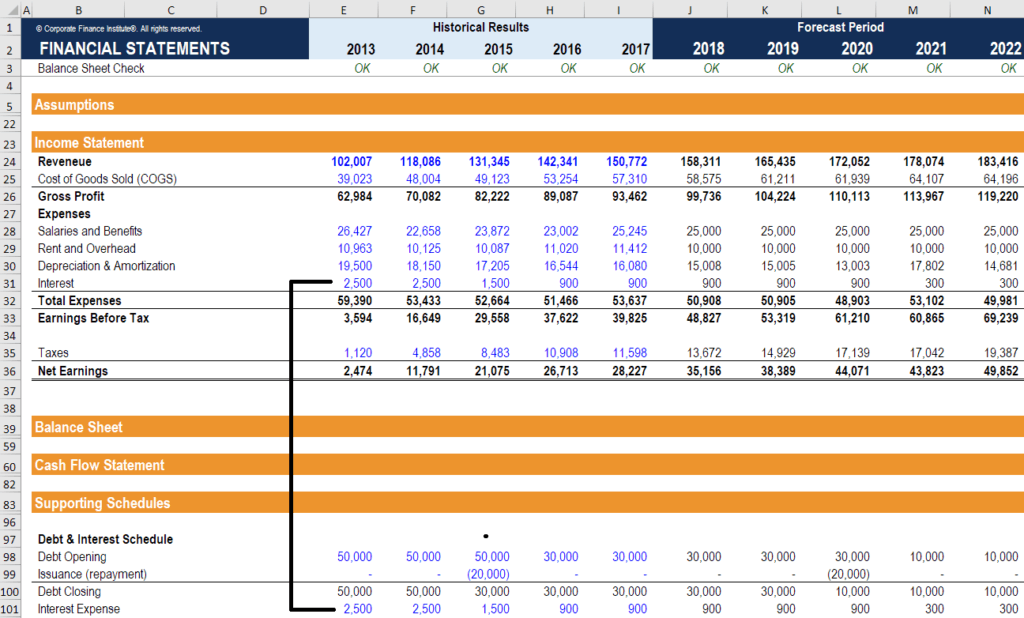

Instead calcualte the companys effective tax rate by dividing income tax expense by pre-tax income. The most straightforward way to calculate effective tax rate is to divide the income tax expenses by the earnings or income earned before taxes. There are no future taxes at the.

It is calculated as the total tax paid divided by the taxable income. You can calculate a companys effective tax rate using just a couple of lines on its income statement. Another way to figure out your effective rate is to take the total tax and divide it by your taxable.

This is to maintain parity between the tax rates of non-resident individuals and the top marginal tax rate of resident individuals. T and P will each calculate current tax liability and expense by multiplying taxable income by the 21 corporate tax rate enacted in the law known as the Tax Cuts and Jobs Act TCJA PL. Ad See the Income Tools your competitors are already using - Start Now.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)